Compare the best day trading brokers in Vietnam and their online trading platforms to make sure you choose the best one for your needs. Use spread comparison, market range and platform features to decide what will help you maximize your profits. No one broker can say is the best all the time for everyone – where you should open a trading account is a personal choice.

Here we list and compare the top brokers for day traders in 2020 with full reviews of their interactive trading platforms. So, whether you are a forex trader or want to speculate on cryptocurrencies, stocks or indices, use our broker comparison list to find the best trading platform for your brokers. day trader.

How to compare brokers

Before you can find the best interactive broker for day trading, you should determine your own investment style and individual needs – you how often, at what time, for how much money and what financial instrument to use.

Then, when choosing between all the top rated trading brokers, there are several factors you can take into account. If you choose only the cheapest, you may have to compromise on platform features.

There is no one size fits all when it comes to brokers and their trading platforms. The best broker will tick all your requirements and personal details.

Here are some key points and areas for comparison in this competitive market:

Cost

- Do they offer low commission rates? – As a day trader placing many trades during the day, low commissions over a long period of time will increase your overall profits.

- Do they offer attractive margin rates? – If you can predict returns above the interest you pay on the loan, then generous margin will allow you to trade big with no capital you have to pay.

- Do they have a complicated fee structure? – Brokerage fees can add up quickly. You need to see the fine print to make sure you won’t be swayed by hidden costs down the line, such as when you want to withdraw money. Having said that, the cheapest brokers for day trading often make that money in other areas, such as customer service.

- Will you need a minimum deposit? – Some brokers will require you to make significant capital to open an account and start trading. For example, if you trade daily at Interactive Brokers, you’ll need to put some serious cash on hand before you can go to work.

- Does the broker have a daily transaction limit? – Certain limits are imposed to protect against extreme volatility and market manipulation. But Interactive Broker day trading limits can be set by you to prevent you from losing too much capital in a day.

- Do they offer different account types? – Different accounts will come with different costs and attractive perks. For example, choose between Interactive Brokers day trading accounts and you can get lower commissions, greater leverage, and advanced tools for technical analysis. Learn more about account types here.

Trading platform features

- Do they have high-tech, informational tools for research and analysis? – You’ll need live quotes, plus detailed charts and access to historical data will also help you trade smarter. The top 10 online brokers all offer a wealth of tools and resources.

- How fast and efficient is the menu htheirs? This is extremely important if you are day trading, as just a few seconds can cost you serious cash. While many virtual brokers offer real-time execution, there is still a fear of slippage. This emphasizes the need to test drive your broker first.

- How user-friendliness is their foundation? – The trading platform provided by the broker needs to work for you. Most brokers offer several to choose from, some will tick the boxes for the average day trader, others will provide a more advanced platform for the veteran trader. Likewise, is it right for your hardware – is the platform compatible on Mac, PC, Linux, or whatever you use?

- Have a mobile platform? – It is very rare that a broker does not offer a mobile trading application, but the quality will vary. If your mobile transaction is important, it is important to check the compatibility of the application (Android, iOS or Windows, etc.)

Customer Service

- How good is their customer service? – Will you be able to quickly reach someone when you need support or advice? This is especially important if something goes wrong like a computer crash. Some brokers offer 24/7 customer support, with call waiting times of less than a minute.

- Do they have a “dealing desk”? – The best brokers provide direct access. You don’t want to send an order to a shipping desk that then initiates it on the market. This is time consuming and may lead to re-quotes. Once you confirm you want to continue, your opportunity may be gone.

Also

- Do they offer any attractive supplements? – Any ‘Open an Account’ promotions? £100 in free trade may not be everything, but it means you can work out any fold in your strategy before it’s your money. Trading without a broker means no free credits for trial and error.

- Is there an Account? Do VIP accounts get Tier II data for free or with reduced spreads?

- What profit do you get with your cash? – You will find you usually have something lying around in your brokerage account. Some brokers won’t give you a dime on that balance, but some will give you 3-5%.

- Trading Strategy – Can you execute your trading strategy or even use automated trading, signals or copy trading at this broker?

A final word on comparing brokers

Do your homework and make sure your day trading broker can meet your specific requirements. It’s always worth testing your potential day trading broker. Set up a demo account, make sure you like the platform, and submit some questions to gauge how good their customer service is. Get this choice and your bottom line will thank you for it.

Need to truncate? Check out this year’s DayTrading.com award winners.

Broker comment

Use this table with trading broker reviews to compare all the brokers we’ve reviewed. Please note that some of these brokers may not accept trading accounts opened from your country. If we can determine that the broker will not accept an account from your location, it is grayed out in the table.

| Broker | Introduction | Minimum | MT4 | Give ice cream |

|---|---|---|---|---|

| 24Option | Yes | $250 | Yes | No |

| Alpari | Yes | From $ / £ / €5 | Yes | Yes |

| ATFX | Yes | 100$ / € / £ | Yes | No |

| Avatrade | Yes | 100 dollars | Yes | No |

| AxiTrader | Yes | 0 $ / € / £ | Yes | No |

| Ayondo | Yes | £1 | Yes | No |

| BDSwiss | Yes | 100$ / € / £ | No | No |

| Binary.com | Yes | $5 | Yes | No |

| Binary | Yes | $250 | No | Yes |

| Binomo | Yes | € / £ / $10 | No | No |

| BitMex | Yes | 0.0001 XBT | No | No |

| Capital.com | Yes | £ / $ / € 100 | No | No |

| City Index | Yes | £ / $100 | Yes | Yes |

| CMC Market | Yes | £ 0 | Yes | No |

| Degiro | No | 0 $ / € / £ | No | No |

| Deriv.com | Yes | € / £ / $5 | Yes | No |

| E-commerce | Yes | $500 | Yes | Yes |

| Easy Market | Yes | €100 | Yes | No |

| eToro | Yes | $200 ($50 in the US) | Yes | No |

| ETX Capital | Yes | £250 | Yes | No |

| Selection of experts | Yes | 10$ / € / £ | Yes | Yes |

| Finq.com | Yes | 100 dollars | Yes | Yes |

| Forex.com | Yes | $50 | Yes | No |

| Consolidated Market | Yes | No min | Yes | No |

| FXCM | Yes | £300 | Yes | No |

| FXPro | Yes | 100 dollars | Yes | No |

| FXTM | Yes | From $10 | Yes | Yes |

| High and low | Yes | $50 | Yes | No |

| Microchip Market | Yes | $200 | Yes | No |

| IG Group | Yes | £250 | Yes | No |

| InstaForex | Yes | $1 to $10 (Depending on account selection) | Yes | No |

| Interactive Broker | Yes | $ 10000 | No | No |

| Invest.com | Yes | £ 0 | Yes | Yes |

| Invest | Yes | $250 | Yes | No |

| IQ Options | Yes | $10 | No | No |

| Only 2 | Yes | 2500 pounds | Yes | No |

| LCG | Yes | 0 $ / € / £ | Yes | No |

| Libertex | Yes | £ / € 10 | Yes | No |

| Market.com | Yes | 100 dollars | Yes | No |

| Nadex | Yes | $250 | No | No |

| NinjaTrader | Right | $50 | Yes | No |

| NordFX | Yes | $10 | Yes | No |

| Oanda | Yes | $ 0 | Yes | No |

| Commercial Olympics | Yes | € / £ / $10 | No | No |

| Pepper | Yes | £200 / $200 | Yes | No |

| Add 500 | Yes | 100 dollars | No | Yes |

| Robin Hood Hero | No | No min | No | No |

| Saxo Bank | Yes | $ 10000 | Yes | No |

| Skilling.com | Yes | 100 £ / € / $ or 1000 NOK, SEK | No | No |

| Contagious | No | $1 | No | No |

| TD Ameritrade | Yes | nobody | No | Yes |

| TradeStation | Yes | $500 | Yes | No |

| Transaction212 | Yes | € / £ / $100 | No | No |

| UFX | Yes | 100 dollars | Yes | No |

| VantageFX | Yes | $200 | Yes | Yes |

| TV bridge | Yes | $250 | No | Yes |

| XM | Yes | 5 $ / € / £ | Yes | Yes |

| XtB | Yes | $250 | Yes | No |

| ZacksTrade | No | $2500 | No | No |

| ZuluTrade | True | $1 to $300 (depends on broker selection) | True | No |

What is an exchange?

A trading platform is software used by a trader to view price data from markets and to place trades with a broker. Market data can be obtained from the broker in question or from independent data providers such as Thomson Reuters. In this section, we detail how to choose the best trading platform for day traders

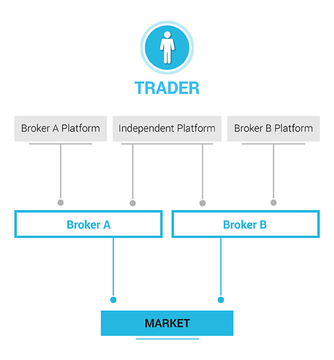

Typically, a broker will provide their clients with a branded trading platform that is more or less unique to that individual broker, but there are also independent platforms that can connect with multiple brokers. An independent platform can be a good choice for experienced traders, while using a broker’s own platform is the easiest way to get started for beginners.

How standalone trading platforms work

How standalone trading platforms workTrading platform features

The best day trading platform will have a combination of features to help traders analyze financial markets and place trades quickly. In particular, a top-rated trading platform will provide excellent implementations for these features:

- Access to current and historical market data – A trader needs to be informed of market price changes as soon as possible so that action can be taken before opportunities run out or losses are realized. perform. Historical data is needed for technical analysis and backtesting of trading strategies. However, not all platforms have backtesting, so check before you commit to a particular piece of software.

- Charts and other visual aids – Market trends and sentiment are best visualized through various charts and plotting of relevant technical indicators.

- Execution – Once you have decided to execute a trade, it needs to be executed immediately in the market. A great platform and broker does it in less than a second. Traders using automated trades want even faster execution, often measured in milliseconds, depending on the strategy used and price sensitivity.

- Automated Trading – The platform provides automation that allows traders to make market moves even if they are not at the computer at the time. The classic “stop loss” feature is a simple form of automation, but there are more advanced platforms that allow you to program your own trading robots to execute complex or responsive strategies much more than you can do yourself.

- Independent Broker (optional) – You may want to be an expert on all the features of your trading platform but still have the option to change which broker you use . The solution is an independent trading platform (listed below), which can connect to a number of different brokers.

Compare standalone trading platforms

A standalone trading platform used to visualize market data and manage your trades, but it needs to connect to one or more brokers world to actually trade in the market. These professional day trading platforms often offer a more advanced interface than the average broker and help you find and place trades with one or more brokers of your choice. Using an independent trading platform, you don’t have to relearn a whole new piece of software just because you switch to another broker.

Standalone platforms often come with advanced features like advanced charting and pattern analysis, automated trading, and trading alerts/signals. Different platforms have different strengths. NOTE – Not all brokers support this type of integration with independent platforms, so use our reviews to find the ones that work.

Trading account

When choosing between brokers, you also need to consider the account types offered. Example:

- Do they offer cash and/or escrow accounts?

- Can you get a managed account?

- Do they offer a single standard account or do they offer different account levels?

Which account is right for you will depend on a number of factors, such as your risk preference, initial capital, and how long you have to trade. With that said, below is a breakdown of the different options, including their benefits and drawbacks.

Cash account

Most day trading brokers will offer a standard cash account. This is simply when you buy and sell securities with the capital you already have, instead of using borrowed capital or margin. Most brokers will offer a cash account as their default, standard option.

Benefits

There are several benefits to a cash account. First, since there is no margin, a cash account is relatively simple to open and maintain. In addition, you have less risk than a margin account because the most you can lose is your initial capital. Finally, you don’t have to pay the interest charges that come with a margin account.

Restrictions

Trading with a cash account also means you have less upside potential because there is no leverage. For example, the same return on a cash and margin account can represent a 50% difference in profit because a margin account requires a lot less capital.

Also, you must wait for the funds to settle in the cash account before you can trade again. At some brokers, this process can take several days.

Overall, no margin means these accounts may not be suitable for the majority of active day traders.

Margin account

Most brokers will offer a margin account. Essentially, this allows you to borrow funds to increase your position size. For example, you can only pay half of the purchase and your broker will lend you the rest.

Note that brokers often impose margin restrictions on certain securities during times of high volatility and short interest rates.

Benefits

Margin accounts come with several benefits. First, you can choose when you pay back your loan, as long as you stay within the maintenance margin requirements. Second, you can leverage the asset to enlarge your position size and potentially increase your profits.

Also, interest rates are often lower than credit cards or bank loans. Finally, if you have a concentrated portfolio, you can use existing securities as collateral for a margin loan.

Restrictions

While there are benefits, there are serious risks. With a cash account you can only lose your initial capital, however, a margin call could see you lose more than your initial deposit. You also have interest costs to factor.

Also, you need to check the maintenance margin requirement. Otherwise, you may be short-pressed resulting in forced liquidation from a margin call.

Overall, a margin account is a reasonable choice for active traders with a reasonable risk tolerance.

Managed trading account

Some brokers will also offer managed accounts. A managed account is simply when the capital belongs to you, the trader, but the investment decisions are made by professionals. These people can be referred to as advisors on the account – these advisors have full control over the trade. There are two standard types of managed accounts:

- Aggregate Funds – With this account type, your capital will be transferred to a mutual fund along with other traders’ capital. Profits will then be distributed among investors. Usually, brokers divide these accounts according to risk appetite. For example, people looking for big profits can put their money in a pool account with a high risk/reward ratio. Those looking for more consistent returns will likely choose a safer fund. Minimum investment for cThe combined account is about $2000.

- Personal Account – With this account, your broker will manage your own capital and make investment decisions tailored to your needs. The main benefit is having an experienced professional on your side. However, you will pay for that privilege with account maintenance fees and commissions. Also, some brokers will impose high minimum investments of at least $10,000.

In general, managed accounts are suitable for people with substantial capital but little time to actively trade. However, those with little capital and those with the time or inclination to enter and exit positions may be better off with an unmanaged account.

Account level

Some day trading discount brokers will only offer a standard live account. However, others will offer multiple account levels with different requirements and a host of additional benefits.

For example, a Bronze account can be an entry-level account. Here you can access chat rooms, weekly newsletters and some financial announcements and commentary. Entry-level accounts often have low deposit requirements.

If you deposit more, say over $1000 and do a certain number of transactions per month, you may be eligible for a Silver account. This can give you access to courses, a personal account executive, and more in-depth market commentary.

Send a little extra, for example $5000 and you may qualify for a Gold account. For this you can get:

- 10% Deposit Bonus

- Daily market research

- Introduction Offer

- A dedicated trading advisor

- Phone access to an active trading community

Finally, some brokers will offer a top level account, such as a VIP account. To qualify for this account, you may need to deposit up to $20,000. You may also need to trade 500 lots quarterly, for example.

However, for your larger deposit you can get even more practical help, as well as bigger deposit bonus, delivery Free translation and other financial incentives. You can also get full access to a wide range of educational and technical resources.

So the best day trading discount brokers offer several account types to meet individual trading and capital requirements. It’s also worth remembering that in general, the more you can invest, the greater the perks and trading experience.

Last word on account

When choosing between brokers, you need to consider whether they have the right account for your needs. The main factors to consider are risk tolerance, initial capital and the amount you will be trading.

Note you can also open different accounts if you want to use some different strategies.

Regulations and licensing

An important consideration when comparing brokers is regulation. There are a number of different regulatory bodies around the world. The reputations of these agencies vary, but almost all can give consumers a high degree of confidence in the brokers they license. Here are some of the top regulators;

FCA (Financial Conduct Authority) – The UK regulator, responsible for all forms of market trading and speculation.</p >

CFTC (Commodity Futures Trading Commission) – US regulatory regulator.

SEC (Securities and Exchange Commission) – United States Market and Exchange Regulatory Authority.

FSB (Financial Services Board) – South African Regulatory Authority

CySEC (Cyprus Securities and Exchange Commission) – Regulatory body of Cyprus, commonly used to ‘trademark of passport regulation’ throughout Europe Europe

BaFin (Federal Financial Supervisory Authority / Bundesanstalt für Finanzdienstleistungsaufsicht) – German regulatory body

Danish Financial Supervisory Authority ( Finanstilsynet)

European Securities and Markets Authority (ESMA) also provides an overarching guide to all European regulators, imposing a number of rules certain Europe-wide – including leverage, negative balance protectionand the ban on binary options. These rules only apply to retail traders, not professional accounts.

How to try the broker for free

Demo account is a great way for beginners to practice trading and test a broker or exchange without using real money. The demo account is funded with simulation money, so you can try out the broker’s platform features and get familiar with the workings of the market. One caveat though – even the best practice platform can’t replicate the pressures of having real money, but it’s a great way to learn the basics and start with zero risk .

Learn more about Demo Accounts

How brokers make money

Even among the best brokers for day trading, you will find contrasting business models. Having said that, there are two main categories:

- Market maker

- Over-the-counter (OTC) brokers

Market maker

Some of the best brokers for online day trading are market makers. Market makers are constantly ready to buy or sell, as long as you pay a certain price. That means they can lose out on price changes before they find a buyer/seller.

But, of course, to take that risk, they seek compensation. So they bid less than the list price while setting the ask price slightly higher. That little edge is where they will make money.

Now that seems like an insignificant amount. However, tens of thousands of trades are placed every day through good brokers for day trading using these systems. Not surprisingly, those minute profits can add up quickly.

Note that day trading brokers using this pattern often offer fixed or variable spreads:

- Fixed Range – Does not change, no matter what is happening in the market. Because of the additional risk, fixed spreads tend to be wider than variable spreads.

- Variable – Volatility in response to market conditions. For example, during the overlap of London and New York, increased liquidity leads to high spreads.

Let’s see an example – if you want to sell 50 Tesla shares, good market makers will buy your stock, regardless of whether they have sellers lining up Not yet. However, they could buy those Tesla shares for $300 each (ask price), while offering to sell them to another trader for $300.05 (bid price). $0.05 that’s where your online broker makes money.

OTC Broker

Many of the best discount brokers for day traders follow the OTC business model. In fact, they are the most popular type of day trading broker. The immediate appeal is the lack of transaction costs and commissions. However, on the best day trading platforms, it’s not that simple.

Basically, an OTC day trading broker acts as your counterparty. They will take the opposite side of your position. Therefore, you do not have to pay commissions or fees in the same way. You are simply trading against the broker.

For example, the best futures or CFD brokers can have both sides of the trade covered, promising a handsome profit. However, some of the best brokers for day trading can also hedge.

Compare

There are some key differences between online day trading platforms that use these systems:

- Increasing liquidity – Effectively the best brokers follow a market maker model that acts as a wholesaler, buying and selling to satisfy the needs of the market.

- Cost – Without a market maker, finding buyers and sellers can take longer. As a result, liquidity may decrease and you may pay higher transaction fees as positions get in and out.

- Motivation – A market maker will make money regardless of your trading results. Whereas an OTC broker has a vested interest when you lose.

Top brokers for day trading will often use a variation of one of the following:these models. Check reviews to see the model a potential broker is using to get a feel for where and how they expect to make a profit.

Broker payment method

Different trading brokers support different deposit and withdrawal options. The availability of one or more specific payment methods can be of importance to traders, as fees and transit times vary between methods. For some traders it is essential that a deposit or withdrawal is instantaneous, while others are fine with a few days processing time. Any trader who makes frequent deposits or withdrawals certainly wants to consider low transaction costs. Below we list the different payment methods that the brokers support them with along with guides that cover everything a trader needs to know.

Trading in different areas

With the world of online migration, you could theoretically opt for day trading brokers in India or anywhere else in the world. pure. However, there are tax and regulatory considerations worth keeping in mind before you choose day-to-day exchanges in Australia, Singapore or anywhere outside your country of residence.

- Tax Considerations – Where you do business and where your broker is located can affect what taxes and how much you will have to pay. Will you pay capital gains tax? Will you pay net income tax? If you start day trading with brokers from Canada, will you pay taxes abroad and domestically? If you are thinking of signing up with a remote broker, find out the tax breakdown first.

- Regulation – Regulation is important for a number of reasons, but your financial security is one of them. Opt out for brokers that are regulated in well-established financial systems, like the EU, US or UK. A broker that is regulated in Bermuda is better than no regulation at all, but you can still run into problems.

Canada and the US also have sample day trading rules – but the two are quite separate. Read more about this on the rules page. Just keep in mind that Canadian day trading platforms can differ significantly from either the US or European versions, and platforms in South Africa will also differ.

Bottom line

The broker you choose is quite possibly your most important investment decision. Everyone’s requirements are different so there is no clear universal winner to switch to. Instead, in your comparison, consider which factors listed above are most important to you and then you will be able to find the best broker for your needs.