ETX no longer offers binary options.

They still offer forex and CFD trading.

| Broker | ETX Capital |

| Headquarters | United Kingdom |

| Type of support | Email, phone, web form |

| Language | Arabic, Chinese, Czech, Dutch, French, German, Hungarian, Italian, Polish, Portuguese, Romanian, Russian, Spanish and Turkish |

| Exchange | Ownership |

| First Minimum Deposit | £ / $ / € 200 |

| Minimum account size | £ / $ / € 200 |

| Minimum Transaction Amount | Minimum bet size 50p (depending on margin requirements) |

| Bonus | Deposit match from 20% to 50% based on deposit amount. Up to £5,000 Rewards |

| Adjustment | United Kingdom Financial Action Authority |

| Deposit Method | Major credit card and bank transfer |

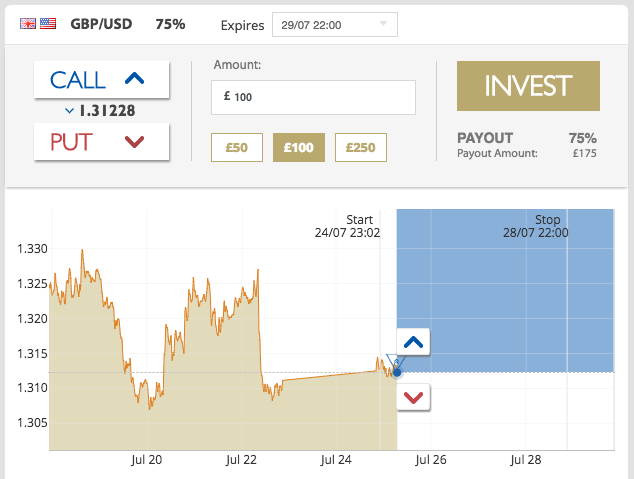

| How to trade | Forex Spot, CFDS, Classic Binary Options, 60 Second Options, Long Term Options, Pair Options and Spread Betting |

| Number of assets | None |

| Asset type | Currencies, commodities, indices, stocks |

| Tablet Deals | ✔ |

| Mobile Trading | ✔ |

| Composite Score | 92/100 |

Formerly Trad Index, ETX Capital is a leading online trading service provider owned and regulated by Monecor Ltd. Headquartered in London, UK, ETX Capital is regulated by the Financial Conduct Authority (FCA) under registration number 124721. Operating since 2002 ETX Capital is not new to the online trading industry. Indeed, its parent company, Monecor Ltd, has been in existence since 1965. With one trading account, ETX Capital traders can trade with four types of trading platforms with access to more than 6000 different products. ETX Capital doesn’t offer traders the benefits of social trading, but still offers a lot.

Trading platform and features

Unlike most other brokers, the main benefit of ETX Capital is that traders can access four types of exchanges with just one trading account. Traders on the platform can trade binaries with the ETXBinary platform with a single trading account, decentralize bets with ETX traders and find forex with TraderPro. For more sophisticated traders, ETX Capital also offers the benefits of the popular MetaTrader4 platform. The MT4 platform allows traders to spend more time on market analysis by customizing their trading activities with the EA.

In addition, all the platforms mentioned above are also mobile compatible. ETX Capital simply downloads a free trading app from Google Play or the Apple Store, allowing traders to easily access their trading accounts from anywhere in the world on a smartphone or device. their mobile device.

Market scope

ETX Capital traders have access to over 6000 different types of financial assets through exchanges. For Forex, the leverage is currently only 1:30 due to the limitations of ESMA.

Trading Account

ETX Capital offers traders only one type of standard trading account. Opening a live trading account is a simple process and takes only a few mouse clicks. To make things easier, ETX Capital only requires a minimum deposit of £/$/€200, depending on the currency you choose as your trading account. You can also use a demo account if you want to test your trading platform before a trader gives real money.

Support

clients ETX Capital’s standard of customer support is recommended. Support services are not available 24 hours a day, 7 days a week, but in several major languages: Arabic, Chinese, Czech, Dutch, French, German, Hungarian, Italian, Polish, Portuguese Spain, Romania, Russia, Spain and Turkey. The only downside to the support service is the lack of live chat. All support requests must be forwarded via email or the International Toll-Free Number (UIFN).

For

spreads, payouts and bonus spreads, traders can choose between fixed spreads (ETXTrader) and variable spreads (ETXCapital & ETX MT4). Lowest spreads start at 0.7 pips against the popular EUR/USD pair. Bonus up to 60%. However, in order to receive the bonus, traders must make a minimum deposit of £/$/€1000.

Conclusion Although

this broker is not the biggest broker, but still has a lot to offer traders in terms of quality of service. Except in the form of trading with multiple trading platforms, ETX Capital traders can enjoy very close spreads as well as dedicated customer support.