Jesse Livermore, one of the greatest traders who ever lived, said that big money is made during great market volatility. In this regard, Livermore successfully applied swing trading strategies that worked. This helps him achieve excellent financial results. A swing trading strategy is simply a market strategy where trading is held for more than one day. They are usually held from 3 days to 3 weeks. Here is how to determine the right swing to increase your profits.

Our team at Trading Strategy Guide has written about other swing trading strategies that work. Read Harmony Trading Strategy – Easy Step by Step Guide or Trend Trading Strategy Strategy – Simple to learn trading strategy. These are some of the most popular strategies ever posted at the Trading Strategy Guide.

This time we will outline a simple swing trading strategy. It is similar to what Jesse Livermore used to trade. Let’s take a look at the swing trading strategy Hepmore used to help forecast the biggest stock market crash in history. It was the Wall Street crash of 1929, also known as Black Tuesday. Here is another strategy called weekly trading strategy that will keep you awake.

By the way, after the stock market crash of 1929, Hepmore reportedly made $100 million. Its inflation adjusted is estimated to be around $1.39 billion today.

Quite a lot of money, wouldn’t you say the same?

Get started with our simple swing trading strategy

If you take a swing trading course now, I believe the current market conditions will allow any trader to use the right trading technique to achieve solid results. There are a few things that I think we should consider before we begin.

One of them is determining whether we should trade a counter-trend system or set up the stock to follow the trend. Either one may work, but it is up to you to determine which one you want to use. I recommend using paper trading on stocks the next time you see a trade develop.

This article will dive into a key swing trading technique on the daily chart. While this can be considered advanced swing trading, this strategy is suitable for all investors. It is perfect for homeschooling. We will tell you how to do the right technical analysis and tell you when to enter a trade and when to exit a trade. We will do this by teaching you how to set the right profit target.

It is important to ensure you have a fully developed training plan before starting to trade any swing trading system. This will prepare you to become more successful and join the ranks of professional traders. Our goal is to provide you with trading opportunities, as well as help you in every way possible to become the best swing trader around. You can also learn how to bank in the forex market .

What is swing trading?

The swing trading strategy is quite simple. Using intermediate timeframes (usually days to weeks), swing traders will determine market trends and open positions. The name swing trading comes from the fact that we are looking for conditions where the price is likely to oscillate up or down.

Swing traders can use a wide range of technical indicators . What makes swing trading unique is that it blends several components of day trading, with the speed of position trading. Swing trading indicators are mainly used to find trends that take place between 3 and 15 trading periods. After we analyze these periods, we will be able to determine whether instances of resistance or support have occurred.

The next step is to identify a downtrend or an uptrend and look for a reversal. Reversals are often referred to as pullbacks or countertrends . When the reverse trend becomes clear, we can choose an entry point.

The goal is to enter a position where the reverse trend will quickly reverse and the price will fluctuate. This is exactly what allowed Jesse Livermore to make most of his fortune.

Currently…

Before diving into some of the key rules that make swing trading strategies work, let us first examine the advantages of using a simple swing trading strategy. You can also read about budget in Forex for better trading.

What are the advantages of a simple swing trading strategy?

The main advantage of swing trading is that it offers great risk to reward trading opportunities. In other words, you will be risking a smaller amount of your account balance for a potential profit that is much larger than your risk.

The second benefit of using swing trading strategies that work is that they eliminate a lot of noise during the day. You will now trade like smart money, which is in a big wave. Also, read our ultimate guide to the Ichimoku Cloud .

The third benefit of swing trading is based on the use of technical indicators. Using technical indicators can reduce the risks of speculative trading and help you make clear decisions. While some swing traders also pay attention to fundamental indicators, they are not necessary for our simple strategies.

The ultimate benefit of using a simple swing trading strategy is that you won’t need to be glued to the screen for the whole day as with the day trading strategy . A swing trading plan will work in all markets starting from stocks, commodities, Forex currencies and more.

Like any trading strategy, swing trading has some risks. Because swing trading strategies take days or even weeks to unfold, you will face the risks of gaps in overnight or weekend trading.

Another risk of swing trading is that sudden reversals can create losing positions. Because you’re not trading throughout the day, it can be easy to let your guard down if price trends don’t go as planned. To reduce the risk of this happening, we recommend issuing a stop order with every new position. Stop orders can help you lock in your profits and can also help you stop losses.

The current…

Before we get started, let’s take a look at the Swing Trading indicator you need.

The ONLY index you really need:

Indicator bollinger bands : This is a technical indicator developed by John Bollinger. Bollinger Bands are designed to detect overbought and oversold zones in the market. They also assess market volatility.

Our swing trading indicator makes it easy to manage trading risk and also uses price changes. Using candlestick trading charts can also be helpful. These charts provide more information than a simple price chart and also make it easier to determine if a sustained reversal has occurred.

Many swing traders also keep a close eye on multi-day chart patterns.

- Head and shoulders model

- Flag Patterns

- Cup and handle pattern

- Moving Average (also consider the Ichimoku Cloud)

- Triangle trading pattern

When there is a higher low along with a steady high, this suggests to traders that it is going through a consolidation phase. Consolidation usually precedes a large change in price (in this case, negative). Learning about triangle trading and other geometric trading strategies will make you a much better swing trader.

This trading swing only includes 3 moving averages:

- Central Moving Average, which is a simple moving average.

- And then on both sides of these simple moving averages are plotted two other moving averages at a distance of 2 standard deviations from the central moving average.

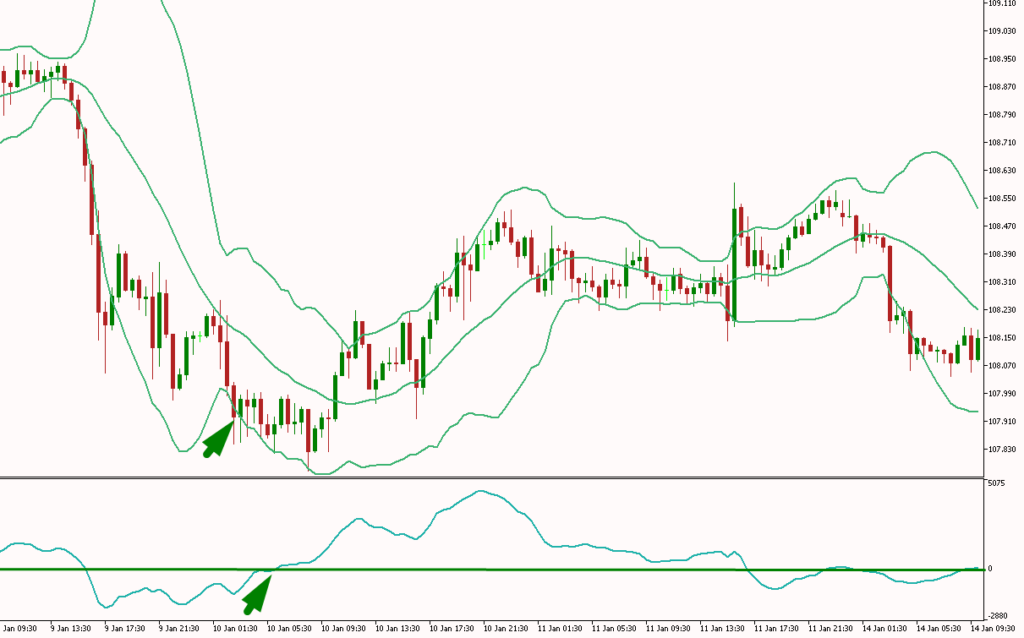

The image above will give you a good representation of the shape of the Bollinger Bands. Most of the trading platforms come with this indicator in their list of default indicators.

If you are interested in learning more about how one can profit from this amazing indicator – Bollinger Bands – look no further than our Bollinger Bands Escape Trading Strategy .

The preferred setting for the swing trading indicator is the default setting because it makes our signals more meaningful. We reached this conclusion after testing the strategy based on several inputs.

Now let’s move on to the most important part of this article, the trading rules of swing trading strategies in action.

Before we go any further, we always recommend that you write down the trading rules on a piece of paper. This exercise will accelerate your learning and you will become a swing trading expert in no time.

Start…

Swing trading strategy works

(Trading rules – Sell deals)

This strategy really consists of only two elements. The first element of any swing strategy that works is the entry filter. For our entry filter, we will be using one of our favorite swing trading indicators, also known as Bollinger Bands. The second element is a strategy based on price action.

Step #1: Wait for the price to touch the upper Bollinger Bands.

The first element we want to see for our simple trading strategy is that we need to see the stock price move into the overbought zone. Any swing trading strategy that works should have this element incorporated.

Note * The preferred timeframe for this simple swing trading strategy is the 4h timeframe. This strategy can also be used on daily and weekly timeframes.

Step #2: Wait for the price to break below the Bollinger Middle Band.

After we touch the upper Bollinger Bands, we want to see confirmation that we are in the overbought zone and the market is about to reverse. The logic filter, in this case, is to take care of a break below the middle Bollinger Bands.

A break below the middle Bollinger band is a clear signal of a change in market sentiment.

We at The Guide to Trading Strategies don’t trade the breakout without identifying if there is an actual buyer/seller (in our case, a seller) behind the breakout. This brings us to the next step of our simple swing trading strategy.

Step #3: Swing Trading Indicator: The Breakout candle needs a Big Bold candle close near the Low Band of the Candle. → Sell at the Close of the Breakout Candle.

So far, our favorite swing trading indicator has correctly predicted this sell-off, but we will be using a very simple candlestick-based strategy for our entry trigger. For entry, we would like to see a big bearish candle breaking below the middle bollinger band.

The second element of this candlestick based strategy is that we need the breakout candle to close near the low range of the candle. This is a sign that the strong sellers really want to push the pair much lower.

Every swing strategy that works should have fairly simple entry filters.

Now, we still need to determine where to place our protective stop loss and where to take profit, which brings us to the next step of our simple swing trading strategy.

Step #4: We hide our Protective Stop on the Breakout Candle.

The breakout candle makes a lot of sense because we used it in our candlestick-based entry strategy. We assume that this candle shows the presence of real sellers in the market. If this candle breaks, then it is clear that this is just a false breakout as there are no real sellers.

There’s nothing complicated about it, right?

If you want to learn more about this breakout technique and how to manage breakout trades, please read our Breakout Trading Strategies used by articlesby Professional Traders .

The next part of our simple swing trading strategy is our favorite swing trading indicator based exit strategy.

Step #5: Take profit after we break and close above the middle Bollinger Bands.

In this particular case we are looking at a short transaction example. So if price breaks back above the bollinger average banks, it’s time to get nervous and take our profits as it could signal a reversal.

The reason why we are profitable here is quite understandable. We want to book profits at the time when the market is ready.

Note * The above is an example of a SELL transaction. Use the same but opposite rules for a BUY trade. In the image below you can see a real BUY trade example, using our simple swing trading strategy.

Click here to get more information.

You can notice that this trade is still going as we have not broken out and closed below the middle Bollinger Bands. This just proves that the higher the timeframe, the stronger our simple swing trading strategy.

In brief

Some complex strategies can be overwhelming and confusing. Using a simple swing strategy may be all it takes to be successful in this business. Albert Einstein, the greatest scientist of all time once said that everything should be made as simple as possible, but not simpler. You can also read how to trade money.

A swing trading strategy should include a swing trading indicator that can help you analyze trend structure and secondly a price entry method that considers price action as the ultimate trading indicator.

We understand that there are different trading styles and if swing trading is not something you can try our Simple Scalping Strategy : Best Scaling System which attracts a lot of interest from the community. our copper.