Binary options robots, or bots, have become increasingly popular. Automated trading software has attracted many new traders to binary. However, they are very risky and binary trading should be fully understood before any robot services are considered. Here we explain how trading robots work, review the top offerings and illustrate what you need to know and be aware of when comparing binary trading robots.

We will detail how and where to get a demo account and also explain why the risk increases dramatically when using automated trading.

We recommend learning binary trading completely before contemplating robot services. Despite being sold as such, they are not a good choice for beginners.

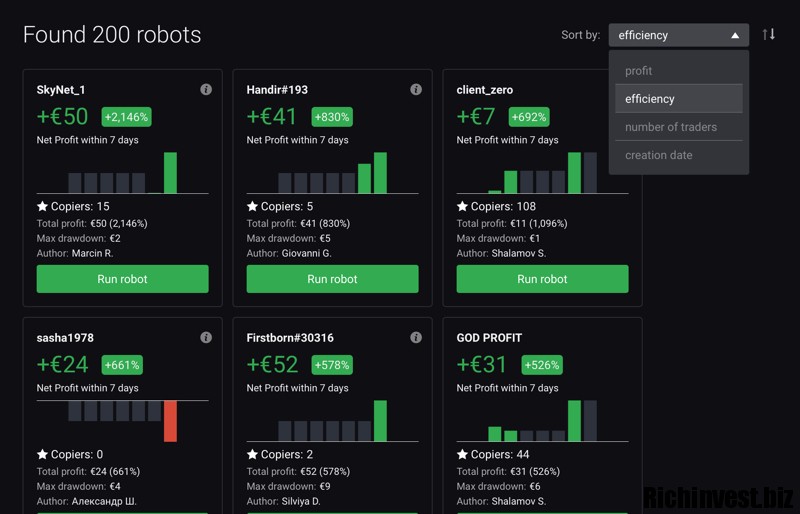

Top Binary Options Robots

What is a trading robot?

A definition;

A robot is a piece of software designed to identify and analyze market signals, accurately identify suitable trades, and automatically execute orders without human intervention.

Reviews about Robots

Whether a trade is placed or not depends on whether the market conditions meet the rules and parameters defined by the trader. A trading bot is not ‘smart’; it merely executes orders predefined by its creator.

These automated trading systems (ATS) have been making headlines for a while. Volatile price movements are often blamed on trading bots. From Wall Street to London this form of trading is dominating the market.

Bots explained

Automated trading robots and algorithms combine signal services with automated trading. So the software will try to identify profitable trades, and then automatically place the trades. This automated element takes the signal service a step further and actually places the trade as well – rather than leaving it to the trader.

The MetaTrader platform (mt4 or mt5) is particularly effective in allowing you to receive signals through the ‘Expert Advisor’ facility. Here you can go further than creating your own alert system by setting parameters to be followed by your own Expert Advisor – or you can download a program from elsewhere and include it works, just by dragging and dropping it onto the .

These systems will have different levels of risk management – from stop loss, to fixed daily spending limit. However, the automatic factor increases the financial risk for traders in general. The feedback and comments we receive are often focused on whether the risk is hidden from traders before they open an account. Make financial risk fully understood.

Self-built

There is also a growing trend for brokers to offer their traders the ability to configure their own ‘bots’ or automated trading systems. These tend to simplify the process, allowing traders to drag and drop technical indicators into their system. The best bespoke robot features also allow traders to run their robot in a demo account, to try it out risk-free.

Brokers are keen to promote robots, because they generate higher trading volumes, and thus reduce the risk for the broker. They can be a great tool for traders – but as always in binary options – any promise of profit is an immediate “red flag”. Robots, like the binary itself, need to be fully understood before being used, and they are not a guaranteed route to profits.

Automated trading

Automated trading, or trading via robots, has several benefits:

- Automated traders don’t sleep

- Using an online brokerage platform allows you to trade 24/7 from any device of your choice. But – of course – you can’t stay online all the time, which means there’s always the unpleasant reality of missing out on possible opportunities – even when you get helpful transaction alerts sent to your phone mine.

- A robot is always on call; whatever the time, as long as there is a chance to meet the pre-programmed criteria, the robot will execute that trade.

- Software has no emotions

- A robot does not frantically chase losses or deviate from a hunch-based strategy. It operates independently based on the criteria it has been set to follow.

- The robot is not overloaded

- All markets are open and lots of opportunities are present. It can easily get bogged down, for fatigue to climb in and for mistakes to be made. For a robot, none of this is a problem; Large amounts of data can be processed instantly and the right action can be taken at the right time – no matter how “vibrant” the market may seem.

Similarly, there are some disadvantages to automated trading:

- Robot does not react

If the market is impacted by an external event, the robot will continue to blindly follow the settings provided to it. Common sense won’t apply to robots. - They often suffer

robot false sale attract fraud. Our scam section below highlights how to spot them, but the automated element allows dishonest services to make easy money recommendations. That is simply not true.

Automation increased risk means loss of certain control. While many risk management techniques can be applied (stop loss and maximum loss, etc.), there is no doubt that the risk is increased.

Cheat

The automated nature of this trading style is fraught with danger. If one trader gives control of their trade to another, the level of risk increases greatly. Our scamspage details some red flags to look for (including a list of scam services), but robots and automated trading in particular attract a lot of scam activity.

Here are a few reasons why:

- Novice Trader – Automated trading software is usually aimed at novice traders or those who do not have the time or knowledge to trade on their own. This group is probably easier to fool and therefore they are targeted.

- Easy Trader Blame – Link to the first point. Dishonest vendors will simply say that the software has been misused, and therefore not at fault.

- Control – If traders have put someone else in control of their trades, it is very easy to tell that money has been lost on the trade.

Scam warning signs will include lack of transparency (unverifiable win rate results), forcing users to use a specific and most obvious broker – promises of guaranteed profits secure or very high. If it was easy, everyone would do it. Step very carefully if conducting automated trading. The risk of fraud is substantial. Here is a checklist of warning signs:

- Get rich quick marketing

If a service promises big profits, with little or no effort, it’s probably a scam. In the same way, any phrase like ‘no risk’, ‘100% win rate’ or ‘easy money’ should be considered a complete lie. - Cold calls

Legitimate service will not call you. - Managed account

It is a very bad idea to allow someone to trade with you or with your money. Even with automated and robot trading, you need to be in control. - Bogus . Bonus Terms

Some bonus terms include a lock in your initial deposit. Check the terms and conditions before parting with any cash. - Sales Channel

Some robot programs force you to open an account with a particular broker. This is usually not the best choice, and is often unregulated and unreliable. - Free Robot Service Not Free

If you have to join a broker and deposit to receive signals – they are not free. Free service no deposit required.

Some of the blacklisted services that pretend to provide automated trading and signals are:

Brit Method / Jason Taylor

Copy

Self-made millionaire Blueprint

Ultimate4Trading

QuantumCode

They all promote binary options as an easy way to make money, and they should be avoided ALL.

Setting

The settings or indicators used in the robot are very important. They will define success or in other words strategy. The number and flexibility of settings or parameters in the robot platform, is a useful comparison factor when evaluating different companies.

The best settings will depend on the individual trading strategy – but the basic parameters should not be ignored. Trade size and expiry time are two simple settings, but traders can forget to check if the size and timeframe they want to use are available with the robot they are comparing.

Moving averages and volume are popular indicators and almost any candlestick pattern can be set as a signal. The self-built bot at Binary.com offers the most flexible settings. Some inferior services do not provide any. Some programs offer money management settings too. Martingale is best avoided, especially for newbies.

Demo account

Better companies will offer a free demo or virtual account to try out the service. This allows traders to modify their settings and find a money management plan that works for them. The best demo accounts will be open end and even top if the balance runs out.

Some demos may require a software download, but most do not. Login details will go into real money account when and if they are upgraded. Many vendors offer mobile apps, and again, most will be compatible on Android, iOS (iPad and iPhone), and Windows.

Binary Bot Review from Binary.com

Binary.com also offers the ability to design and create automated trading bots. Binary.com is licensed in the UK and Malta, but is based in Malaysia and is popular in the region, especially Indonesia and Singapore.

Often referred to as a broker for advanced traders, Binary.com currently offers a range of ‘advanced platforms’ – including a ‘Binary bot’ platform that provides a ‘toolkit’ for users to create own algorithm for automated trading software.

So the platform allows to build their own automated trading tools, but – as is often the case with this brand, they offer more advanced clients. Tools and settings are available, providing greater depth than at a rival broker. This allows users to target more complex strategies. In turn, this can lead to more precise and specific trading.

Binary Bot matches the rest of the Binary.com interface. Some of the other platforms’ distracting elements have been removed and replaced with more features and depth – typical of the brand. Read more about the trading platform in the Binary.com review .