Short term trading is one of the most popular trading methods adopted by retail traders. This is because it gives you instant gratification. Our team at Trading Strategy Guide loves to keep our trading strategies simple. In this article, we will show how to turn a simple trading principle into the best short-term trading strategy. Below you can read our updated article for the best short term trading strategy.

Is short-term trading not for you? Do you position yourself on the opposite end of the trading strategy spectrum, such as a swing trader? If so, we encourage you to read, MACD Trend Following Strategy – Simple to Learn Trading Strategy .

While this short term trading strategy can be used by focusing only on price action short term trading tips, you can modify it at any time. Add indicators to filter out some false signals. The best short term trading strategy is pure price action strategy. If you want to use indicators, you need to know how to choose the most accurate indicators for short-term trading. Our team at Trading Strategy Guide put together a step-by-step guide to the most popular Forex indicators here, Big Trading Strategy .

What indicator are we using for this short term trading strategy?

We will only use the 20 period moving average. Moving averages can be easily found on most Forex trading platforms.

So move forward with the best short term trades. We will also look at some short-term trading tips to strengthen your forex trading knowledge. We also trained in Drawing Trendlines with Fractals .

Steps for the best short term trading strategy

(Rules of buying and selling)

Let’s start with our first short-term trading tip. To understand price action, you must understand the underlying cause that makes price action patterns work. This short term trading strategy uses a specific pattern derived from a well known strategy used by Hedge Funds.

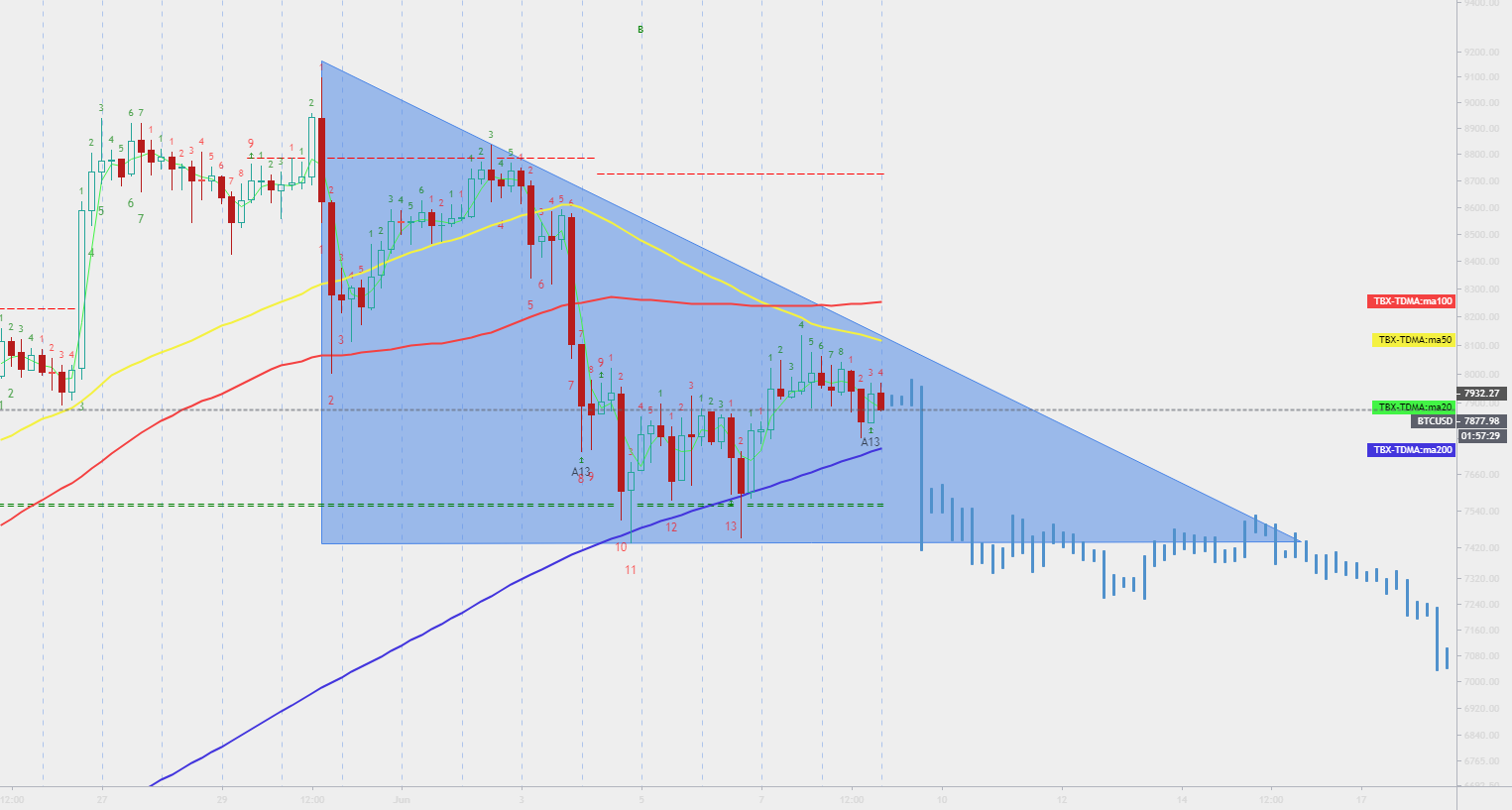

We simply put it: the best short term trading strategy comes from the Turtle trading system. This system uses a 20 day breakout of the price. If the price breaks to a new 20-day high, people will buy. Conversely, if the stock price breaks to a new 20-day low, one will sell a stock (see Figure below). The main downside of this strategy is that it takes 80% of the time.

That’s pretty bad, wouldn’t you say the same?

What we did next was reverse this trading system. We have made it the best short term trading strategy with over 80% accuracy. With short term trading tips you can use this principle and reverse any losing strategy. Even so, make sure you are back testing the strategy and see if you can come up with a profitable system. Also, read simple but profitable strategy, for more trading tips .

Let’s go ahead and explain the short term trading strategy in a simple step by step guide:

Step #1: Wait for the market to make a new 20-day low

The way you should count the lows is simple. Every time the market makes a daily low, you can start counting. As a general rule, you only calculate the daily low that is lower than the daily low calculated previously.

A picture is worth a thousand words, so here you have an example:

In the above example, we have shown, how to accurately count the daily lows. As we could watch the market failed to make a new 20 day low, so we had to stop counting. We start all over again when the market hits a new daily low.

Now let’s identify a valid 20 day low pattern and see how to correctly trade the best short term trading strategy.

Please see the chart below:

Step #2: Wait for the market to break above the 20-day MA

For the success of our short-term trading strategy, this step is very important. We don’t want to choose the top and bottom. We feel more comfortable entering the market once the price confirms it is ready to reverse.

Let’s move forward and define our entry point. This brings us to step 3 of the best short term trading strategy.

Step #3: Enter a long position when we cross the 20-day MA

As soon as you cross the 20-day moving average, buy in the market. The combination of the 20-day low and the 20-day moving average is the secret to our powerful short-term trading strategy. Incorporating the 20-day MA in your day-trading system is one of the best short-term trading tips you can get.

We have received our entry, but we still need to determine where to place our protective stop loss and take profit orders. This brings us to the next step of the short term trading strategy.

Step #4: Place a protective stop loss below the low before breaking the 20-day MA

The best short term trading strategy uses a very rigid stop loss method. The obvious place to hide your protective stops should be just below the most recent swing low before breaking the 20-day MA. If the market breaks above the 20-day EMA, and it reverses and breaks below that low, this means trouble. That is reason enough to close the trade at a small loss.

Why? Because it signals the prevailing trend is still maturing and will continue. This is why you don’t want to enter the trade anymore. If you listen to price action, this is the best short-term trading tip the market can give you.

In the next short-term trading tips, we will learn where to make profits:

Step #5: Take profit at the 50% retracement of the downline before the downtrend

The logical place to take profits is at the 50% Fibonacci retracement level. Usually, that’s the first real target from where the market might reverse. We don’t want to take our chance and risk to lose more profits. So we will liquidate the whole position here for a good profit.

Note ** The above is an example of a Buy Buy transaction Use the same – but opposite – rules for a sell transaction. In the picture below you can see a real SELL trading example using the best short term trading strategy.

Conclusion

We hope that this short-term trading tip will help you become a better trader. Like every other strategy presented here at Trading Strategy Guide , you must use strict money management rules. This short term trading strategy is a perfect example of how one can simply reverse a losing trading system and turn it into a profitable one. Here You can learn about How to fade momentum in Forex Trading .

If you want to learn more short term trading tips on how to conquer the Forex market or any other market, we suggest you take no more than 5 minutes and read How to Make Money Trading – Make Money Trading today! This article has attracted a lot of attention from our trading community.