Do you know how to trade with the best Fractal Trading Strategy? This Fractal Trading Strategy will answer all your questions about fractals. You will learn how to use this strategy step by step to achieve consistent winning trades .

Today, we are going to dive into a trading strategy with the Bill Williams Fractal Indicator / Bill Williams Alligator.

Before we start trading using fractals profitably, I want to give you some background information about Bill Williams himself. This will help you understand the importance of these particular metrics. Also, read about Scaling and Scaling in Forex.

Bill Williams Quick Overview: Trade Bill Williams Fractals

Mr. Williams developed a unique theory from combining Chaos Theory with trading psychology. Along with the influence they have on the movement of the market. Bill Williams has a vast knowledge of stocks, commodities, and forex markets, which has led him to develop many indicators, including fractal trading patterns.

These include Acceleration/Deceleration Oscillators, Alligators, Awesome Oscillators, Fractals, Gator Oscillators and Market Facilitation.

Each indicator has a specific value. They are great for trading if you understand the basic concepts of each.

His market view was that, in order for you to trade money, you must be able to understand that underlying market structure. You have to be aware of the market insider division, which he calls dimensions .

These sizes include:

- Fractal (phase space)

- Zones (combination of energy and force)

- Momentum ( energy pha )

- Deceleration / Acceleration (phase force)

- Equilibrium line (odd attraction)

I could go on for quite a while about Bill Williams. But the important part to note about all of this is that his analysis and views on the market are different. These powerful stats are not obsolete, as some claim. They work very well when you apply the right strategy.

His indicators come standard on most trading platforms. These indicators will most likely be under his name, Bill Bill, Williams or Williams Williams indices.

Indicators used for the Blac Fractal . Trading Strategy

Bill Williams Fractals: How does the fractal indicator work? Well, these are simply arrows above or below the candles on the chart. These small pieces are formed when five repeating bars arrange in a separate way. You need the fifth bar to close to discover the lowest high or low low. We will go into more detail about this indicator and show you how to use the alligator indicator. You can find fractal indicator on mt4 or other popular trading platforms. No need to run download fractal indicator as it will be available to you.

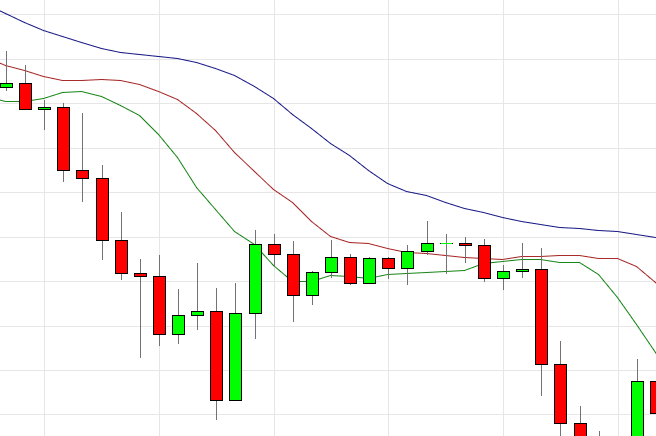

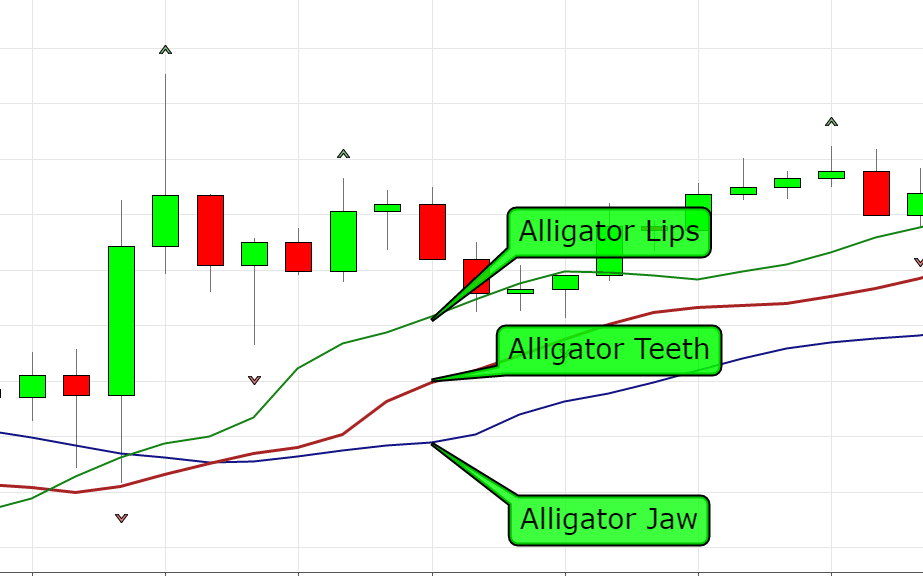

Bill Williams Alligator: How does the Bill Williams Alligator Indicator Work? This indicator consists of 3 specific moving averages.

The 13-period line is called Function (blue)

The 8-period line is called the tooth (red)

The 5-period line is called the lip (green)

We will go deeper into this indicator a bit. Each of these lines has a specific name. This is because we will refer to them later in the strategy.

This is what alligators look like:

We have developed a strategy called Big Three Trading Strategy that uses three specific moving averages if you want to check it out later.

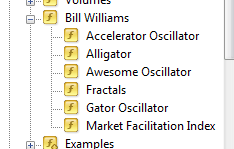

These are just two of the five indicators that Bill Williams has developed.

Như bạn có thể thấy ở trên, đó là tất cả 5 chỉ số mạnh mẽ của Bill Williams đạt tiêu chuẩn trên nền tảng giao dịch của bạn.

Tôi thích mỗi trong số 5 chỉ số này, nhưng sau khi nghiên cứu và thử nghiệm rộng rãi, chỉ số cá sấu và fractal không chỉ là cách dễ nhất để giao dịch với các chỉ số của anh ta mà còn cực kỳ mạnh mẽ với chiến lược đúng đắn.

Fractal trading strategy steps: Fractal trading techniques

Step #1: Apply both Fractals and Bill Williams Alligator Indicator on your Chart

The first step you’ll want to take is, of course, toss these important indicators into your chart. Like I said, they come standard on every trading platform I know so this should be very simple for you to do.

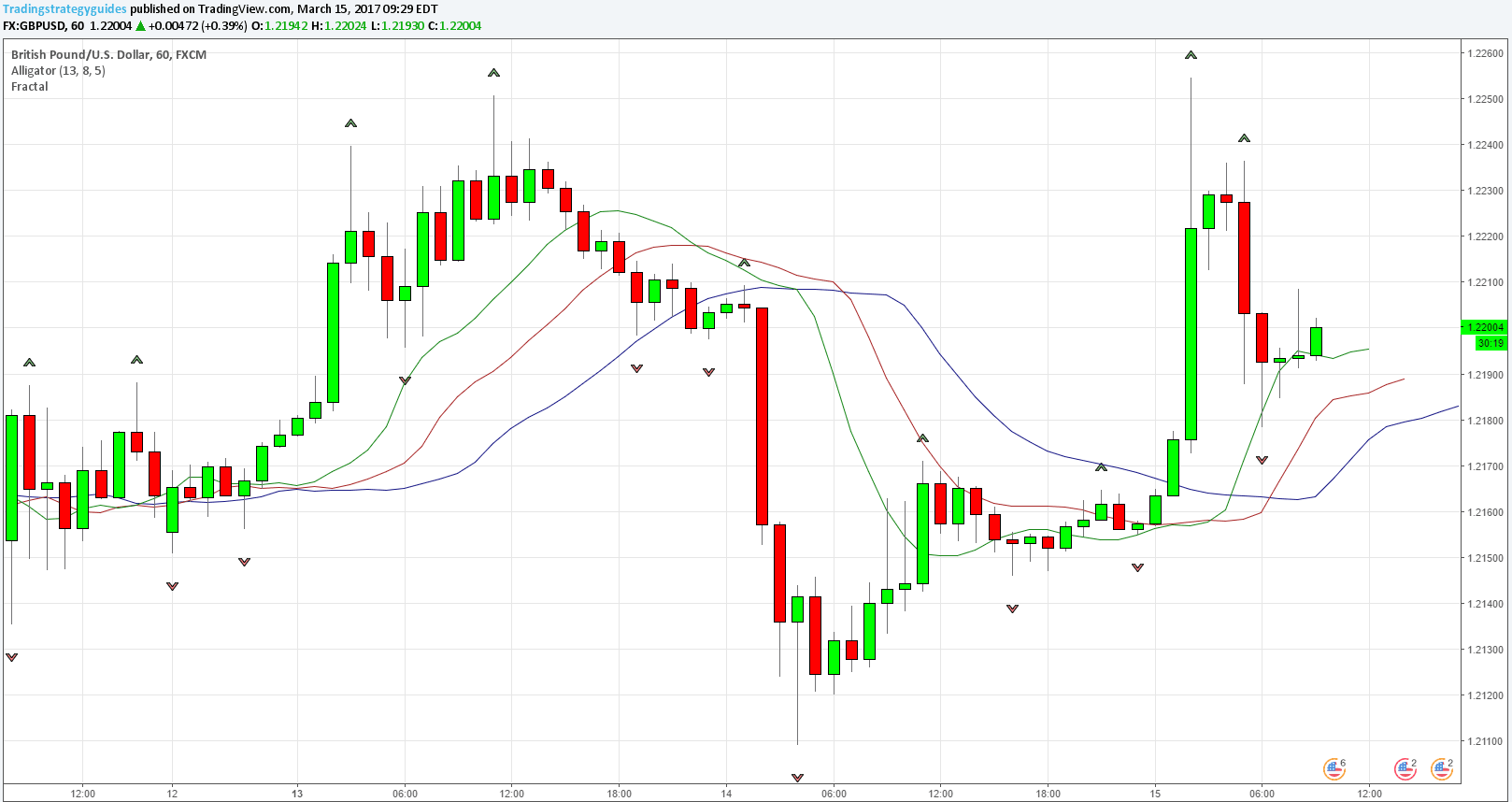

When you do this, your chart will look like this:

Perfect.

Step #2: Trade Bill Williams Fractals: Identify where Fractals have formed (above or below alligator teeth)

Note ** In this example we are using purchase entry, so all these rules will be for buy entry.

Ok, so let’s get into what these fractals are all about.

The fractals indicate a bottom or a top. Basic fractal indicators consist of a very minimum of 5 bars. So when you see a fractal here’s what could have happened for it to appear:

- There is a series of at least five bars in a row, with a high in the middle and then two lower highs on either side.

- There is a series of reversals of at least five consecutive bars where the lowest low is in the middle and two higher lows on either side (forming a sell fractal)

- The fractal can appear with just one candle to its right but be aware that this is an unconfirmed fractal as price action can penetrate the level. So for a fractal to appear and stay on the chart forever, the trader has to wait for 2 candles to the right of the fractal.

- The fractals have what are known as high and low values. This is indicated by the up or down arrows.

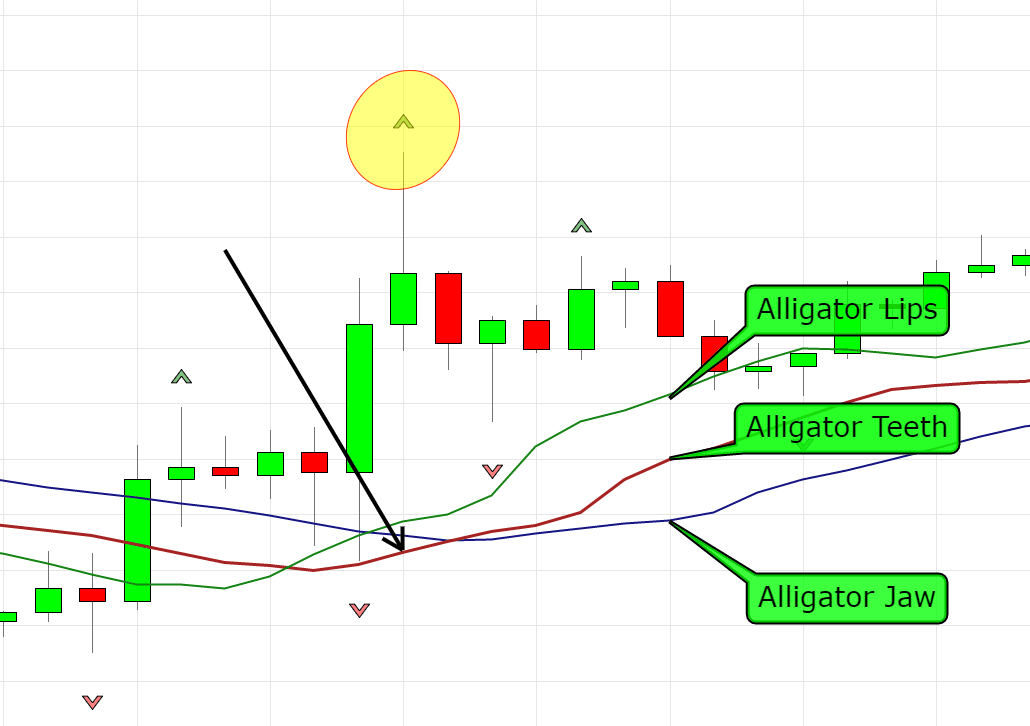

Let’s take our chart example for this fractal blaster trading strategy.

Above are the only alligator indicator lines on the chart. Now you need to know where the fractals are being placed on the candles for this strategy regarding this particular indicator.

Here is the fractal that we want to pay special attention to:

I drew a yellow circle on this particular fractal. This up fractal appeared on this candle ABOVE the red line or (crocodile tooth) This is the #1 criterion for the Fractal Blaster strategy.

In a BUY trade, the Fractal must appear on a candle ABOVE the red line (crocodile tooth).

What is happening here is that the fractal forms a new high relative to the previous fractal and thus creates a fractal that appears on the candle.

To get to step #2 (for a BUY trade), the fractal must show a fractal up and appear above the alligator tooth.

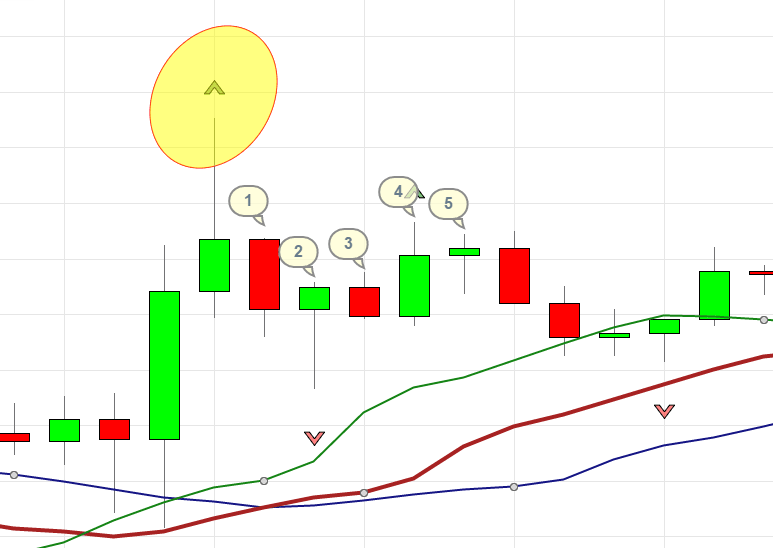

Step #2: Price action should stay above Crocodile Teeth for at least 5 consecutive candles (Buy trade)

This is where all the magic happens.

More often than not when a fractal occurs like the one above, the price action remains flat. This means there hasn’t been a real breakout in the recent timeframe. You can also trade with the triangle breakout strategy.

The reason this strategy has to wait for at least five consecutive candles is that this is where a pullback is forming, a reversal could be forming, or price action is still consolidating in a flat market . Any one of those looks uncomfortable if you are looking for a big upside move to form on the chart.

As you can see, the price action stayed silent and did not move up or down strongly these five candles. That is exacly what you should see when trading this strategy.

Before we look further at this strategy, this is what will make this strategy reset and confirm a BUY trade entry in the future.

- Reset if: A sell fractal appears below the Alligator Tooth line before a position is opened. Like this:

As you can see if this happened in our BUY transaction example, we would tell ourselves that this purchase is invalid and we should look elsewhere. The reason is that this could trigger a long Bearish trend which is not good if you are trying to go long here.

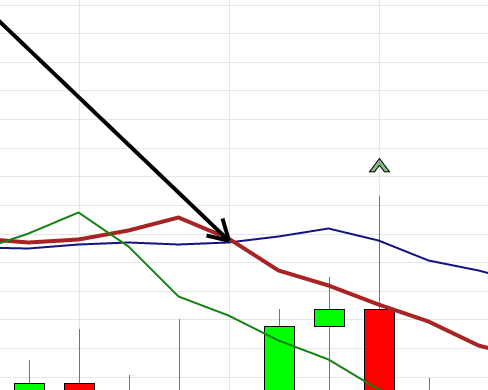

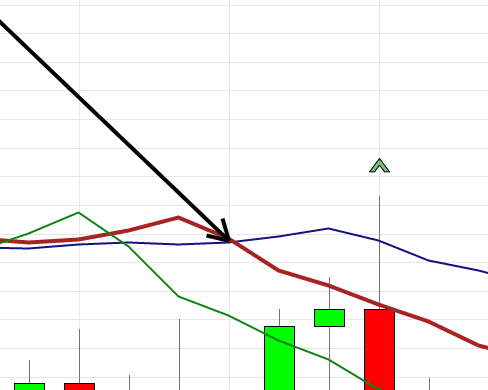

2. Reset if: Any of the two lines of the Alligator indicator have crossed after the fractal candle identified in Step #1. Like this

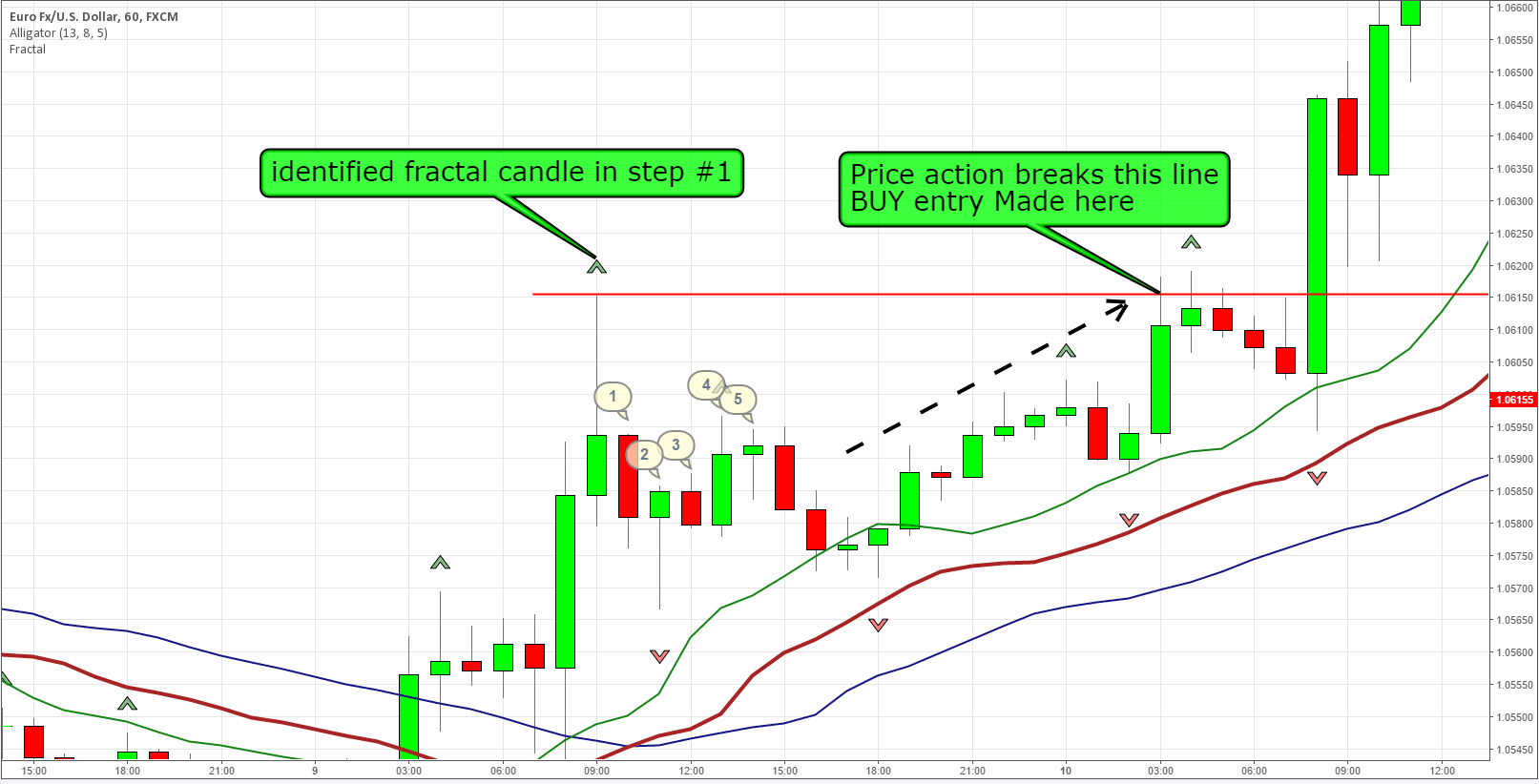

Step #3: Price action needs to break above the Fractal candle discerned in Step #1

Once you see that five consecutive candles have not made a strong move to the downside and are in the middle of the high of the fractal candle and the alligator tooth, then we go ahead and order an entry.

You can execute an entry this way, or if you are sitting in front of your chart live with this happening, you can also execute a market order. Either is ok to do because the same criteria are needed.

Here’s what it will look like:

As you can see, I marked where our original fractal was discovered. What happened then was that five or more candles appeared that did not drift down to the alligator teeth, the alligator lines did not intersect and the price action eventually broke above the fractal candle thus triggering a trade.

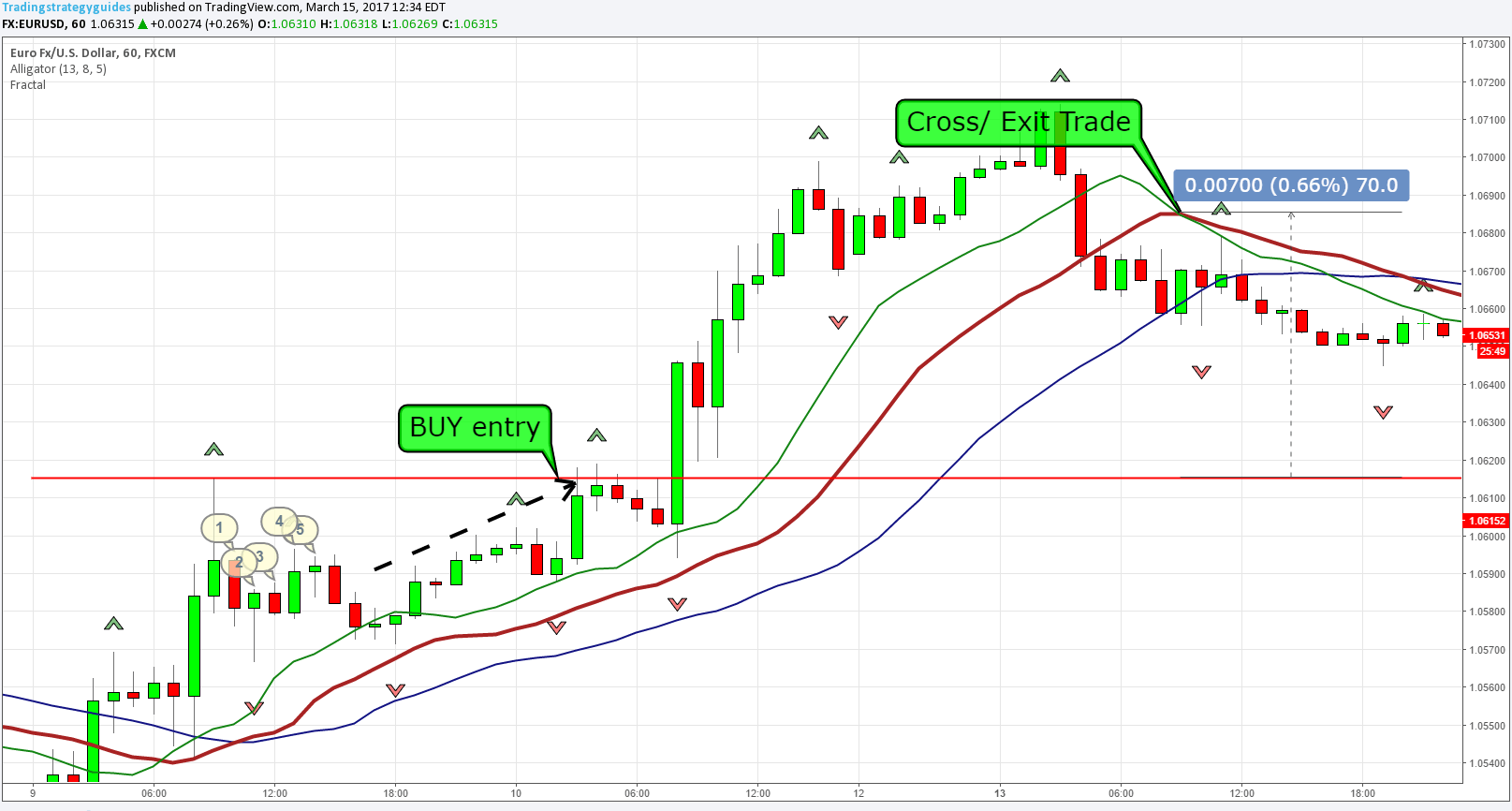

Take Profit Target / Stop Loss.

You can try variations to this strategy as far as profit and stop loss are concerned.

Exit the trade when two of the alligator lines cross.

This most likely means that the alligator will go back to sleep and the price action will either go the other way or consolidate.

This trade will give you a 70 pip winner.

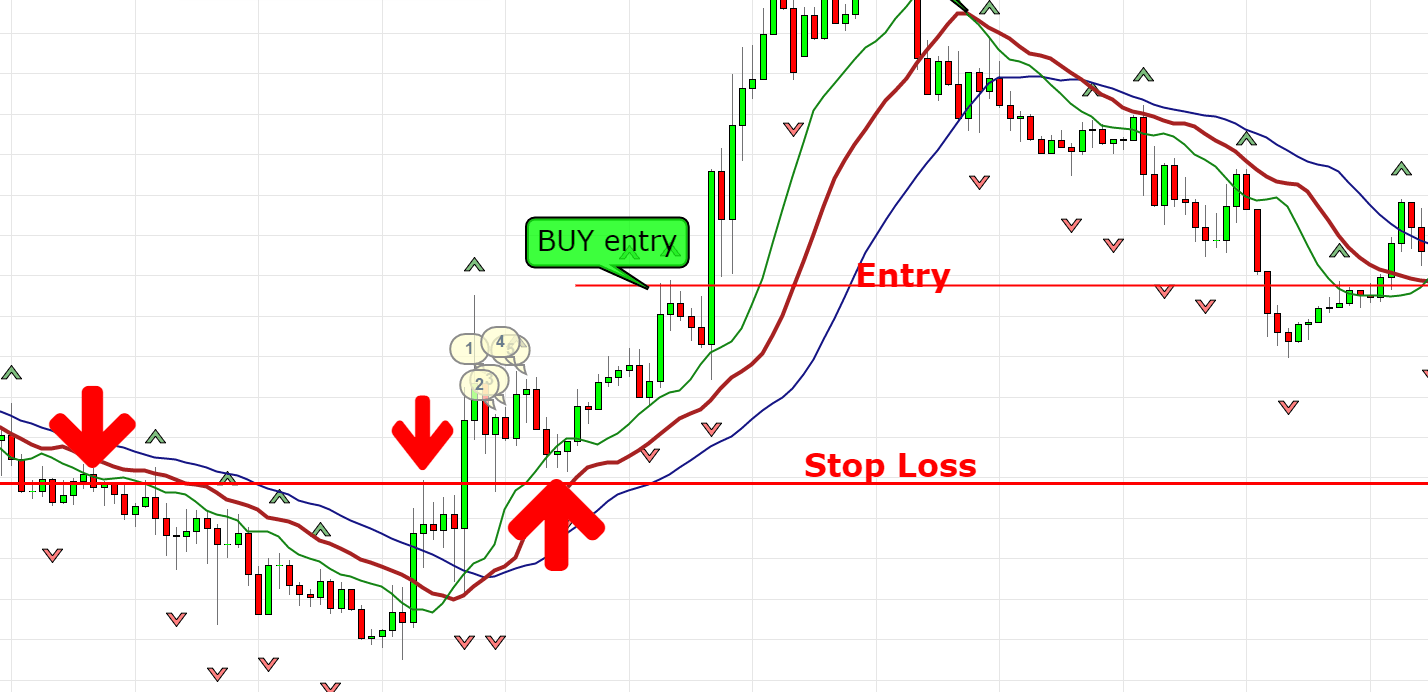

Place your stop loss below the previous support/resistance zones. Check out my other posts here about these important areas.

This will give you the best chance to salvage the trade if the price action will turn you on and turn bearish. It could bounce off these areas and turn back in the bullish direction.

Above are the BUY entry criteria. A sell would be exactly the opposite rule.

Sell transaction steps:

Step #1 Apply both Fractals and Bill Williams Alligator Indicator on your Chart

Step #2 A down fractal must appear below the alligator tooth and the price action must stay below the alligator tooth for at least 5 consecutive candles.

Step #3 Price action needs to break below the Fractal candlestick discerned in Step 1

Step #4 Exit the trade when two of the alligator lines cross.

Conclusion

These basic fractal trading techniques will put you in the right direction if you are looking for a great strategy to use with these indicators. There are many different strategies you can use with these indicators, but in our experience we like this combination of the Bill Williams indicators.