In this article, we will discuss the most important things to know about the top Forex indicators . These indicators will act as essential buy and sell signals that can be used in any trading strategy. Our ultimate guide to technical indicators will explore the best forex volume indicators and what are the forex trend indicators . We will start from the basics and then reveal the best and most important forex indicators for traders. In addition, we will demonstrate how to develop your forex strategies based on indicators.

If this is your first time on our site, our team at Trading Strategy Guide welcomes you. Make sure you hit the subscribe button so you get Free Trading Strategies every week straight to your email. Our tested trading strategies have helped traders to tap the forex market and many more.

No matter what type of trader you are (day trader, investor, swing trader or trend trader), you need Forex trends in order to be profitable. The currency market needs to go up or down once your order is triggered, otherwise you won’t stand a chance to make any profit. Our forex trend indicator will let you know if the price is likely to go up or down.

Technical indicators make it easy to identify the current price trend and predict where the price will move in the future. By developing the best forex indicator strategy, you can increase the amount you make per trading day.

If you are new to the forex market, please check out our Forex Beginner’s Guide to Forex Trading which contains all the information you need on how you can start trading FX.

Let’s start by defining what a Forex indicator is

Table of contents

Explanation of 1 Forex Indicator

2 How many types of Forex indicators are there?

2.1 Top Indicators

2.2 Delay Indicators

2.3 Confirmation criteria

3 How to use Forex trend indicators

4 Best Forex Volume Indicators

5 Forex breakout strategy indicator

5.1 Last Words – Forex Trend Indicators

Forex Indicators Explained

Forex indicators are simply tools used in the technical analysis process to forecast future price movements. A technical indicator that uses a rigorous mathematical formula based on historical price and/or volume and displays the results as a visual representation, overlaid on the shelf or at the bottom of your window .

If used correctly, technical indicators can add a new dimension to understanding how price moves. The best trading strategies will often rely on a variety of technical indicators. It is well known that many traders, especially novice traders, use technical indicators as their main tool in analyzing price movements.

Basically, these technical indicators are used to assist your price chart analysis. Most Forex trading platforms should come with a set of the most popular technical indicators. To find a fx platform, we recommend forex trading platform

There is also a potential danger you need to be aware of, which we call: Analysis paralysis. In other words, you need to be careful not to fall into the trap of using too many technical indicators that can ultimately affect your ability to analyze market prices.

FX indicators are very useful in analyzing price charts. If you don’t know how to start using the FX indicator, please check: How to apply technical analysis – Step by step guide

Now let’s see what the different types of Forex technical indicators are and how to use them correctly.

See below:

How many types of Forex indicators are there?

There are countless technical indicators available to choose from. In technical analysis, most Forex indicators fall into one of three categories, as follows:

- Top Forex Indicators (Parabolic SAR, RSI, Stochastic)

- Lagging Forex Indicators ( Moving Average )

- Confirm Forex Indicators (Balanced Volume)

You have to take the necessary time and learn what each technical indicator means. No stat gives you a 100% win rate, so don’t be a fairy tale chaser. This is why many traders use multiple indicators. Taking a closer look at the market will help you succeed as a trader.

What are the best technical indicators in forex?

Here is a method to improve our chart reading skills and learn which FX indicators to use and how to combine them: Best combination of technical indicators – Market making method .

In addition, FX technical indicators can be sorted by the type of data we extract from them. We can identify four types of indicators to understand the market:

- Forex momentum indicators (RSI, Stochastic, CCI, Williams %R)

- Forex Trend Indicators (Moving Average, MACD, Parabolic SAR)

- Forex Volatility Indicators (Bollinger Bands, Envelopes, ATR)

- Forex sentiment indicator or forex volume indicator (OBV, Chaikin Money Flow)

Leading Index

A leading technical indicator that gives early warnings and trade signals about where the price will move. These indicators can determine the direction of a trade before a new trend even begins.

This sounds too good to be true, and you’re right if you doubt it.

If the leading indicators could signal a trade first, before the trend started, we would all be extremely rich by now, which is not the case. The downside is that leading indicators are notorious for many false signals.

This means a lot of the time they will mislead you in the wrong direction.

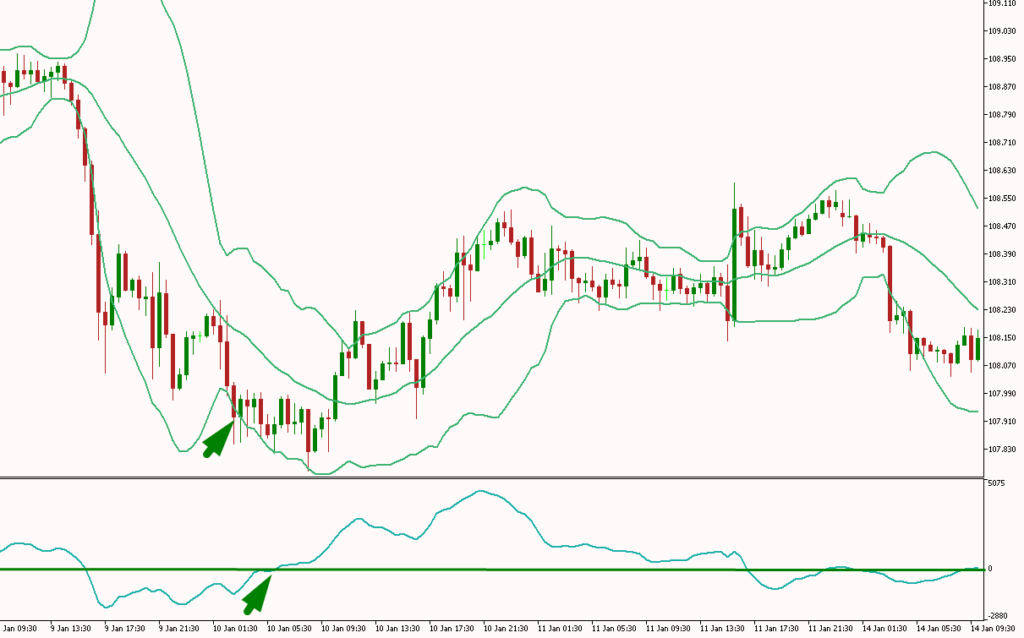

In the example above, we have EUR/USD with the RSI showing overbought conditions in the market. Despite the overly high RSI, the EUR/USD rate continues to rise as the prevailing and dominant trend remains bullish. A novice trader might have sold after the RSI entered the overbought zone, which would have cost him money. With experience, traders will learn to time their entry and exit with a sense of precision.

Note * Technical indicators are not perfect, but if they are used correctly for their strength and in the context of a trending frame, great things can be done.

Lagging Index

A lagging technical indicator, as the name implies, is lagging behind the current market price. Typically, lags are caused by using larger price input data in their calculations. But, a lagging indicator can be extremely helpful in measuring market trends.

The whole idea of using a lagging indicator to identify trends is that they remove a lot of the inherited market noise in prices and give you a better idea of the trend. But, the downside is that the lagging indicator will only warn you of a trend after the trend has started.

That is not so great because many times this means you will be too late to the party and secondly, the more you join in the direction of the trend the less profit will be available to you. In this case, by using a lagging indicator to trade, you miss out on a portion of the potential profit.

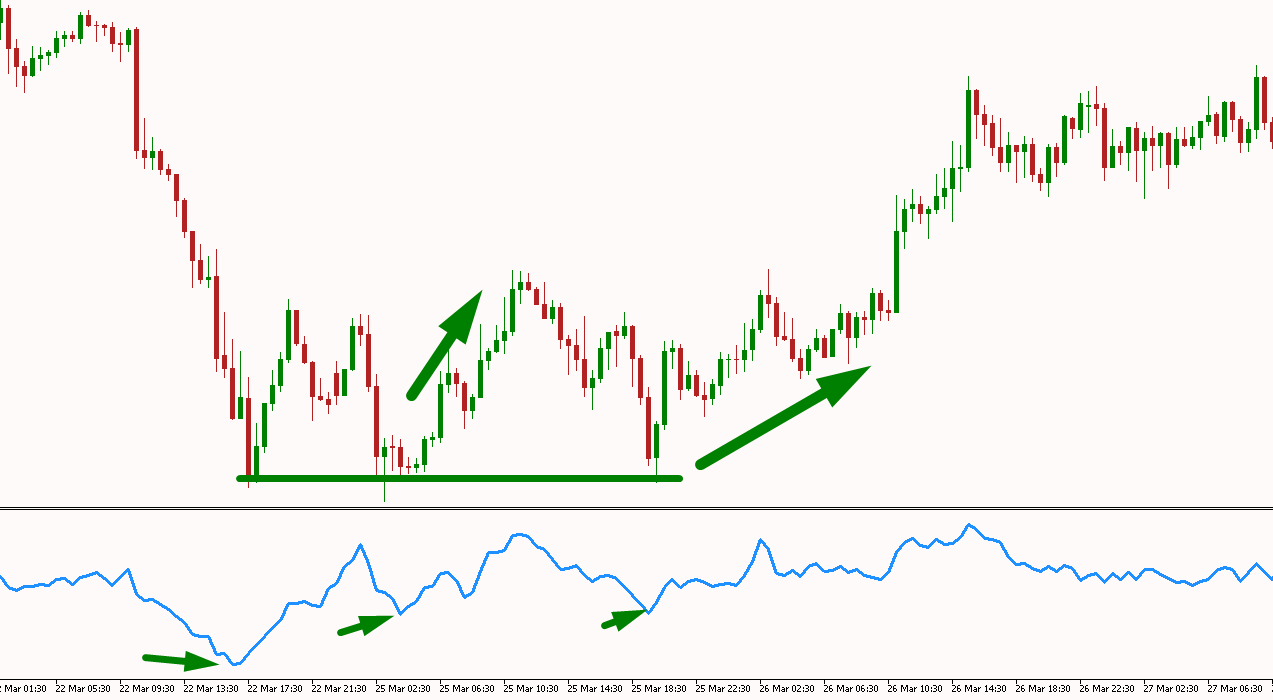

The classic moving average crossover system is a good example of how lagging indicators signal a change in market sentiment after a new trend has begun (see Forex chart below).

Note* we must remember that most technical indicators are lagging in the wild.

Confirm the stats

A confirming technical indicator can be extremely useful to confirm your price analysis. As the name implies, confirming indicators are used only to confirm that the price action reading is correct. One of the most popular confirming indicators is the Balanced Volume – OBV. The volume indicator is extremely useful.

The way one would use and interpret the OBV readings is pretty straightforward. What drives the trend is the buyers and sellers and their aggressiveness and in this regard, volume increases when the market moves in an uptrend or in a downtrend.

In the example below, if for any reason you will conclude that the uptrend will reverse, then using the OBV indicator it will confirm your analysis. The uptrend is lacking momentum as buyers are not buying this uptrend as indicated by the OBV indicator.

Understanding the differences and similarities between the three types of technical indicators can help you better read the information they provide and then decide how to trade. The best trading indicator for you will depend on your trading goals.

Alternatively, you can also use functional indicators such as the Forex bar timer indicator. The Candle Timer Indicator simply counts down the time until the next candle opens. It is simply a functional tool used by many professional traders to evaluate price charts.

Now let’s discover what is the most important Forex indicator of all time.

How to use Forex trend indicators

The 200-day moving average FX trend indicator is considered the best trend indicator out there.

For example, if you are looking at the 200 Day Moving Average. What you will be plotting on your chart is a moving point looking at the last 200 closing prices and then plotting the average price. This way you can eliminate a lot of the inherited noise in your price charts and give you a much simpler view of what is going on in the market.

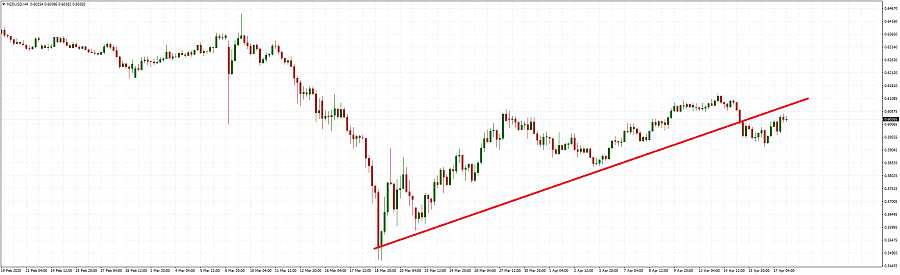

Moving averages are really an easy way to identify and provide a bit of definition to a trend. This will give you an answer as to whether you are in an uptrend or in a downtrend and how solid the trend is. Because moving averages can gauge trend direction, they are also known as trend indicators (see Forex chart below).

The slope of the moving average and where the price has a relationship with the MA will determine the trend.

The second most important technical indicator is the Forex volume indicator.

How to Use the Best Forex Volume Indicators

The Forex Volume Indicators are used as confirmation tools to confirm the trend. Moreover, the volume indicator is so versatile that it can also be used to confirm Forex breakouts. Identifying breakouts will allow you to trade ahead of the market.

Volume indicators can help us better understand how healthy and safe trends are. A volume-based indicator will usually be displayed at the bottom of your chart, and many of them take the form of oscillators. Most oscillators will have an upper and lower barrier that will usually signal buying and selling pressure.

Looking for the best forex volume indicator strategy? Your hunt is over. Test yourself FREE Volume Trading Strategy to Win 77% Trades .

We also promised that we will show you which Forex breakout strategy indicators you need to trade Forex breakouts.

See below:

Forex breakout strategy indicators

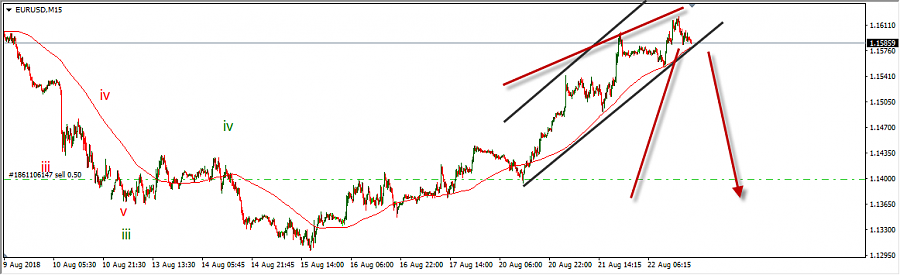

How to set the odds in your favor when trading breakouts?

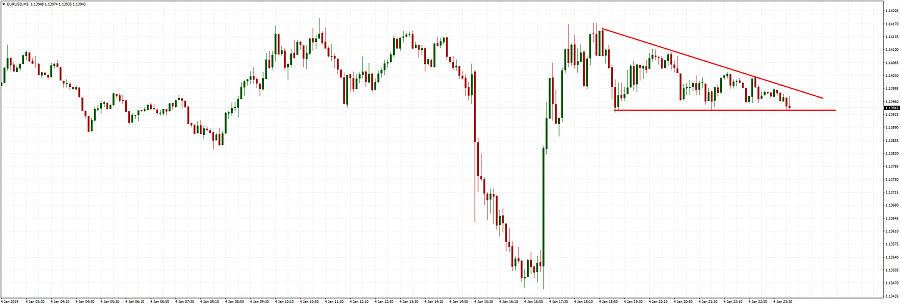

A breakout is probably the most common and conspicuous chart pattern. They also create great opportunities for profit. Most trends emerge from a breakout of consolidation. The high frequency in which the breakout occurs makes it easy for the breakout to give false signals. Using a technical indicator to confirm a Forex breakout is very important if you want to distinguish between a fake breakout and a genuine breakout.

If you want to learn how to use forex breakout strategy indicators, please check out some of the best trading strategies used for breakout trading by professional traders: Strategy break trading Break is used by professional traders.

What makes a breakout valid is whether or not the FX breakout occurs as a result of smart money activity. So, in order to evaluate the breakout, we really need to use a volume indicator to measure the buying and selling activity of professionals.

One volume-based indicator is the VWMA (Volume Moving Average).

VWMA is one of the most underrated technical indicators used only by professional traders. The VWMA looks like a moving average, but instead, it is based on volume. It is not just a moving average price.

Final Words – Forex Trend Indicators

Forex Indicators can be extremely useful if you keep it simple, but it can be problematic if too complicated. Be sure to fully understand any forex indicator you choose to use. Several technical indicators can be of great help in reading price action, and more importantly, they can help you forecast future price movements. However, before venturing into the world of Forex technical indicators, you must remember that price is still the ultimate truth-teller about what is really going on behind any chart.

Each stat has its own power. On the one hand, the Forex trend indicators are more useful for determining the overall direction of the market. At the same time, some of the best forex volume indicators can be used more to confirm the strength of the trend. Read about the best forex strategies here.