Learn how professional traders use the Forex position size calculator to implement sound risk management strategies. How to calculate Forex position size is very important to correctly manage your risk. In this guide, we will show you how to use our exclusive Forex position size calculator so you can figure out your position size whenever you need it.

You can find the calculator by visiting Forex position size calculator download link HERE .

Your position size should always be based on your risk tolerance. However, you still need to find out what is the maximum size position I should have in Forex trading to stay profitable. The 2% rule is the norm in the hedge fund industry .

The 2% rule is an effective way to control risk establishing that you should only risk 2% of your account’s value on any particular trading idea.

So, what is position size in Forex trading?

Position sizing is part of any successful risk management strategy .

Position sizing tells you how much you should risk each time you take a trade. That is how much risk you are willing to accept depending on how many pips are at risk in the open market. Basically, position size takes into account three components:

- Account size.

- How much risk or % of your account you are willing to risk on each trade. It’s a personal decision about how comfortable you are and how powerful your trading is. Everyone is comfortable with their risk tolerance, however, most professional traders will not risk more than 1% or 2% of their account balance.

- Stop loss. If you don’t have a stop to limit your losses theoretically, the loss could potentially destroy your account and in some unforeseen circumstances could put you in your position. owe money to your broker.

This is just a basic model to give you some basic understanding, but you must use position size with your money management to ensure your consistency on your losses, but also in keeping your account balance from getting damaged.

Moving forward, we will outline how to use the Forex trading position size calculator.

See below:

Forex position size calculator

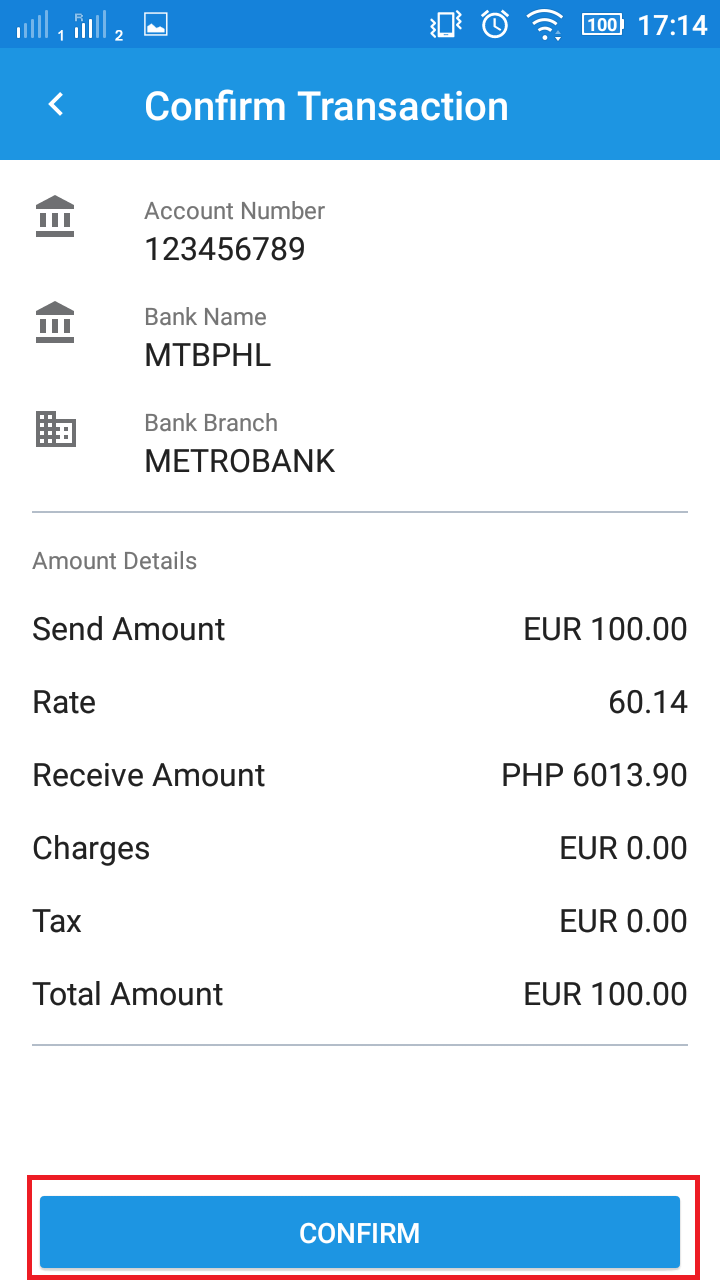

Once you have found the calculator on our Forex position size calculator download page, it will ask you for a few pieces of information. The Forex position size formula requires these inputs to calculate how much you should risk on any given trade.

Our proprietary Forex position size calculator app requires the following inputs:

- Select the currency of the account you are trading in.

- Select the currency pair to be traded.

- The current size of your trading account. Enter your account balance rounded to the nearest whole number; Entering decimals will get an error.

- The percentage of the account you want to risk in the trade. You don’t have to enter a percentage or anything. Literally just write the number to represent the percentage you want to risk. Enter a risk percentage in your account that you are comfortable with. (1-2% is usually recommended as a comfortable level of risk that will prevent blowing up your account.)

- And finally, enter your stop loss size in pips. (This is the amount of buffer you allow in the price movement of the pair you are currently trading).

The position size you need to trade to risk the exact amount will then appear under the pop-up. Press calculate to see your results.

When opening your current trade, simply enter the number of lot sizes specified by the Forex position size calculation formula. This way you will be trading within your risk parameters.

For more instructions on how to use the Forex position size calculator download page, just hit the instructions button.

Forex position size calculation formula

If you want to trade within your risk parameters, simply use the following position sizing formula:

Lot position size = $ at risk / (Stop Loss in pips x Pip Value)

This represents one of the easiest recipes anyone can remember. However, we will present with other ways how to calculate forex position size. In this way your knowledge of Forex mt4 size position will be complete.

The amount at risk simply represents the amount in your account that you want to risk on each trade. Do you want to risk 2%, 5% or maybe 10% of your account? It’s up to you, but as we said at the beginning, doing proper risk management requires risking no more than 1% or 2%.

$ at risk = % Risk x Account balance

Stop loss is determined individually based on several factors such as your exit strategy or technical reading skills.

The value of Pip Pip is a known variable. For example, each EUR/USD pip movement is worth $1 when trading a mini lot. However, if you are a math geek, you can divide the risk amount by the stop loss to find the pip value.

Smart position sizing can instantly turn you from a losing trader to a low risk and high return trader. The concept of position sizing is designed to help you achieve your financial goals whether it is:

- To maximize your chances of hitting your X% profit target.

- To minimize and reduce your chances of withdrawal as large as Y%.

- Or some combination of both.

Doing position sizing wisely in the long term will result in more consistent account growth. Also, read this guide on Forex Trading For Beginners .

How to calculate position size in Forex

How to calculate position size in Forex?

That is the next important question we will answer. For this purpose, we will assume a real situation that every trade faces before opening a trade.

For example, we will use a hypothetical account size of $10,000 and use a maximum exposure of 2% on any trade. Our risk exposure in this particular case would be $200.

2% * $10,000 = 2/100 * $10,000 = $200 (Risk / Trade)

We are making trades based on our account size and 2% risk and the maximum risk we will place our technical stop loss in the market is $200. The third component that we need to consider in order to size our position is our stop loss. For simplicity, our maximum stop loss is 50 pips. To find the value per pip, we divide the risk amount by the stop loss.

Value per pip = $200/50 pips = $4 / pip

Last but not least, we must use the following Forex position size calculation formula:

Position Size = Value per pip * [(10k EUR/USD) / (1 USD per pip)]

You now have all the details you need to calculate the position size for your trade. Applying the position size formula above to our hypothetical example would result in you needing to place 40,000 units of EUR/USD or 4 mini lots to stay within the original risk parameters.

Conclusion – Forex position size calculator download

Besides your own psychology , how to calculate forex position size is the most important topic you can learn. Trading the Forex market without a Forex position size calculator can be like riding a roller coaster. If you don’t know how to calculate position size in Forex, you will probably never succeed in the market.

The Forex position size formula is another component of a money management strategy.

Now that you have learned the basics of the Forex position size calculator application, you can control your risk parameters and why not, you can have a better night’s sleep knowing that your financial Your account will not be blown overnight. If you are not good at math, that is no longer a problem because we give you the best Forex position size calculator leverage that will turn any retail trader into a manager. reputational risk.