Learn how to use the Aroon Indicator trading strategy to spot changes in the trend direction with deadly accuracy. Every trader needs to know how to gauge the strength of a given trend and asset. The Aroon Oscillator is a two-in-one technical indicator that will help you pinpoint reversals and their strengths and weaknesses. This guide is all about spotting trend changes with this powerful tool.

If this is your first time on the site, our team at Trading Strategy Guide welcomes you. Be sure to hit the subscribe button so you get Free Trading Strategies delivered directly to your inbox every week.

Market trends are always changing. Don’t be fooled by a trend that is about to change gears. The problem is that most traders have trouble identifying when the trend changes. Market wizard and billionaire hedge fund manager Paul Tudor Jones has this to say about identifying trend changes:

No training, class or otherwise, can prepare the final third trade of a move, whether it’s the end of a bull market or the end of a bear market.

For more famous trading quotes that can give you a glimpse into the minds of the most successful traders and hedge fund managers check out: Top Trading Quotes of All Time – Learn to Trade .

If you want to be able to spot major trend changes, you need to be equipped with the right tools.

So which is the best indicator?

The best indicator for determining trend change and trend strength is the Aroon Oscillator .

Next, you will define the Aroon MT4 indicator and reveal the secret ArAroon oscillator formula :

Table of contents

1 What is the Aroon Stat

2 What is the Aroon Oscillator Formula?

3 How to use the Aroon Oscillator

4 Aroon Oscillator Trading Strategy

4.1 # 1 Aroon’s Breakthrough Trading Strategy

4.2 # 2 Aroon’s Trend Strength Strategy

5 last word – Aroon Fluctuating

What is the Aroon Index?

The Aroon Oscillator is a technical indicator that is part of the family of oscillators . Aroon was developed by Tushar Chande in 1995, and it can help you identify incoming trends and their strengths or weaknesses. Chande was born in India, and in Sanskrit Aroon means “The First Light of Dawn”.

As the name suggests (early light) this oscillator is designed to reveal the early start of a new trend.

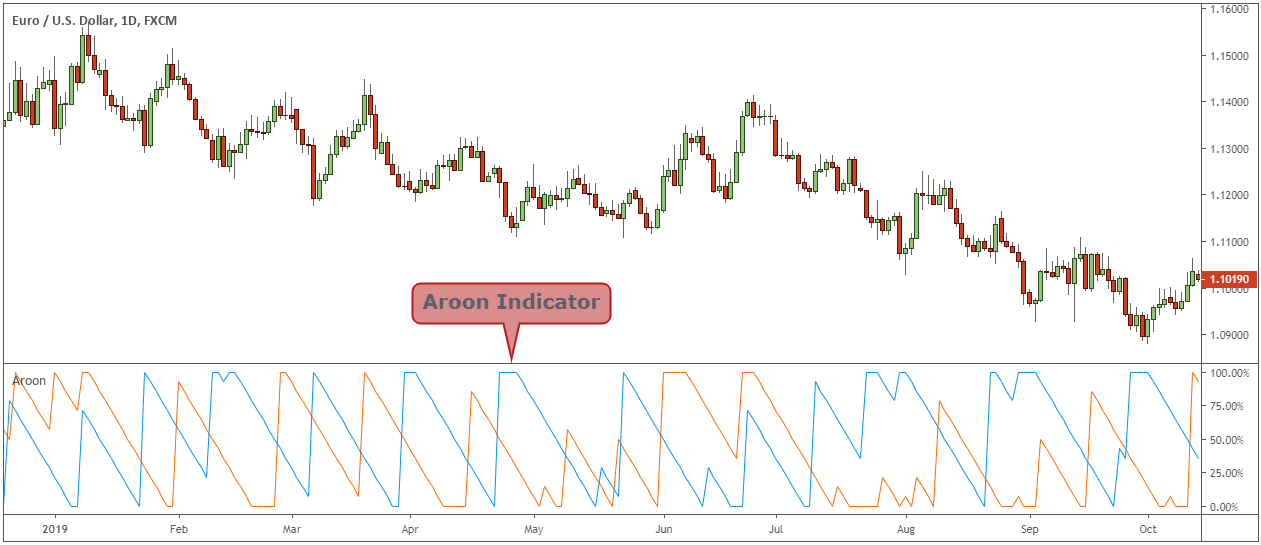

Check out the Aroon chart below:

Typical momentum indicators focus solely on detecting the relative strength of a trend. For example, the ADX indicator can be used to identify only strong moves.

Check out how to measure trend strength with the Best ADX Strategy Built by Professional Traders .

In essence, the Aroon technical indicator combines the benefits of two other oscillators:

- On the one hand, we can recognize when a new trend will emerge. To identify market reversals, you can use the

- Mass Index indicator (Check out Volume Index – The Ultimate Guide to Trend Reversals ).

- But on the other hand, we can detect trend strength without using other technical indicators. If you are looking to develop your trading skills to accurately read market strength, check out For sure Indicator Strategy .

We can see that the Aroon technical indicator is a combination of Mass Index and KST Indicator.

Too many technical indicators can lead to analysis paralysis.

So being able to use just one index and extract a lot of information from it is a big advantage.

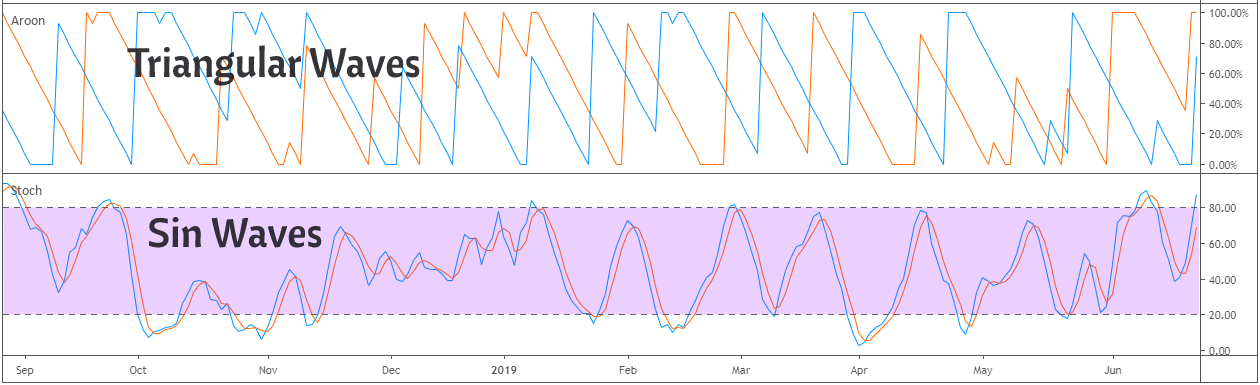

Second, traditional oscillators use sine waves to give us a visual representation of the indicator’s readings. However, the Aroon line is more triangular in shape. For technical traders, being more visually oriented, this can be advantageous in and of itself as trade signals are millions of times easier to spot.

The secret to identifying a trend reversal and its strength depends on understanding the Aroon oscillator formula. So let’s get started.

What is the Aroon Oscillator Formula?

The main idea behind the Aroon technical indicator is that strong uptrends will likely see new highs and strong bears will likely see new lows. In essence, Aroon will give you key insights as we form new highs and new lows.

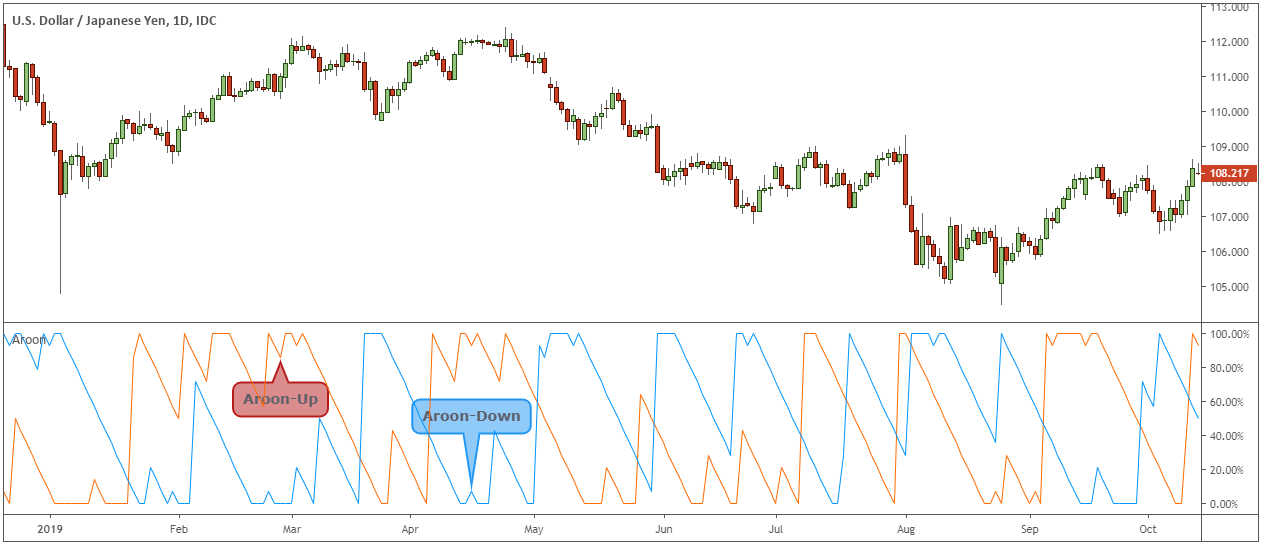

The Aroon indicator consists of two lines oscillating between 0 and 100:

- Aroon-Up, which measures the strength of an uptrend.

- Aroon-Down, which measures the strength of a downtrend.

The Aroon-up line uses the high price in its calculation, while the Aroon-up line uses the low price in its calculation. These two lines are then drawn side by side to better represent the image.

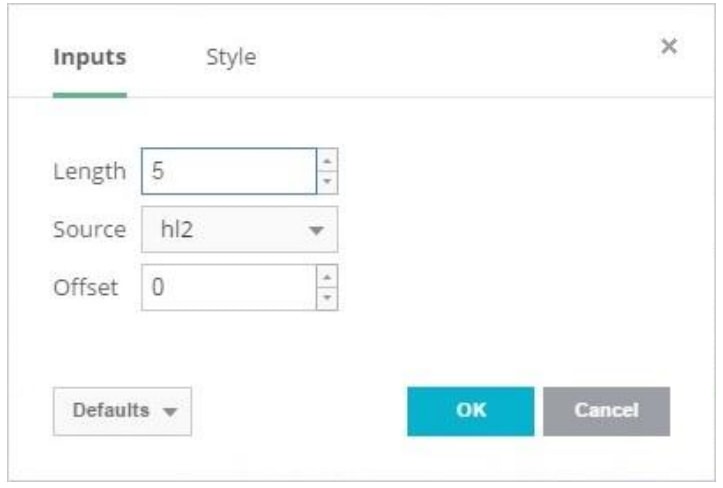

The default parameter setting for Aroon is 14 periods.

But, what are the best settings for the Aroon indicator?

Chande recommends applying the best setting for the Aroon indicator of 25 data periods:

- Aroon-up is showing how much time has passed since the previous 25-period high.

- Aroon-down is showing how many periods since the recent 25-period low.

Note * For long-term trading strategies, we like to look as far back as past prices (> 25 periods). But for short-term trading strategies, we want to look at the most recent price data (<25 periods).

Aroon indicator settings:

Unlike other pulse oscillators, which are based on price changes and time, the Aroon indicator is quite unique. We also incorporate 25-period highs and lows into the Aroon oscillator formula:

The above mathematical formula shows you how to calculate the Aroon indicator lines.

The Aroon Up and Down Indicator requires tracking the price highs and lows over the past 25 periods.

Luckily, we don’t have to remember the math behind the Aroon calculation. Our trading platform will do it for us.

Let’s see how to use the Aroon indicator to trade money.

Here’s how to get started with the Aroon technical indicator:

How to use the Aroon Oscillator

For example, traders can use the Aroon technical indicator for:

- Identify a new trend (up or down).

- Assess the strength of trends.

- Define region scope and merge.

- And, predict market reversals.

The above are just a few examples of how to use the Aroon indicator.

For the entries, we will use next to the upper (100) and lower (0) boundaries, the center line (50).

So here is the basic interpretation of the Aroon reading:

- An index close to the 100 level indicates a strong uptrend/downtrend.

- A reading close to zero indicates a weak uptrend/downtrend.

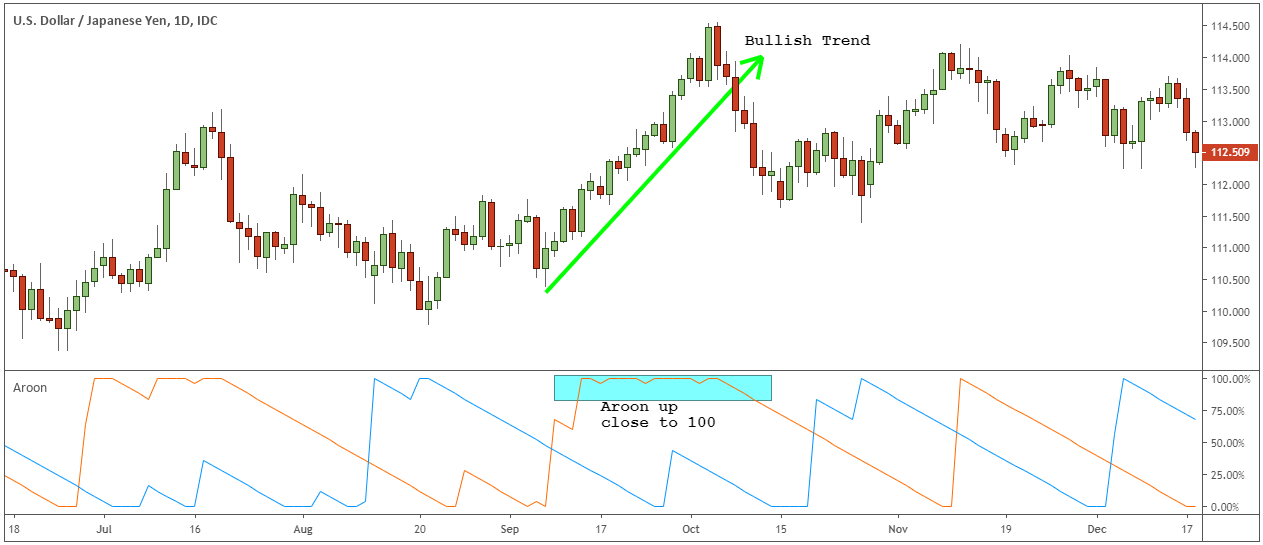

When the Aroon up line is close to 100 and the Aroon down line is close to zero, the market is in a strong uptrend.

Conversely, when Aroon down is close to 100 and Aroon up is close to zero, the market is in a strong downtrend.

Aroon’s up and down lines will decrease as time passes between a new high or low.

When to enter a trade based on a new high formation versus a new low formation?

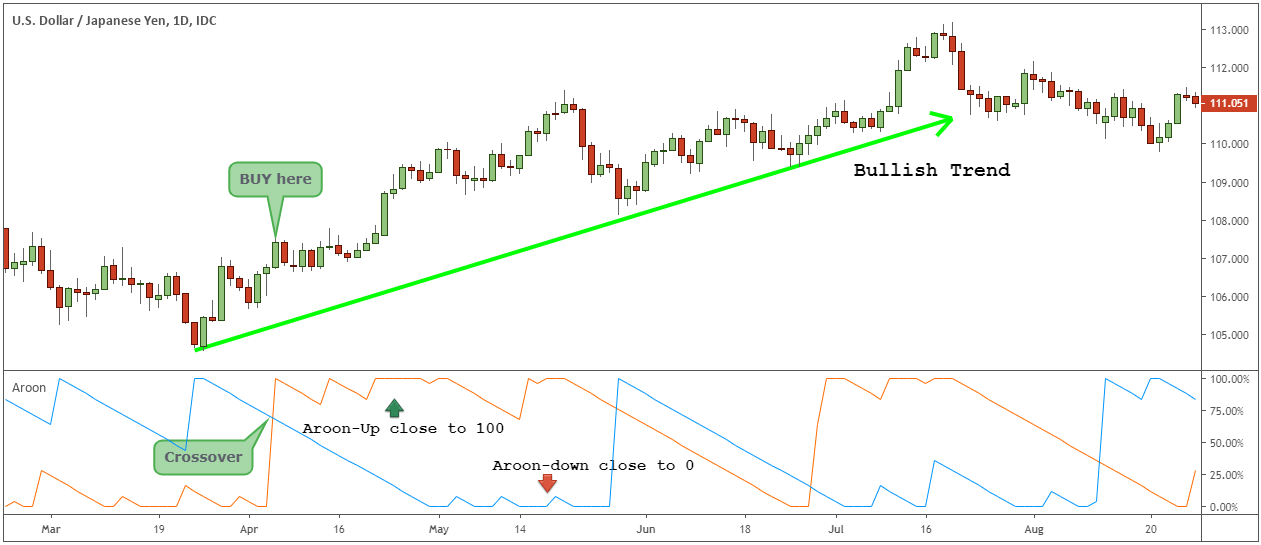

The buy and sell signals for Aroon are simple.

The main Aroon buy signal will occur when Aroon-Up is moving upwards. As the Aroon-up is gradually rising towards the 100 level, the chart will also show that the price will move in an up direction. The reason behind this is that our chart is currently forming these higher highs. We are getting multiple bullish candles, that’s what the Aroon line is revealing. Also, be sure to read the Best Candlestick Strategy PDF Guide .

On top only Aroon-Up moves upwards, Aroon-Down needs to move downwards to confirm the uptrend. When Aroon-up crosses above Aroon down, a buy signal is generated.

The interpretation of this signal is that we are getting recent highs higher and further from lower lows. All in all this is a clear sign of an uptrending market.

Note ** Aroon sell signals will be exactly the opposite. The Aroon sell signal is triggered when Aroon-Down is crossing below Aroon-Up.

Next, we will explore 3 powerful Aroon trading strategies to navigate any asset class and market.

Aroon Oscillator Trading Strategy

Aroon is a very flexible trading indicator packed with many trading features. You can use it as a trading system on its own. Here are the top three trading strategies based on the Aroon indicator that you can use to get more profit:

- Aroon breakout trading strategy(will help you spot consolidation and breakout).

- Aroon Trend Strength Strategy (will help you to go with the trend).

- Aroon’s pullback trading strategy (will help you to trade a pullback).

Aroon’s #1 Breakout Trading Strategy

How to spot trade consolidation and breakout with Aroon?

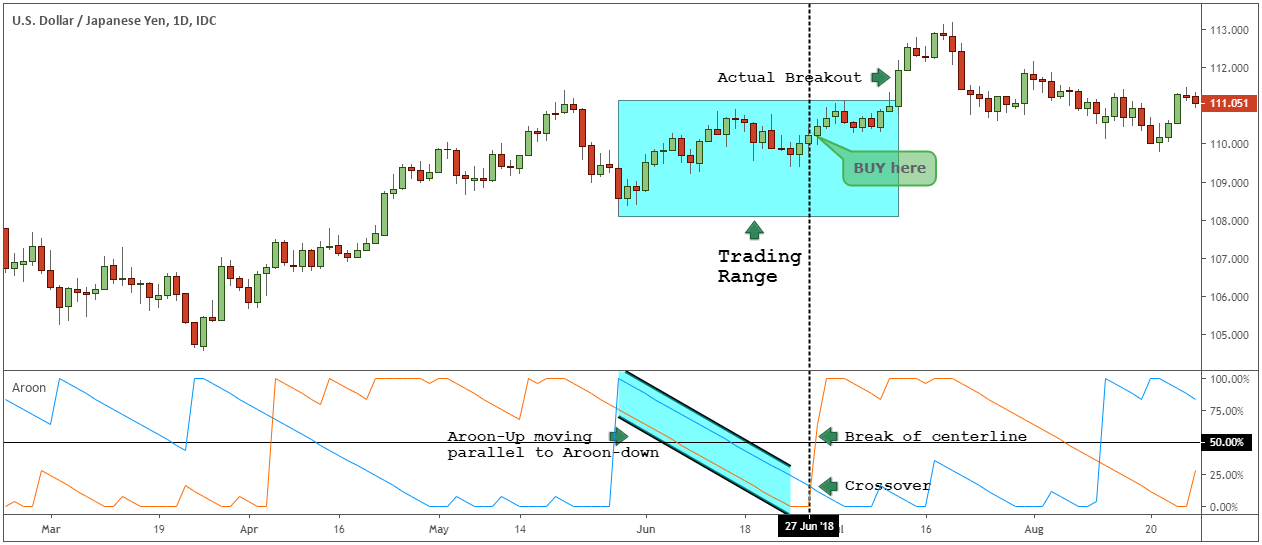

When the Aroon Up and Aroon Down lines are parallel, it is a signal that the price is consolidating. Aroon’s interpretation is that no new highs or lows are made during the default period.

You have two options for trading consolidation.

Wait for the breakout to happen and take a trade in the direction of the breakout.

Or, wait for the Aroon crossover followed by the central diagonal to add a confluence for the trading direction.

More often these Aroon signals will occur before the actual breakout.

See the Aroon chart below:

So you basically predict the breakout.

This is like the front running of all market participants.

You can enter a trade before anyone else.

Now let’s see how to go strong with Aroon. Also, learn how to trade using the RSI Oscillator .

#2 Aroon’s Trend Strength Strategy

The hidden strength of the trend can be revealed through the Aroon lines.

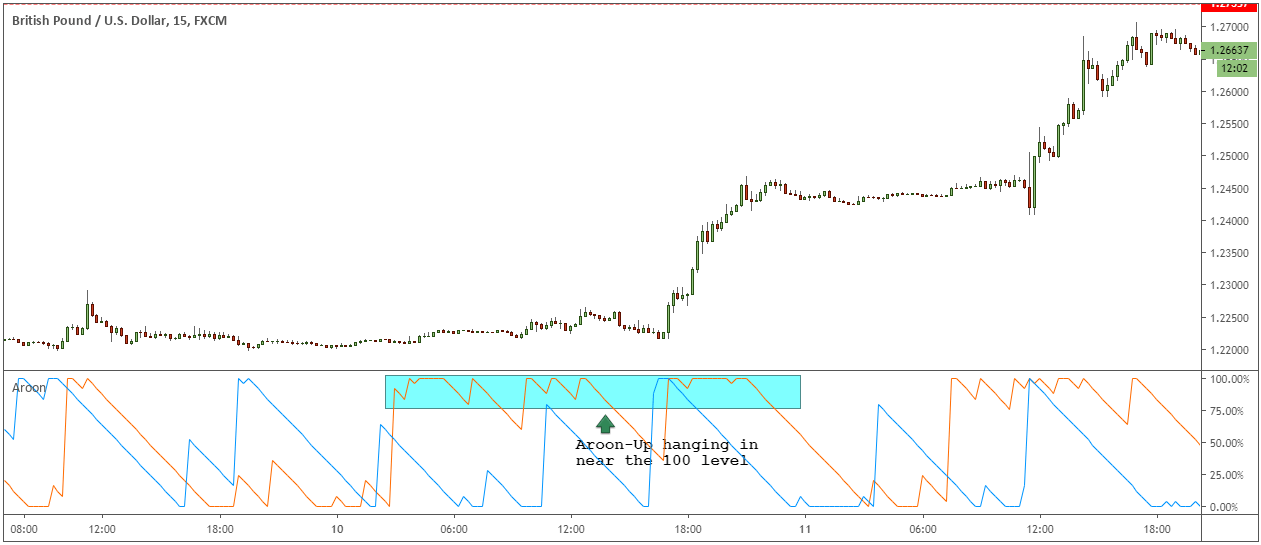

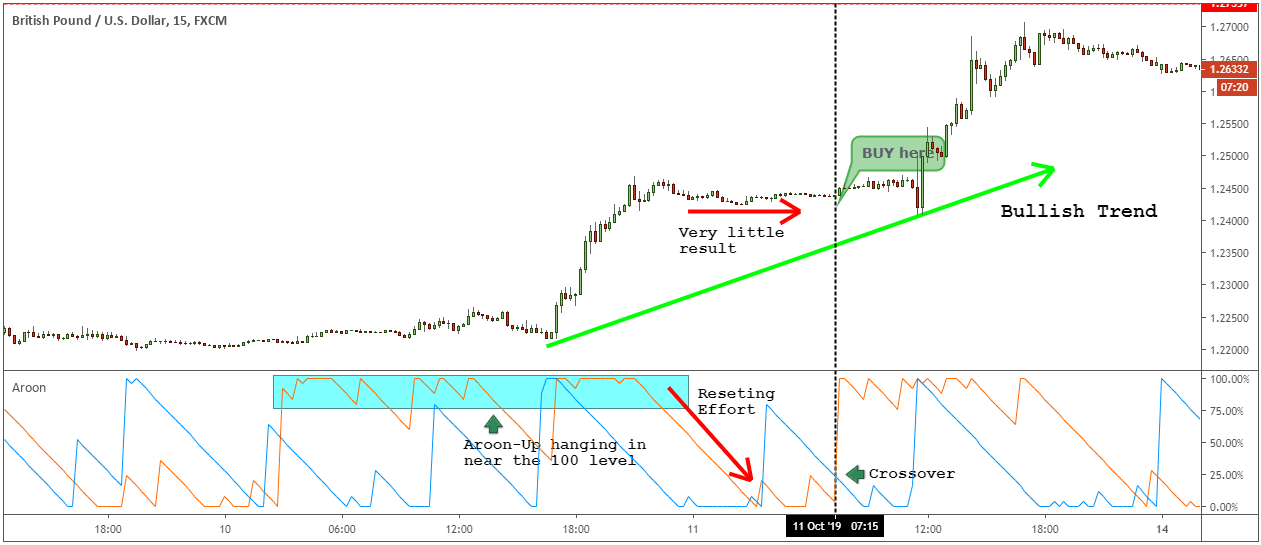

After we hit level 100, we sometimes start to have small periods of change.

Aroon UP will simply hang, like reaching a plateau.

This is the same type of behavior that can be found when a traditional oscillator reaches an overshoot reading. And, it remained in overread state for a good amount of time.

A picture is floating around:

A continuous reading of Aroon-Up near the 100 level is a sign of a very strong trend. However, at some point, one or two trading scenarios can occur:

- Expect a trend reversal

- Or, to expect a pullback

The Aroon interpretation of this reading suggests that we have been forming these higher highs for a very long time. For Aroon-Down, we will form a lower low.

Usually these oversold readings on the Aroon oscillator signal the presence of a strong trend. However, if you are looking to just widen the market, you can exit your trade as soon as Aroon-Up crosses the center line.

But, we are looking to trade with the trend.

And, we have developed a proven way to distinguish between a pullback and a full reversal.

We call it the law of effort versus result.

Effort is activity measured in Aroon lines (in our case Aroon-Up). And, the result is activity as measured by price action. The theory is that if Aroon-UP resets itself by moving out of 100 readings and into 0 readings, price should follow the lead of Aroon-Up readings.

We expect efforts to put in lower prices. If not, and we see only a small change in price, we know the uptrend is strong.

Here is how you can capture the pullback with Aroon and trade with the trend.

We have combined Aroon trend strength strategy and Aroon pullback trading strategy into one big market advantage. If you like this strategy, be sure to check out the other proven in Best Trading Strategy Terms .

The Last Word – Aroon Fluctuating

The Aroon indicator is an anomaly indicator that can help you spot the strength of a trend and follow that trend until a buy or sell peak is reached. We like how flexible the Aroon Up and down indicator is. The Aroon Oscillators triangles make it easy for the untrained eye to spot buy and sell signals.

All in all you have a pulse oscillator that can easily be in your top 3 best technical indicators for profitable trading. Which indicators you are using, it affects how you interpret the trends. Of course, there is no single indicator that is the Holy Grail of trading.

Aroon is an effective tool for detecting changes in trend direction and trend strength.