Social trading is a new way of investing. It is a simple concept of trading decisions based on the wisdom of the masses. Investors will share details of the deal – others can use this user-generated financial analysis. The growth of social media has led to an explosion of publicly shared transaction information.

Social trading broker

What is social trading?

Since the beginning of online trading, the social aspect of this activity has naturally and strongly appealed to investors looking for an easy shortcut to profits. Social trading has gone through many incarnations over the years and it’s safe to say it’s still at this point.

Many beginners offer a clear path to some degree of success and a real understanding of profitable trading.

How does it work?

The process by which online traders execute their own trades based on data generated by other users on different trading platforms. This can be done by evaluating emotions or directly copying the trades of other traders that generate regular profits.

There are a number of online activities built specifically for these user-generated financial data. Covers a wide range of business models. According to one study, around 80% of online brokers offer some form of social trading. In fact, social transactions have spread end-to-end throughout the industry.

The most basic social trading channels come in the form of groups of social media-based signals. There are operators like eToro and have built entire businesses that have built their own trading platforms based on social interactions between merchants.

Recently, specially developed and designed platforms have created transaction-focused chat-based workgroups, allowing members of these groups to collaborate on an unprecedented level.

Benefits of social trading

The appeal and top selling point of social trading is that it forms a kind of symbiotic relationship between those who provide useful data and those who consume it. It also represents a simple ‘entry level’ option for beginners and beginners. You also benefit from other people’s strategies, such as learning from others, evaluating your decision making and improving your trading.

With the right type of copy trading strategy, those who have mastered a trade can make some money. Traders can benefit from trading as well as the following. Popular trader financial bonus broker. Through improved trading terms or direct fees.

Followers will find that the benefits can be two things. First, this easy investment method can generate good returns. But followers can learn from the profitable traders they follow. Following something else can provide a great learning opportunity. But success depends on choosing the right social trader.

What are the social trading subtypes?

The most common form of social trading is copy trading. Copy trading is all about using a huge network of traders. This allows followers to link their account directly to a professional trader’s account. The transactions of the city’s specialists, the software is automatically copied and reproduced by the software.

This type of social trading requires no input from the followers’ point of view, so the popularity is explained. The investment amount is adjusted according to the believers. Thus, a professional forex trader who trades over £1,000 can still be followed by a beginner risking a few pounds.

eToro is arguably the largest and most advanced copy trading network. Many trading features, expert profile analysis tools and monetization options. Total number of copy trading packages. As a result, eToro is the preferred destination for millions of merchants in 150 countries around the world.

Easy online transaction

When social trading was first introduced, it was designed to allow people to trade through a web browser. The goal is to make trading and investing simple, enjoyable and profitable. Early pioneers in social transactions ensured an intuitive and user-friendly platform. The platform is constantly being improved to provide new tools and improvements. For example: a concept like one-click transaction (eToro feature). Brokers also focus on providing their clients with free training tools and explaining the concept of social trading. Demo accounts are a popular way for traders to familiarize themselves with ideas.

On most advanced platforms, traders can open a buy position online by either a buyer or a seller. You can also set up Discount and Discount Orders. These are powerful risk management features. Automatically stop trading when you reach a certain goal. Likewise, Trailing’s stop loss trade, the trade stays open but increases the stop loss if the trade is profitable. This is useful if traders are not always monitoring their positions.

eToro Social Trading

Offering the simplest and most advanced trading platform since 2007 and serving over 5 million users in 140 countries, the world’s leading social trading platform today is eToro. More than 1,000 assets are traded on the platform. Provide clients with powerful charting and analytical tools to manage various online accounts and social features.

In 2010, eToro launched its first social trading platform. It has grown into an important part of the platform. The company has allowed traders around the world to interact and learn from each other, copy each other and view each other’s portfolios. Roubini Think Lab predicts that by 2021, one in four traders will be using social investment and trading services.

Copy trade description

Since the first idea appeared, copy trading has developed rapidly. Reflecting the growth of social media and the ability to instantly share information, copy trading (or ‘social’ trading as described above) allows traders to quickly share share their trading ideas and strategies with interested people. The followers of these traders can automatically copy their trades and profit from them.

Platform

Sometimes called copy trading or social trading, this idea quickly gained traction because novice investors could see, learn and copy experienced traders. . They can piggyback on their success and make the same deal at the same price. The immediate nature of these trades meant that followers didn’t fall for the price swings. In other words, you can configure your account to make exactly the same transactions as housestransactions that they follow .

Social trading is very appealing to traders taking their first steps in the investment world. Usually sold as a way for newbies to get in without a huge amount of research or prior trading experience. But do you have to copy more transactions than that? Read on to find out .

How is the trade done?

After a trader decides to follow someone else using a copy trading platform, you need to find the correct trader to follow. This can be done by different methods. Traders can filter by performance factors, trading frequency, trading assets, trading style. Some people may find those with lasting consequences. Others may prefer those who made big profits in the past few days.

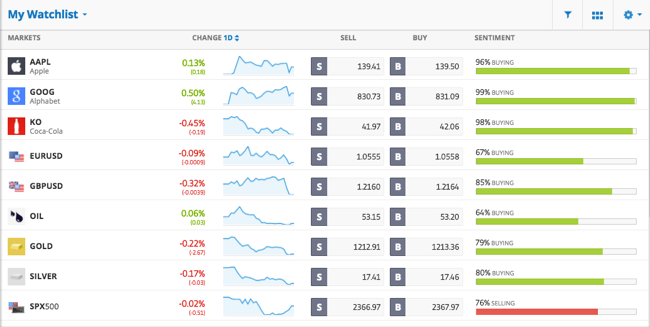

You can run this search in the window above.

With one click, after finding a person to follow, the user can open all trades made by that individual. The actual amount can be as little as £1 per position as users can make big trades with the millionaire forex trader. Once configured, each time a new trade is opened or closed, the follower will open or close the trade at the same price. Apart from the size of the investment, everything is the same.

Traders can copy (or follow) as many people as they want and mirror every trade. Of course, they still have the flexibility to exit a particular trade or end a copy. There are no promises and the followers are in complete control.

Discount Offer

Best Broker to Offer Copy Trading

Become an expert and copy

Of course, the explanation provided so far is very one-sided. Following other merchants has drawn the majority of people into social trading. But money has another side, one trader follow me . Without a talented and profitable trader, there is nothing to follow and the pattern unravels very quickly. If so, what motivates traders to try and gain followers?

First, early traders are trying to make a profit for their own benefit. They are opening and closing positions to increase return on investment. But assuming they were successful, why would you trade with social exchanges? Yes, brokers often generate a significant portion of their trading volume, rewarding traders with a significant number of followers.

It’s all good for the trader to make a single trade so the broker gets £1 through commission or spread. Even if the same trader makes the same trade, what if 1,000 users follow all exactly the same trade and make a £1000 broker? The broker can then compensate the trader by reducing the transaction fee. Brokers know they need to attract good traders to see if they really have followers. So a good trader can trade well, attract users and generate more trades to quickly increase their profits.

Who can get the most out of copy trading?

In fact, social trading should attract many investors. Here are three different descriptions of ‘traders’ and how they can best use the social trading platform. Most people belong to one of these categories.

- Traders want to follow others

- The most obvious and most popular group of merchants. Those who do not have the experience, knowledge or time to analyze the market or assets and trade at the best price. How about simply following other profitable traders? [ Follow or copy ]

- Aspiring traders who want to learn

- Many traders want to learn more, they quickly admit highly profitable traders – yet. But in the long run, they may want to make all the decisions and make their own deal. But now you can mix trades while learning from experienced traders and making money trading. [ Follow map ]

- Traders are profitable, increase revenue

- Existing traders with profits elsewhere may find the lure of additional income strictly followed. In terms of risk management, it is very rare to know that a trade generates a certain income. In the worst case, you can cover the transaction costs and at best you can significantly increase your profits. [ Lead ]

Therefore, most people will belong to one of these groups, and social transactions will suit all of them. Perhaps a group of slanderers – ambitious traders who are hesitant about social trades. They especially want to choose themselves, not track, but why not make the most of both worlds? Seller cannot copy both and still no reason to copy others .

FAQ

What is Forex Social Trading?

Forex Social Trading shares trading information such as tips, signals or comments but is unique to the forex market. Social trading usually includes forex assets, but they are sometimes mentioned individually.

How to start a copy agreement?

eToro is at the forefront of social transactions. Their trading platform makes it easy to find other profitable traders, and the trading platform is very smooth. They offer a demo account where everyone new to social trading can learn everything including copy trading with demo money. The demo account provides the best starting point, allowing traders to use the platform freely.

Copy MT4 Agreement

Copy trading software providers do not currently integrate Metatrader 4 extensively.