Day trading strategies are essential when you are looking to capitalize on small, frequent price movements. A consistent, effective strategy depends on in-depth technical analysis, using charts, indicators, and patterns to predict future price movements. This page will provide you with detailed information on trading strategies for beginners, which work to advanced, automated and even asset-specific strategies.

It will also outline some regional differences to be aware of, as well as point you in the direction of some helpful resources. Ultimately, you will need to find a trading strategy that suits your specific requirements and trading style.

Also, make sure your choice of broker matches your day trading based strategy. You’ll want things like;

- Excellent transaction execution speed,

- Price Action Data (+ Level 2 if possible)

- Ability to trade directly from the chart,

- commercial automation,

- Stop Loss and Take Profit

- Et cetera.

Visit the brokers page to make sure you have the right trading partner in your broker.

Trading Strategy for Beginners

Before you get bogged down in a complicated world of highly technical indicators, let’s focus on the basics of a simple day trading strategy. Many people make the mistake of thinking that you need an extremely complex strategy to succeed during the day, but often the simpler, the more effective.

Basic things

Incorporate the invaluable elements below into your strategy.

- Money Management – Before you start, sit down and decide your risk level. Remember that most successful traders will not put more than 2% of their capital on each trade. You have to prepare yourself for some losses if you want to be present when the winning starts.

- Time Management – Don’t expect to make money if you only allocate an hour or two a day to trading. You need to constantly monitor the market and be on the lookout for trading opportunities.

- Start Small – While you find your feet, stick to up to three stocks in a day. It’s better to be really good at a few rather than average and not make any money loading.

- Education – Understanding the complexities of the market is not enough, you also need to be informed. Make sure you stay up to date with market news and any events that will affect your assets, such as economic policy changes. You can find loads of financial and business resources online that will help you know.

- Consistency – It’s harder to stay emotionally comfortable when you have five coffees and you’ve been staring at the screen for hours. You need to let your math, logic and strategy guide you, not nerves, fear or greed.

- Timing – The market will become volatile as it opens each day and while experienced day traders can read patterns and profits, you should wait your time. So hold back for the first 15 minutes, you’re still hours ahead.

- Demo Account – A must-have tool for any beginner, but also the best place to backtest or test new strategies, or tweaks, for advanced traders. Multiple unlimited demo accounts, so no time limit.

Ingredients All Strategic Needs

Whether you’re after automated trading strategies, or a beginner and advanced strategy, you’ll need to take into account three essential ingredients; volatility, liquidity and volume. If you want to make money from small price movements, choosing the right stocks is paramount. These three factors will help you make a decision.

- Liquidity – This allows you to quickly enter and exit trades at attractive and stable prices. The liquid commodity strategy, for example, will focus on gold, crude oil and natural gas.

- Volatility – This tells you your potential profit range. The bigger the volatility, the bigger the profit or loss you can make. The cryptocurrency market is a well-known example of high volatility.

- Volume – This measurement will tell you how many times a stock/asset has been traded over a set period of time. For day traders, this is known as ‘average daily trading volume.’ High volume tells you there is a significant interest in the asset or security. An increase in volume is usually an indicator that the price is rising or falling, which is coming very quickly.

5 day trading strategy

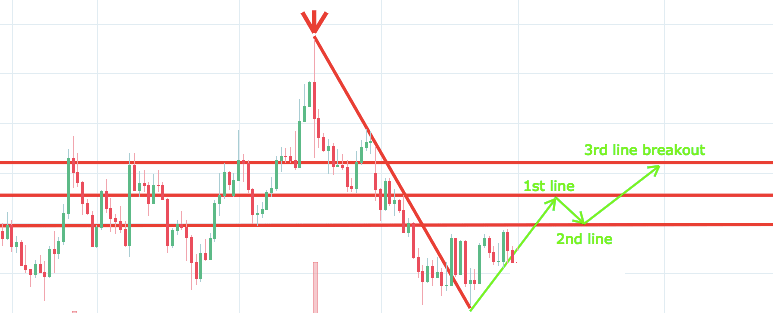

1. Breakthrough

The breakout strategy revolves around when price clears a defined level on your chart, with increasing volume. The breakout trader enters a long position after the asset or security breaks the resistance. Alternatively, you enter a short position after the stock breaks below support.

After a security asset or trade breaks through a specified price barrier, volatility usually increases and price will often trend in the direction of the breakout.

You need to find the right instrument to trade. When doing this, keep in mind the asset’s support and resistance levels. The more often prices hit these points, the more valid and important they become.

Entry points

This part is nice and simple. Price is set to close and above the resistance level requires a bearish position. Price is set to close and below support needs a bullish position.

Plan your escape

Use the asset’s recent performance to establish a fair price target. Using chart templates will make this process more precise. You can calculate the average recent price movement to create a target. If the average price move is 3 points from many recent swings, this would be a reasonable target. Once you reach that goal, you can exit the trade and enjoy the profit.

2. Scaling

One of the most popular strategies is scaling. It is especially popular in the forex market and seems to take advantage of minute price changes. Motivation is quantity. You will look to sell as soon as the trade is profitable. This is a fast and fun way to trade, but it can be risky. You need a high trading probability to even overcome the low risk-to-reward ratio.

Be wary of volatile, liquid and hot on time instruments. You cannot wait for the market, you need to close the losing trade as soon as possible.

3. Momentum

Popular among beginner trading strategies, this strategy revolves around acting on news sources and identifying significant trend moves with the support of high volume. There is always at least one stock that moves about 20-30% per day, so there are plenty of opportunities. You just need to hold your position until you see a reversal sign and then exit.

Alternatively, you can gradually reduce the price drop. This way of rounding your price target is as soon as volume starts to drop.

This strategy is simple and effective if used correctly. However, you must make sure you are aware of upcoming earnings announcements and news. Just a few seconds per trade will make all the difference to your end of day profits.

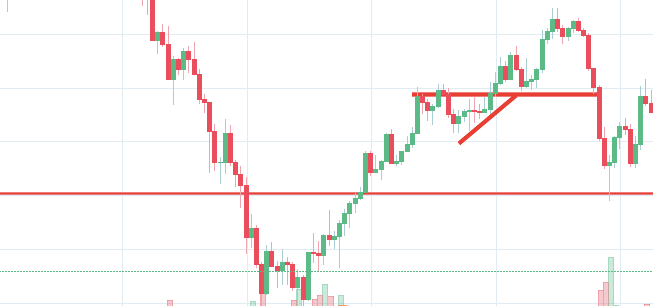

4. Reverse

Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. It is also known as trend trading, trend pullback and meaningful reversal strategy.

This strategy defies basic logic when you aim to trade against the trend. You need to be able to pinpoint possible pullbacks, plus predict their strength. To do this effectively, you need in-depth market knowledge and experience.

The ‘daily pivot’ strategy is considered a unique instance of reversal trading, as it focuses on buying and selling daily lows/reversals.

5. Using Pivot Points

The day trading pivot point strategy can be great for identifying and acting on key support and/or resistance levels. It is especially useful in the forex market. Additionally, it can be used by range-bound traders to identify entry points, while trend and breakout traders can use pivot points to identify key entry points. The key level that needs to be broken for the move to be counted as a breakout point.

Calculate Pivot Points

The pivot point is defined as the turning point. You use the previous day’s high and low, plus the security’s closing price, to calculate the pivot point.

Note that if you calculate pivot points using price information from relatively short time frames, accuracy is often reduced.

So how do you calculate an pivot point?

Center pivot point (P) = (High + Low + Close) / 3

You can then calculate support and resistance levels using pivot points. To do that, you will need to use the following formulas:

- 1st resistor (R1) = (2 * P) – Low

- First Aid (S1) = (2 * P) – High

The second support and resistance level is then calculated as follows:

- Second resistor (R2) = P + (R1-S1)

- Second support (S2) = P – (R1- S1)

- Application

When applied to the FX market, for example, you’ll find that the trading range for the session typically takes place between the pivot point and the first support and resistance levels. This is because a large number of traders play this range.

It’s worth noting, this is also one of the systems & methods that can be applied to indexes. For example, it can help form an effective S&P day trading strategy.

Limit your losses

This is especially important if you are using margins. Requirements are usually high for day traders. When you trade on margin, you are increasingly vulnerable to strong price movements. Yes, this means the potential for greater profits, but it also means the potential for significant losses. Fortunately, you can use stop loss.

Stop loss controls your risk for you. In a short position you can place a stop loss above the recent high, for long positions you can place a lower lower than the recent low. You can also make it dependent on volatility.

For example, a stock price moves £0.05 a minute, so you place a stop loss of £0.15 above your entry, allowing it to fluctuate (hopefully in the expected direction).

A popular strategy is to set up two stops. First, you place a physical stop loss order at a specific price. This will be the largest amount of capital you can afford to lose. Second, you create a mental stop. Put this at the point where your input criteria is violated. So if the trade takes an unforeseen turn, you will make a quick exit.

Forex Trading Strategy

Forex strategy is risky in nature when you need to accumulate profits in a short period of time. You can apply any of the above strategies to the forex market, or you can check out our forex pagefor detailed strategy examples.

Cryptocurrency trading strategy

The exciting and unpredictable cryptocurrency market offers many opportunities for day traders to convert. You don’t need to understand the complex technical structure of bitcoin or ethereum, nor do you need to take a long-term view of their viability. Simply use these simple strategies to profit from this volatile market.

To find specific cryptocurrency strategies, visit our cryptocurrency page.

Stock trading strategy

Day trading strategies for stocks are based on many of the same principles outlined on this page, and you can use many of the strategies outlined above. Here is a specific strategy that you can apply to the stock market.

Average diagonal move

You will need three lines of moving averages:

- One set at 20 periods – This is your fast moving average

- One set at 60 periods – This is your slow moving average

- One set at 100 periods – This is your trend indicator

This is one of the moving average strategies that generates a buy signal when the fast moving average crosses and crosses the slow moving average. A sell signal is generated simply when the fast moving average crosses above the slow moving average.

So You will open a position when the moving average moves in one direction and you will close the position when it goes in the opposite direction.

How can you definitely establish a trend? You know the trend is above if the price bar stays above or below the 100-period line.

For more information on stock strategies, see our Stocks and Stocks page .

Spread Betting Strategy

Spread betting allows you to speculate on a large number of global markets without ever actually owning the asset. Plus, the strategies are relatively simple.

If you want to see some of the best day trading strategies revealed, check out our spread betting page .

CFD Strategy

Developing an effective day trading strategy can be complicated. However, opt for a tool like CFD and your job could be a little easier.

CFDs take care of the difference between where trades are entered and exited. Recent years have seen their popularity skyrocket. This is because you can profit when the underlying asset moves relative to the taken position without having to own the underlying asset.

For CFD specific day trading tips and strategies, see our CFD page .

Regional difference

Different markets come with different opportunities and barriers to overcome. Intraday trading strategies for the Indian market may not work when you apply them in Australia. For example, some countries may not trust the news, so the market may not react the same way you expect them to return home.

Regulation is another factor to consider. Indian strategies can be tailored to suit specific rules, such as high minimum capital balances in margin accounts. So go online and check for vague regulations that won’t affect your strategy before you put your hard-earned money into cash flow.

You may also find different countries have different tax loopholes to jump over. If you live in the West but want to apply normal day trading strategies in the Philippines, you need to do your homework first.

What taxes will you have to pay? Will you have to pay it abroad and/or domestically? Marginal tax differences can make a significant impact on your end-of-day profit.

Risk management

Stop loss

The strategies work with risk into account. If you don’t manage your risk, you will lose more than you can afford and be out of the game before you know it. This is why you should always use a stop loss.

Price may look like it’s moving in the direction you hope, but it could reverse at any time. A stop loss will control that risk. You will exit the trade and incur only a minimal loss if the asset or security doesn’t go through.

Savvy traders usually don’t risk more than 1% of their account balance on a single trade. So if you have £27,500 in your account, you could risk up to $275 per trade.

Position size

It will also allow you to choose the perfect position size. The position size is the number of shares taken on a trade. Take the difference between your entry price and the stop loss price. For example, if your entry is £12 and your stop loss is £11.80, your risk is £0.20 per share.

Now to find out how many trades you can make in one trade, divide £275 by £0.20. You can have a position size of up to 1,375 shares. That is the maximum position you can take to comply with your 1% risk limit.

Also, check that there is enough volume in the inventory/asset to absorb the slot size you use. Also, keep in mind that if you have a position size that is too large for the market, you may experience slippage on entry and stop loss.

Learning methods

Video

Everyone learns in different ways. For example, some will find day trading strategy videos most helpful. This is why some brokers now offer a variety of day trading strategies in easy-to-follow training videos. Head to their learning and resources section to see what’s on offer.

Blog

If you are looking for the best day trading strategies that work, sometimes online blogs are the place to go. Usually free, you can learn inside strategies and more from experienced traders. On top of that, blogs are often a great source of inspiration.

Forum

Some people will learn best from forums. This is because you can comment and ask questions. Plus, you often find day trading methods that are easy for anyone to use. However, due to limited space, usually you only get the basics of day trading strategy. So if you’re looking for more in-depth techniques, you might want to consider an alternative learning tool.

PDF files

If you want a detailed list of the best day trading strategies, PDFs are usually a great place to go. Their first benefit is that they are easy to follow. You can open them as you try to follow the instructions on your own candlestick chart.

Another benefit is how easy they are to find. For example, you can find day trading strategies using quick google download PDF price action templates. They can also be very specific. So it’s relatively straightforward to find commodity or forex specific PDFs.

Additionally, you will find them geared towards traders of all experience levels. Hence you can find PDF for beginners and advanced PDF. You can even find country-specific options such as day trading tips and strategies for India PDF.

Book

Having said that, a simple PDF won’t go into the level of detail many books will. The books below provide detailed examples of intraday strategies. Easy to follow and understand also makes them ideal for beginners.

- Simple Strategy – Strategy Powerful day trading for trading futures, stocks, ETFs and Forex, Mark Hodge

How to Day Trade: A Detailed Guide to Day Trading Strategies, Risk Management and Trader Psychology, Ross Cameron - Day Trading Strategy : Proven Steps for Trading Profits, Jeff Cooper

The Complete Guide to Day Trading: A Practical Guide from Professional Day Trading Coach, Markus Heitkoetter - Stock Trading Wizard: Advanced Short-Term Trading Strategy, Tony Oz

So daily trading strategy books and ebooks can help improve your trading efficiency. If you want to read more, check out our book page .

Online courses

Others will find structured and interactive courses the best way to learn. Fortunately, there are now a variety of places online that offer such services. You can find commodity day trading strategy courses where you can be guided through crude oil strategy. Also you can find FTSE trading, gap and intraday hedging strategies.

Trade for a living

If you’re looking to pack up your day job and start trading for a living, you’ve got a challenging yet exciting journey ahead. You will need to revolve around advanced strategies, as well as effective money and risk management strategies. Discipline and mastery of your emotions are essential.

For more information, visit our ‘ trading for a living ‘ page .

Last word

Your profit at the end of the day will depend a lot on the strategies that you use. So it’s worth noting that it’s often a simple strategy that proves successful, regardless of whether you’re interested in gold or the NSE.

Also, keep in mind that technical analysis will play an important role in validating your strategy. Also, even if you opt for an early or late day trading strategy, controlling your risk is essential if you want to still have money in the bank at the end of the week. Ultimately, developing a strategy that works for you takes practice, so be patient.