In this article we will cover best forex simulator of 2020. You will find step by step guide on how to choose the best emulator, how to use the emulator for day trading. and also how to test your forex trading strategy.

Using a simulator will help you break out of bad habits and become a better trader. Simulated forex trading can be one of the most effective ways to practice risk-free trading. Through this guide you will learn how to get live market experience and discover the benefits of using Forex trading simulators.

Is this your first time on our site? The team at Trading Strategy Guide welcomes you. Make sure you hit the subscribe button, so you get the Guidefree deals delivered weekly to your inbox.

To determine if forex trading is for you, you need to enter the market and do your due diligence before putting any real money into the game. Using real-time historical data, you can reduce your learning curve and quickly determine if forex trading is right for you.

Simulated forex trading shows some problems. Often, positive results on a demo account can turn into negative results in a live trading environment. This can lead people to question the validity of the simulated transaction.

However, the real cause behind this discrepancy is the lack of emotional involvement you get when real money is at stake.

Moving forward, you will learn what simulated forex trading is and how you can benefit from sim trading.

See below:

What is simulated Forex trading?

The Forex Trading Simulator is a software that allows you to test your strategy offline using historical data from the markets. If you have new trading ideas, a trading simulator can help you test them. This allows you to find what works and what doesn’t, and eliminate any lost strategies.

Although you may be working with a demo account, the market conditions are the same as the live trading environment. You can open and close trades and modify orders the same way you would in a live trading session.

The main advantages of using a free Forex trading simulator are as follows:

Acts like a live trading environment.

Ability to backtest and forward test your trading strategy.

Execute new trading ideas to see if they work.

Trade a risk-free account with all the trading functions and features of live trading.

Using a free forex trading simulator can help you learn the ropes to trading success. If you apply the 10,000 hour mastery rule to your trading, you definitely need a forex sim to practice your skills.

Before you start evaluating your current trading strategy, you need to make sure you’re using the right setup.

In the next section, we will show you what to look for when comparing the main features of the best forex trading simulators.

See below:

Best Forex Trading Simulator

There are several important elements that every forex trading sim needs to be equipped with. At a minimum, it is important that your emulator meets the following requirements:

1. Live food

It is essential to make sure your emulator has a real market environment that transmits live price data. Without live price data, you will miss the opportunity to test your trading strategy effectively.

A live price feed that mimics the spread. This means that when you run your strategy through a simulator, it will use the actual spreads found in the market.

This feature is more important than anything else.

Having real-time price data will ensure that your backtested results are accurate. This helps you determine if you can rely on simulation history data found in the software.

This brings us to the next important feature that any sim trading software should have.

See below:

2. Forex Trading Simulation Historical Data

Second, you need to have accurate historical forex data going back several months. Not having enough historical price data to simulate the performance of your trading strategy will result in unrealistic opposite results.

The best online forex simulators will give you historical prices. It will also give you the ability to browse historical quote data for your preferred currency pair. In addition to the end-of-day quote data, the database should also include intraday quotes. Regardless of your trading style, be it day trading or swing trading , the best forex trading simulator will be able to help.

Past price data needs to be in a clean format where you get the high, low, open and close prices for the selected currency pair and selected timeframe. In some cases, you can also get tick volume information. If your trading strategy is volume-based it is important to have access to volume data.

Let’s go ahead and see what other features your free forex trading simulator should have.

See below:

3. Flexible virtual money account

In our experience, traders don’t see the importance of using a virtual account balance. You should start with a balance close to the amount you want to use in your live transactions. If you can only fund your live trading account with $5,000, there is no point in using a $100,000 demo balance.

This has the potential to set unrealistic expectations that will lead to bad habits when you start live trading.

Simply put, make sure that the virtual currency account you are using to backtest your trading strategy is the amount you will fund your trading account with. This will also allow you to make a more realistic risk management strategy .

This way you will have no problem switching to live trading.

When you start trading with a demo account, you don’t need to invest any real money. Make sure you choose a free forex trading simulator that has a minimum of features and trading tools to get you started.

Getting started with the world’s most popular Forex trading platform aka MetaTrader4 can save you time in the long run.

Below you will find a step-by-step guide to using the MT4 Strategy Checker

Best Forex Trading Simulator – MT4 Strategy Checker

In this section you will learn how to backtest a strategy using the MT4 Strategy Checker. For this reason, we will use a default strategy that can be found in the MT4 strategy library.

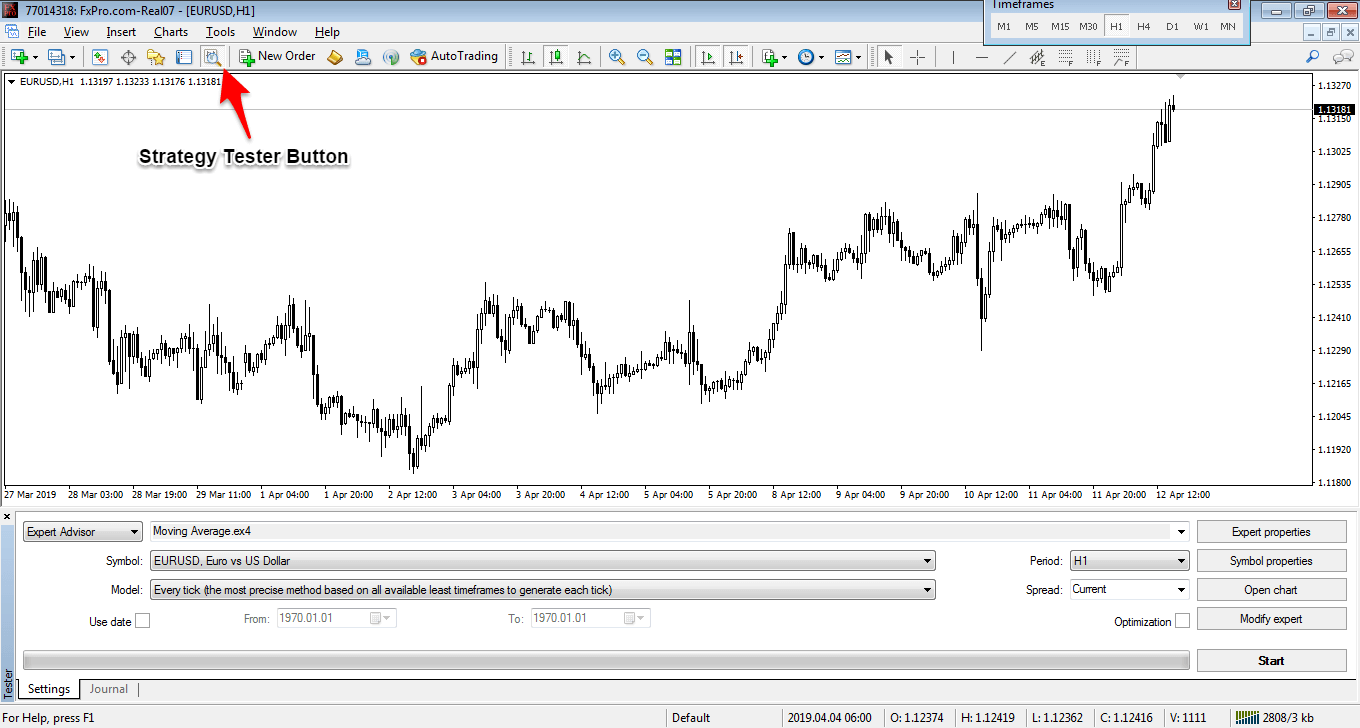

The first step is to open the Strategy Tester window by pressing CTRL + R or clicking on the corresponding icon found in the top toolbar.

See picture below:

Make sure you have selected your preferred timeframe window and settings accordingly. For the purposes of this example, we have selected the following settings:

- Expert Advisor = Move Average.ex4 (the name of the strategy we backtested)

- Symbol = EUR/USD (the instrument we implement our strategy)

- Model = Each tick is the most accurate method

- Time = 1H (preferred timeframe to run our strategy)

- Spread = Present

We recommend playing with these settings over and over until you discover winning settings.

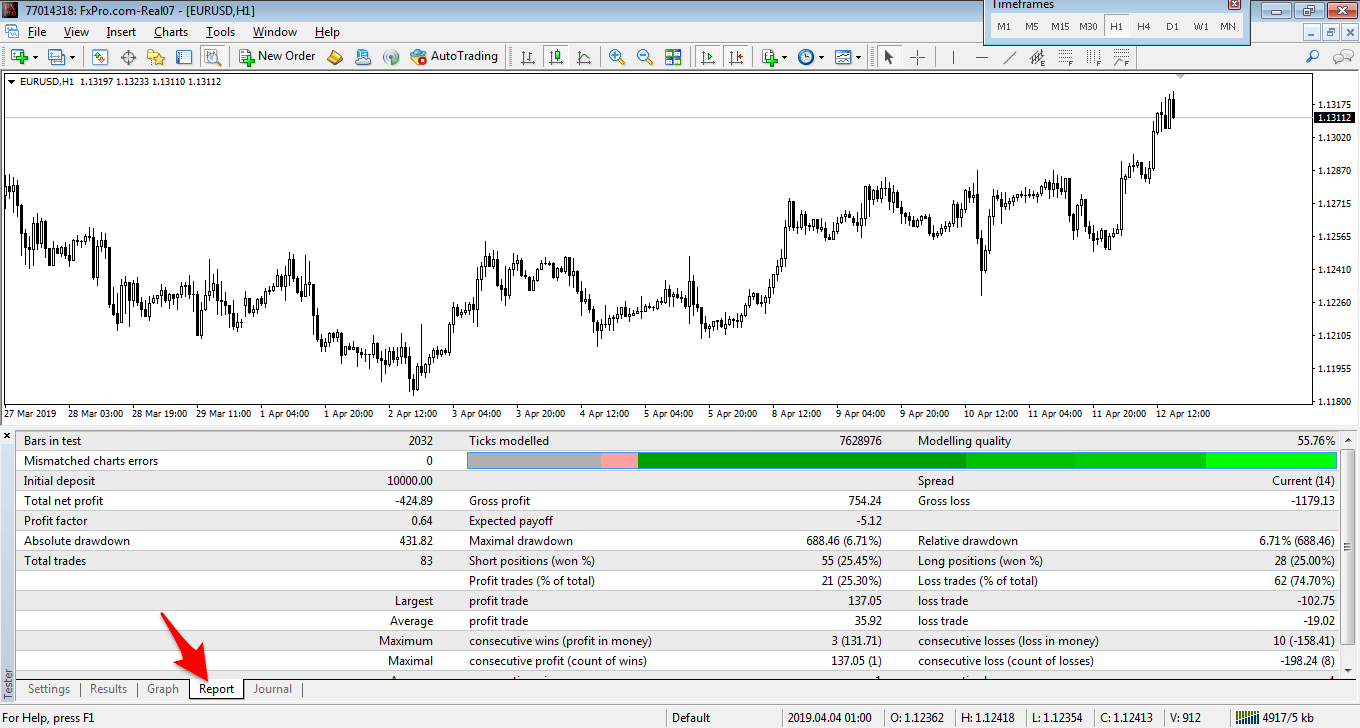

Once finished with selecting the settings, click the Start button so that the simulation can begin. You can check the results of the backtesting strategy in the Reports tab.

In the proposed example, we can see that the Default Moving Average trading strategy generated a net loss of around -$400 during the test period. This means we are not ready to jump into live trading yet.

We need to work more on our strategy and fine-tune the strategy parameters until you discover a profitable trading strategy that you are comfortable with.

Check out our guide How to Backtest Trading Strategy for more trading tips and tricks.

Conclusion – Forex Trading Simulator

The goal of Simulated Forex trading is to filter out bad trading strategies and optimize your trades to get bigger profits from your trading system. The key to successful trading is to make the switch to live trading as soon as the simulation provides proof that you have an edge in the market.

Find a forex trading simulator that is popular among other traders and execute your trading strategy risk-free before you start trading in real time. Get first experience, start live trading as you develop your strategy.

Sim trading is part of the process of becoming a profitable trader and it is the perfect environment to learn Forex trading skills without losing money in the process. Also, check out our 0 to 1 Million Dollar Forex Strategy .