The wedge trading strategy is a reversal trading strategy that has the potential to generate huge profits. When it comes to price action trading, the most important thing is to recognize certain patterns in the market. Our team at Trading Strategy Guide has spent a lot of time teaching you the most popular and profitable price patterns, similar to the Head and Shoulders Price Patterns Strategy .

In this tutorial, we will show you how to define or define a falling wedge pattern and a symmetrical wedge pattern. They are almost identical patterns, but not exactly the same.

Like most price patterns, you will be able to trade this pattern on any market and on any timeframe. No matter what type of trader you are – swing trader, day trader and scalper – you can make great profits trading falling wedges.

Regardless of the environment in which you see the falling wedge pattern its shape and the information it actually gives you with its price pattern there is a very clear uptrend. Going forward, we will focus on recognizing falling wedge and symmetrical wedge patterns and then we want to focus on how to trade the strategy effectively.

Note * No technical indicator is required to trade the wedge trading strategy. This is because we are dealing with a pure price action trading strategy.

Before we begin to cover the rules of strategy in depth, we will define and learn how to recognize each one. Also, read about Forex Mentors and the best investment you can make.

Wedge Falling Model Explained

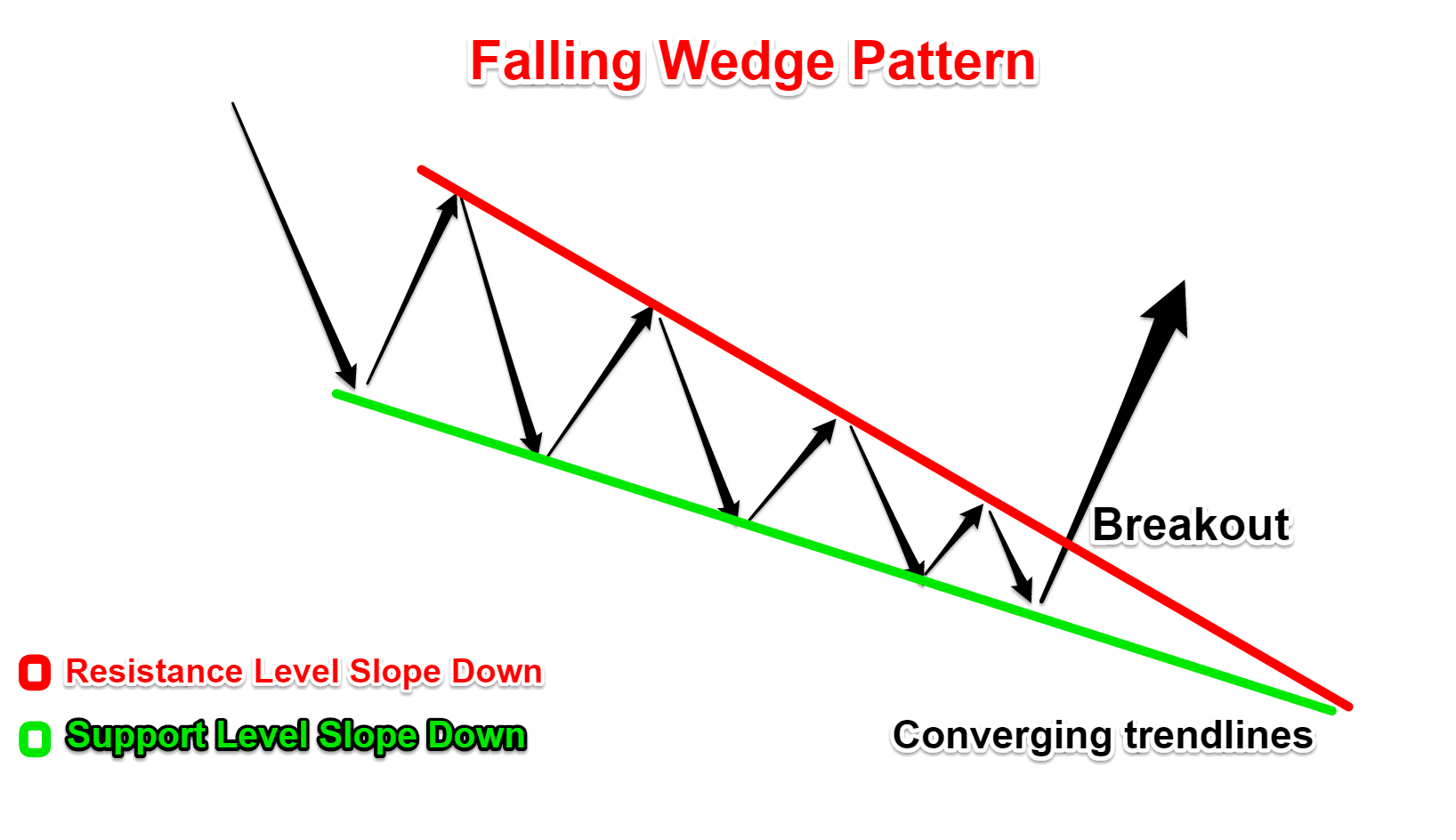

It is important to realize that the falling wedge pattern has two parts to its price pattern structure:

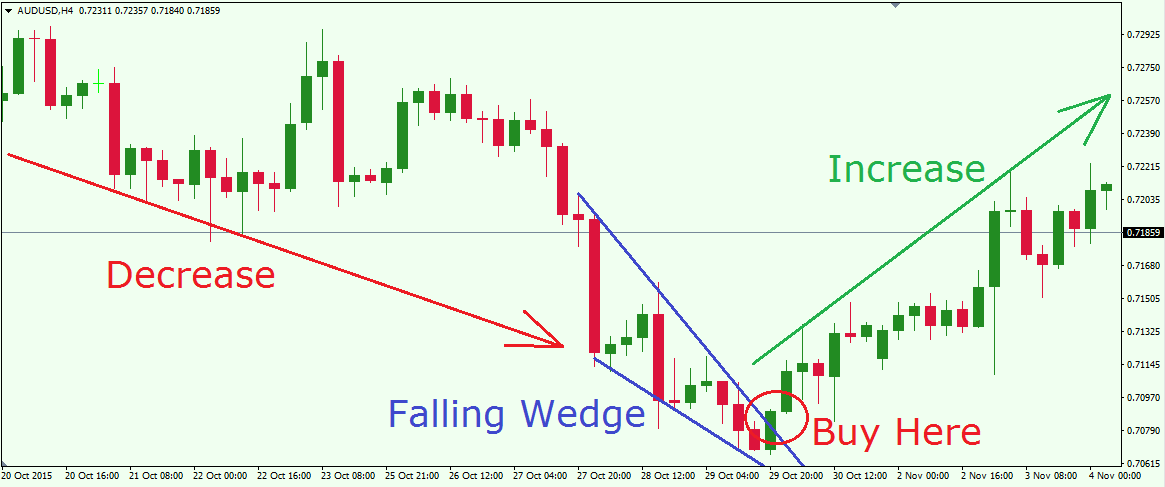

- The main feature of the falling wedge pattern is that we need to be in a downtrend before the pattern develops.

- This is therefore a reversal pattern.

- Part two is an actual falling wedge pattern that looks like a triangle pointing down.

Now, how to recognize the price structure of a falling wedge pattern?

You need to have a series of lower highs followed by a series of lower lows, the more the better. Each lower point should be lower than the previous low and each higher should be lower than the previous high.

However, as we near the end of the falling wedge pattern, you will notice that the price will not be able to make a lower low.

While the falling wedge pattern develops, you will see the length of the swing becoming tighter and tighter. Especially when we move to the downside. And at some point in the future, the two trend lines connecting the high and the low will converge.

The falling wedge pattern is not confirmed until it breaks the bullish resistance.

We can certainly say that there are some common characteristics between the falling wedge and the bullish flag but the difference is that the flag pattern has many short-term positive patterns while the wedge is an action. long term price. We are also trained for the best short term trading strategies.

Before jumping into the rules, we still need to identify our second favorite pattern, the symmetrical wedge pattern.

Symmetrical Wedge Model Explained

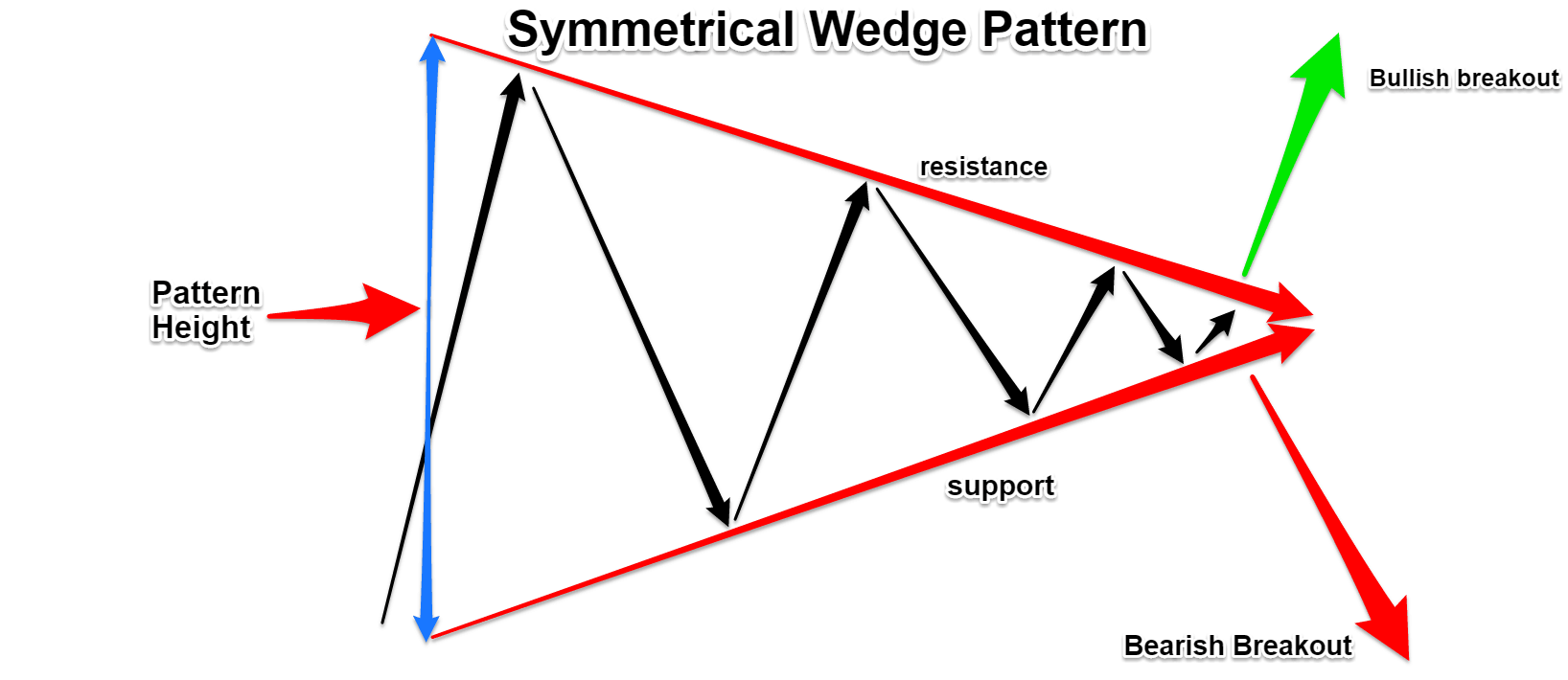

The symmetrical wedge pattern is another simple price action pattern. It is built like a falling wedge pattern. The symmetrical wedge pattern has the shape of a symmetrical triangle. It can be recognized by the distinct shape created by two diverging trend lines.

This is determined by drawing two trend lines:

- A downward resistance trendline connects a series of consecutive lows.

- An upward support trendline connects a series of consecutive higher lows.

And at some point in the future, two trend lines connecting the high and low will meet on the right side of the pattern.

There are many opportunities to trade the symmetrical wedge pattern. This pattern can appear at the end of an uptrend as well as at the end of a downtrend. More than simply a reversal pattern, this can also be traded as a continuation pattern.

Usually, a breakout of either trendline will result in an unstable move. Your job as a trader is to wait patiently and enter only when a breakout occurs.

Now, let’s see how you can effectively trade the falling wedge pattern and the symmetrical wedge pattern. Simply follow the wedge trading strategy rules below.

Wedge trading strategy rules – Buying opportunity

As a general rule, we must note that, the more the market consolidates between the upper and lower bounds of the falling wedge and the symmetrical wedge, the higher the odds of a breakout occurring sooner.

First, we will focus on the falling wedge pattern because it has outstanding potential for profits to be made.

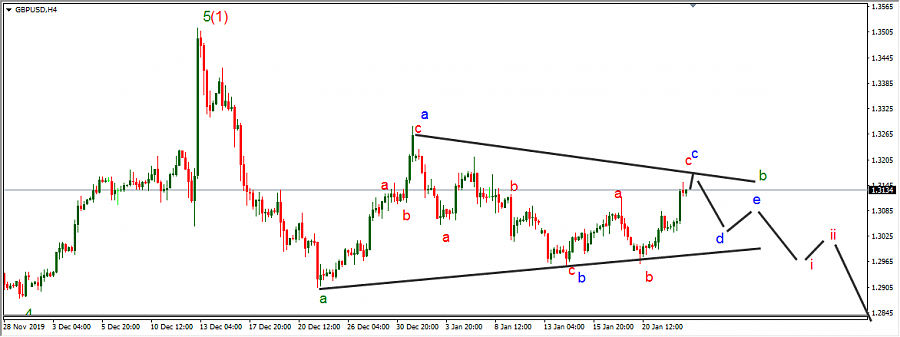

Step #1: Wait until you can spot on the Price Chart the Structure of a falling wedge pattern and draw two trend lines connecting the highs and lows.

We are only looking for a visual representation of a falling wedge pattern. So the more compressed the model the better. Finally, we will break up. The volatility behind the breakout will push the price higher very quickly.

Note ** Often you will find that the shape and price structure of a falling wedge pattern can vary from pattern to pattern. Ideally, as long as we follow the definition given earlier, we should trade any falling wedge pattern that respects those rules.

Next, we need to figure out where we need to enter the transaction, which brings us to the next step:

Step #2: Buy when we break and Close above the Downward Resistance Trendline

It is important before the breakout to see the contract price within the two trend lines. So when the price hits the resistance trendline, the sellers will step in and when the price hits the support trendline, the buyers will step in.

In the end, we will be forced to price within this bound range.

As we get tighter and tighter, that’s what we focus on because the pressure that builds up will eventually lead to a breakout. To avoid possible false breakouts, we will also wait for a close above the slope before we actually buy.

Note *** We need enough energy and enough momentum to break through the upper resistance of the falling wedge pattern. If you are still having trouble identifying genuine breakouts, we recommend you take a quick look at our Breakout Trading Strategy Used by Professional Traders .

Now that we are in a transaction, we need to find our target, which brings us to the next step.

Step #3: Take Profit Once We Pass the Origin (Starting Point) of the Falling Wedge Pattern

The starting point of the falling wedge was our first wall of resistance and obviously, we wanted to cash me our profits at the first trouble area. This is a more conservative goal.

Alternatively, you can track your stop loss below each low and try to capture as much as you can from the new trend.

Now that we have a clear understanding of where to take profits, there is still one more thing that we need to take care of, which is the Stop Loss position.

Step #4: Place a protective SL below the last swing before the Breakout

Where we are going to hide our stop loss is pretty intuitive to figure out. The last low before the breakout can provide us with a very attractive low risk relative to the potential profit available.

A break below the swing low will eventually invalidate the falling wedge price structure, so we want to minimize our losses and exit the trade.

Note * The above is an example of a buy Buy For a sell trade, we need to trade a relative pattern that is a rising wedge pattern. Use the same – but opposite – rules for a sell trade.

Symmetrical wedges follow the same wedge trading strategy rules, but the only difference is that we have a more realistic way to measure our profit targets.

For our profit target, we will measure the distance between the high and the low of our symmetrical wedge pattern, and you will add that distance wherever the price breaks out.

Summary

The reason why we chose to use the falling wedge pattern and the symmetrical wedge pattern is because people won’t realize what is developing until after the breakout, but if you focus to spot the this price pattern before big profit is waiting for you down the line You can also trade with triangle breakout strategy.

The psychology behind the falling wedge pattern is that when the price action narrows the buyers become more aggressive while the sellers don’t have enough strength to keep pressing down on the paddles.

If you compress an object hard enough after it reaches maximum compression, it will come back strong. The same principle can be applied to the falling wedge pattern, which is why it has such a huge potential to make significant profits.