This amazing harmonic pattern trading strategy will give you a whole new understanding of price action. Our team at Trading Strategy Guide knows the geometric patterns that can be found in the wild. Similar anomalies can be found in financial markets, such as in harmonic patterns. This ability to repeat and create complex patterns is what makes Forex harmonic patterns so amazing. We also have training for fractal trading strategies .

Harmonized patterns are complex patterns in the Forex market. If you want to start with a simpler price action pattern, we recommend using the Head and Shoulders Pattern Strategy.

We can distinguish six basic Forex harmonic patterns:

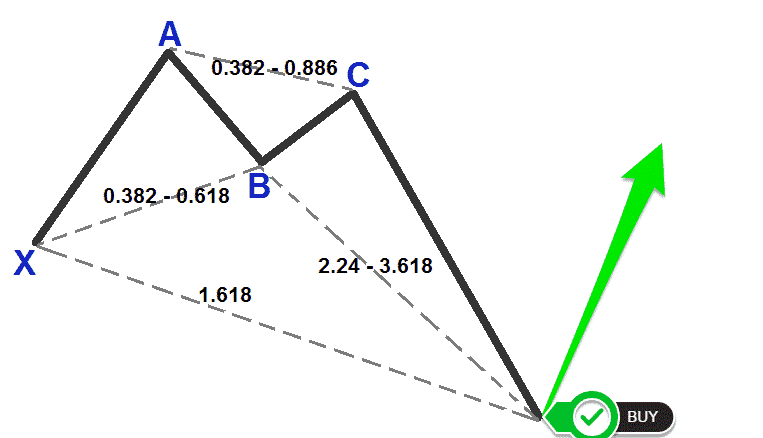

- The Gartley – pattern developed by HM Gartley, this pattern is used most often in the harmonized trading community. Using Fibonacci ratios, the Gartley pattern seeks to identify breakouts, resistances, and support cases. This pattern is characterized as an uptrend, followed by a minor reversal, followed by a smaller uptrend and completed by a larger reversal (forming an asymmetrical shape (M). or W shape).

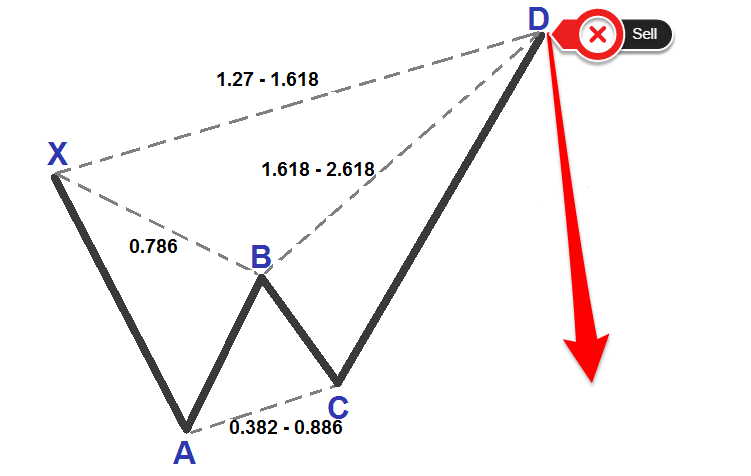

- Butterfly Pattern – there are two different types of butterfly pattern; Butterflies decrease and butterflies increase. Like Gartley patterns, these patterns are designed to reveal when a trend reversal is stronger than the original trend. Using the triangles created in the butterfly, traders can determine whether holding a short or long position is most profitable.

- The crab pattern- crab pattern is ideal for traders trying to determine exact price movements. It allows traders to maximize profits on securities with low volatility. The crab pattern is similar to the butterfly pattern but denser. This makes it possible to capture smaller movements.

- The bat pattern – when compared to other patterns, the bat pattern is still trapezoidal, but more symmetrical. For both bearish and bullish patterns, the right and left sides will be roughly the same height.

- Shark Pattern – shark pattern is one of the newer harmonic trading patterns and has been in use since 2011. This pattern uses the same leg reversal sequence. The sloping outer lines and shallow dip in the middle create a dorsal fin-like histogram. This is how the shark model got its name.

- Cypher – cypher pattern is an advanced trading pattern that combines Fibonacci trading with other indicators (such as RSI). Cypher uses tighter Fibonacci ratios (usually less than 1), which gives the visual appearance of steep slopes.

Each of these patterns will help you effectively set stop loss and stop limit. To get a more comprehensive view of the market, it is very helpful to track multiple harmonious trading patterns at once.

There are many benefits of harmonic trading. For example, if you become an expert on one of the Forex harmonic patterns, you will know how to trade it on certain pairs. You will be able to tell when the best time to trade is when and when the market will react a certain way.

You will become an expert in Forex harmonic patterns. A useful tool for trading this strategy is a harmonic pattern scanner or dashboard that shows all the patterns on different instruments. However, we recommend that you study the samples carefully before using the scanner or the control panel.

Our favorite time frame for Great Harmony Pattern Trading Strategy is the 1h, 4h or daily chart. For the sake of simplicity, we will refer to the Great Harmony Pattern Trading Strategy as the AHPT trading strategy. We don’t want to go to the lower timeframes because, after retesting, we discovered the great Harmony Pattern Trading Strategy that works best on the higher timeframes.

If you want quick profits, check out our favorite day trading strategy, Best Random Trading Strategy – Easy 6 Step Strategy . It may be more suitable for your own needs. This strategy does the same and is suitable for trading other asset classes like stocks, futures, options, etc.

Throughout this article, you will learn the effectiveness of this template in terms of strengths and weaknesses. You will also learn how to effectively trade Forex harmonic patterns. This constant repeatability makes Forex harmonic patterns so appealing to our team at Trading Strategy Guide . We are also trained in how to trade with Gartley pattern .

Before we start, let’s see what indicators we need to successfully trade Harmonized Patterns Trading Strategy:

If you are not great with geometry, most standard Forex trading platforms come with a harmonic pattern indicator. This can help you detect and measure Forex harmonic patterns. Forex harmonic patterns use Fibonacci numbers to identify exact trading points.

TradingView Platform: Comedy Pattern Indicator

The Harmonized Patterns indicator allows you to call market turning points with great accuracy. Check out the Price Action Pin Trading Strategy if you have no prior knowledge of how a reversal trading strategy looks like.

Now let’s jump into the rules of the AHPT trading strategy.

Note*: Moving forward, we will focus on the Butterfly air conditioner model. This is one of the most popular Forex harmonic patterns.

What is a harmonious butterfly pattern?

In technical analysis, the Butterfly harmonic pattern is a four-legged inversion pattern. The leg is a swing wave motion that connects and consists of a high swing and low swing. Here is how to determine the right swing to increase your profits.

Summary of the butterfly harmonic pattern rule:

- AB = 0.786 or 78.6% retracement of swing leg XA;

- BC = 38.2% min – 88.6% max of swing leg AB;

- CD = 1.618 min – 2.618 max of AB swing pins;

- CD = 1.272% min – 1.618% max of the XA swivel;

Determine the Butterfly conditioning model.

The Butterfly harmonic pattern depends on point B. It defines the structure and establishes other measurements in the pattern to identify trading opportunities. For the Butterfly pattern, point B, it must possess the exact 78.6% retracement of the XA swing. Other rules redefine the structure further including that the BC projection must have at least 1,618 measurements.

In addition, the Butterfly pattern must include the equivalent AB = CD pattern. That is a minimum requirement. However, the 1.27AB=CD substitution is more common for this structure.

The 1.27XA projection is the most important number in potential reversal zones. And finally, point C should be in the 0.38-0.886 retracement range.

You can start drawing the butterfly pattern as soon as you have the first two legs of the pattern. Once you have the points X, A and B, you can start tracking the price action. You can look for confirmation that wave C conforms to the Butterfly pattern rule.

Great harmonic pattern trading strategy rules

Now it’s time to reveal the amazing Harmony Pattern Trading Strategy rules. We’ll start with the most interesting part. This is always the entry point and continues with the rules for stop loss and take profit orders.

There is something important that we need to learn before to really identify the Harmonized Patterns Trading Strategy rules. This is to give you instructions on how to apply the Harmonized pattern indicator.

Step #1 How to Apply the Harmonic Pattern Indicator

I will guide you through this process step by step. All you need to do is follow this simple guide. See the image below to better understand the process:

- First, click on the harmonic pattern indicator that can be placed on the right toolbar of the TradingView platform. In the MT4 terminal you can locate the harmonic pattern indicator in the Indicators library.

- Identify on the chart the starting point X, which can be any high or low point on the chart.

- Once you have identified your first high/low, you simply follow the wave movements in the market.

You need to have 4 points or 4 high/low points that link together and form Forex harmonic patterns. Each swing leg must be validated and adhere to the harmonic pattern strategy rules as outlined above.

Now, we will give the entry rules for the bullish Butterfly harmonic pattern.

See below…

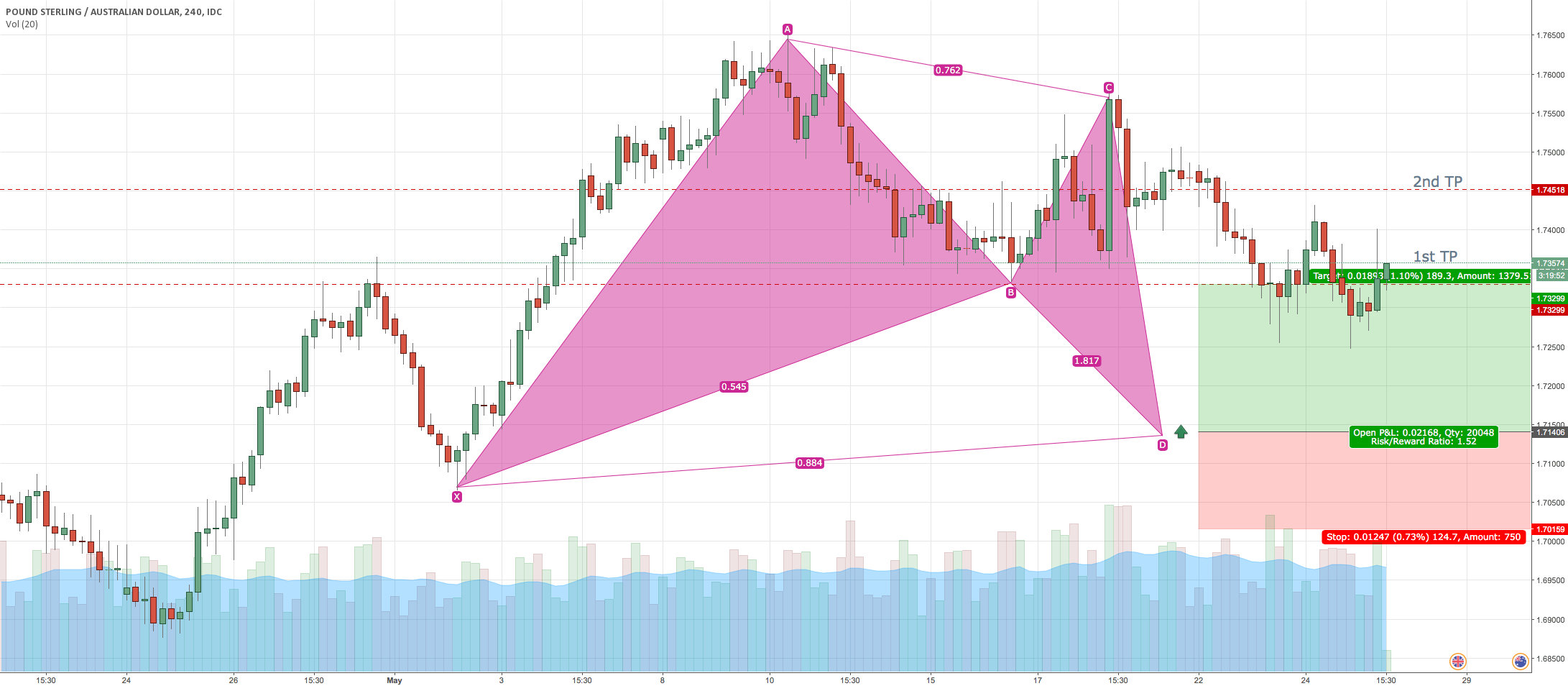

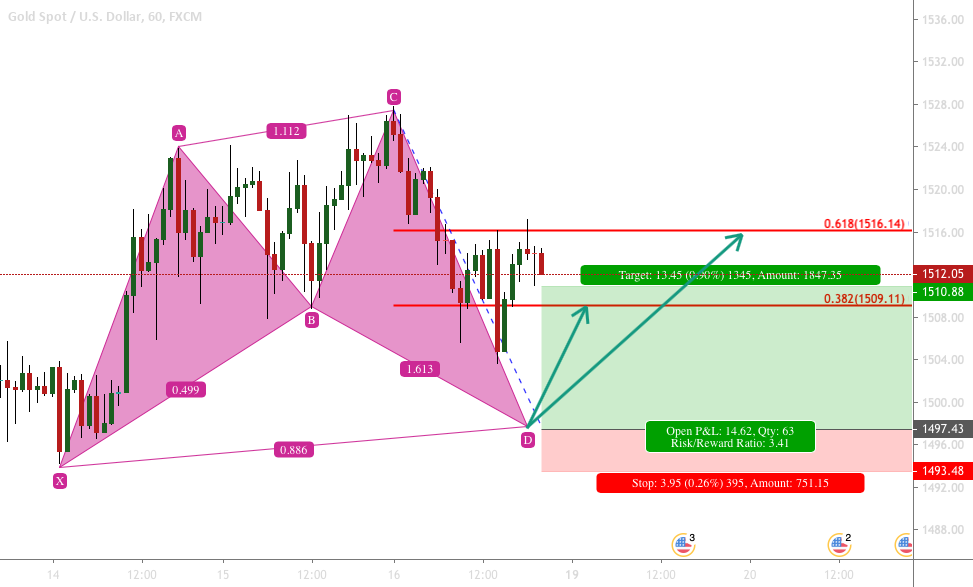

Bullish butterfly air conditioner model – Buy Entry

Ideally, as a trader, you’d want to enter when point D is completed. As we established earlier, point D of the Butterfly Forex harmonic pattern can develop in any position. between the 1.27 – 1.618 Fibonacci extension of pin A. As the market is not a perfect place, we will initiate a buy order when the market reaches the 1.27 Fibonacci extension.

In the example above, we entered at the 1.272 Fibonacci extension, but we were able to see the point D extending to the 1.573 Fibonacci extension. This remains within the 1.272 – 1.618 range confirming the bullish Butterfly harmonic pattern.

It’s still a great entry level.

Where to place your protective stop loss is the next logical question.

Bullish Butterfly Harmonic Pattern – Stop Loss

For the Bullish Butterfly Harmonic Pattern, you would normally want to place your protective stop loss below the 1.618 Fibonacci extension of the XA leg. That’s the logical place to hide your stop loss. This is because any of the interrupts below will automatically invalidate the Butterfly harmonic pattern.

So far, we have identified the right entry point and stop loss position for the Harmonized Patterns Trading Strategy. Now, it’s time to shift our focus and determine where to profit.

Bullish butterfly air conditioner model – Profit

More profits with the AHPT trading strategy will further enhance your trading experience. and will affect the expected profit because this will almost guarantee you will be profitable. Forex harmonic patterns, while they are a reliable pattern, you want to be very aggressive with your profit target.

As said: no one breaks by making profit

So where do you get your first partial profits?

See picture below:

A great harmonic pattern trading strategy has a more conservative first partial profit target set up at Point B. Usually this is where you will find some resistance on the way back as this is important swing point.

We want to close the second part of our trade once we reach the 0.618 Fibonacci retracement level of the CD leg. You can even aim for a retest of A. Though that might be your next goal once you become more experienced with the harmonic pattern indicator.

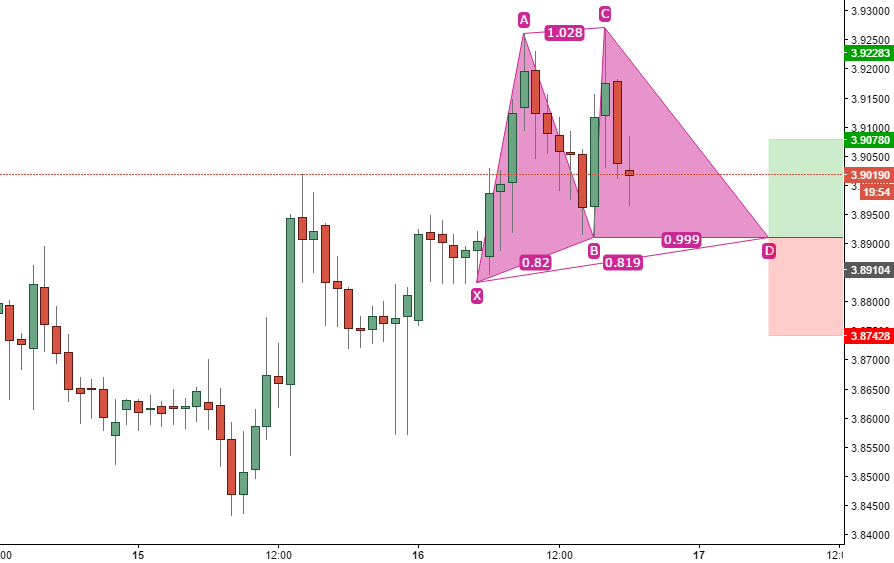

Take a look at the chart below:

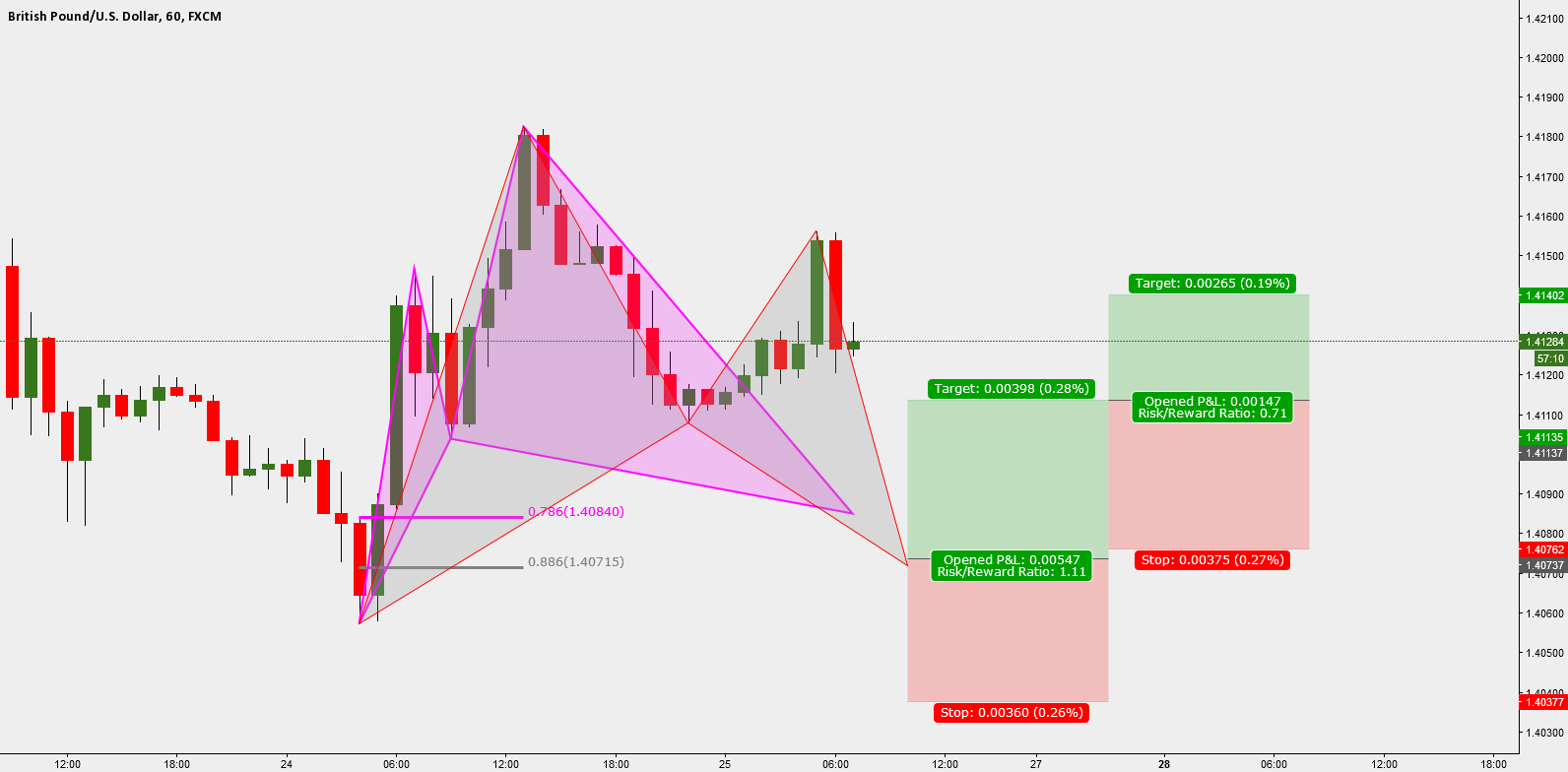

Note ** The above is an example of a BUY trade using the Bullish Butterfly Forex Conditional Pattern. Use the same rules for the Bearish Butterfly Forex Harmonic Pattern for SELL trades. In the image below you can see an example of an actual SALE transaction. You can do this using the Bearish Butterfly Forex Conditional Pattern.

Watch:

Don’t be discouraged if this chart may look confusing at first glance. Study the rules above and you will see this trading example follows the strategy rules perfectly.

Conclusion:

For all Forex harmonic patterns and trading in general, accuracy is key. This is because we eliminate mistakes when we are as precise as possible. Harmony pattern trading strategy gives us the highest probability of success. The great thing about Forex harmonic patterns is that they recognize areas where supply and demand are concentrated. If you are a lover of supply and demand trading, read Supply and Demand Trading – Understanding Market Movements . It’s a great preface to supply and demand trading.