What is a candlestick in IQ Option?

Candlestick is an important tool in financial trading on IQ Option. It is a chart that shows the opening price, closing price, lowest price and highest price of an asset over a certain period of time. Each candle on the chart represents a specific period of time, which can be 1 minute, 5 minutes, 15 minutes, 1 hour, or even 1 day.

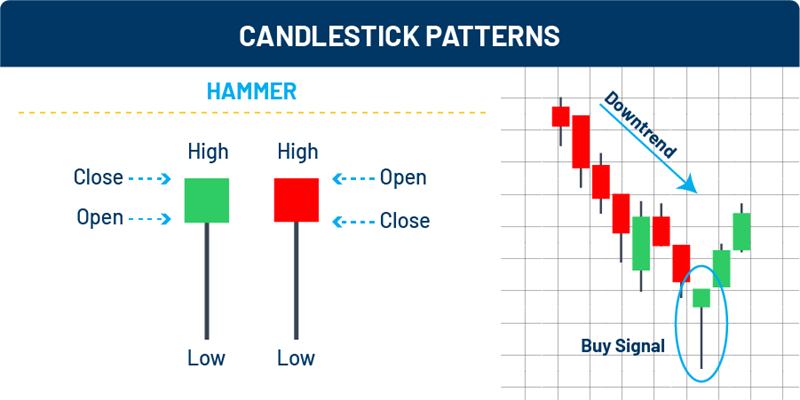

Each candle consists of a body and two shadows. The body of the candle represents the difference between the opening price and the closing price. If the candle body is green, it means that the closing price is higher than the opening price. Conversely, if the candle body is red, the closing price is lower than the opening price. The shadow of a candlestick represents the range of the lowest and highest prices during that period.

By analyzing the patterns and trends of candlesticks, traders can make effective decisions to buy or sell assets on IQ Option. It is important to master how to read and understand candlesticks to be able to predict future price movements and make the right decisions.

Understanding candlestick components

Understanding candlestick components is an important part of candlestick chart analysis in stock trading. Each candlestick consists of three main parts: the candle body, the upper shadow, and the lower shadow. The candle body represents the difference between the opening price and the closing price during a specific period. The upper shadow represents the highest price the stock reached during that period, while the lower shadow represents the lowest price. By analyzing these components, traders can better understand market sentiment and predict future price trends. At the same time, understanding the components of a candlestick also helps traders make smarter decisions when buying and selling stocks.

Anatomy of a Candlestick in IQ Option

Candlesticks are one of the most important tools that investors use to analyze asset price charts. Each candlestick contains a lot of information about the fluctuations in asset prices over a certain period of time. Therefore, understanding the structure of a candlestick is very important for effective investment on IQ Option.

Each candlestick consists of three main parts: body, upper shadow and lower shadow. The body represents the difference between the opening price and the closing price during that period. If the body is green, it means that the closing price is higher than the opening price, and vice versa, if the body is red. The upper shadow is the part that represents the highest volatility of the asset price during that period. The lower shadow represents the lowest volatility of the asset price during that period.

By looking at the structure of a candlestick, investors can assess the market situation and make reasonable trading decisions. For example, a candlestick with a long green body and no or short upper shadow, may indicate that the uptrend will continue. Conversely, a candlestick with a red body and long upper shadow may signal a trend reversal.

In short, understanding the structure of a candlestick is an important factor that helps investors make accurate trading decisions on IQ Option. To become a successful investor, take the time to study and apply knowledge of Anatomy of a Candlestick to your trading strategy.

How You Can Set Up Candlesticks On Your Charts

To set up candlesticks on your chart, you first need to choose the right chart type. There are different types of charts such as line charts, bar charts, candlestick charts, and Renko charts. Once you have chosen the type of candlestick chart, you need to determine the time period you want to monitor, which can be 1 minute, 5 minutes, or 1 day. Then, you can choose the color and display style of your candles. Popular candlestick patterns include single candlesticks, double candlesticks, and triple candlesticks. To understand candlestick charts better, you need to learn about candlestick patterns and their meanings. Finally, you can apply different technical indicators to analyze candlestick charts and make your trading decisions. Experiment and adjust the way the candles are displayed on your chart to find the style that works best for you.

Using Candlesticks for Price Action Trading in IQ Option

Using Candlesticks for Price Action Trading in IQ Option is a popular method that helps traders make smart and accurate decisions. Candlesticks are charts that show the opening price, closing price, highest price, and lowest price over a period of time. By analyzing the price action through candlesticks, you can make predictions about price trends and make trading decisions based on that information.

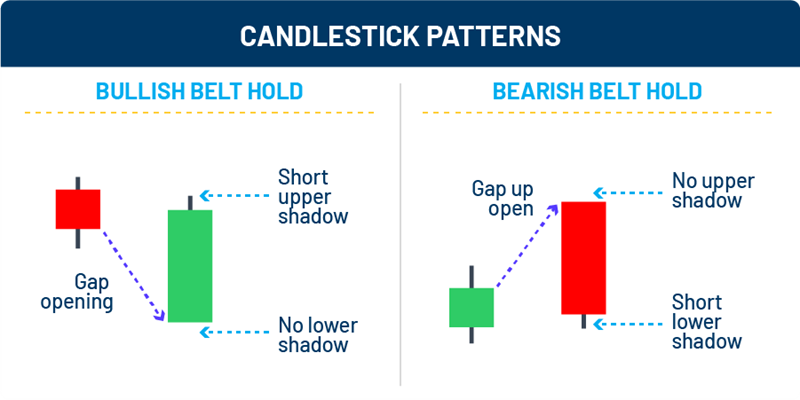

Some popular candlestick patterns such as Pin Bar, Engulfing, Doji, Hammer, and Hanging Man provide traders with buy and sell signals. For example, a Pin Bar candlestick pattern with a long tail feather can indicate a reversal in the price trend, while an Engulfing candlestick pattern can indicate a strong reversal.

By combining the use of candlestick patterns with technical indicators