Robinhood is a streamlined trading broker that has gained serious traction in bringing online trading to the masses through its free app. Specifically, it offers stocks, ETFs, and cryptocurrency trading. However, as the review highlights, there can be a price to pay for such a low fee. With that being said, this Robinhood review will test all elements of their service, including platforms, mobile apps, customer service, and accounts, before rolling it out. final judgment.

Brief history

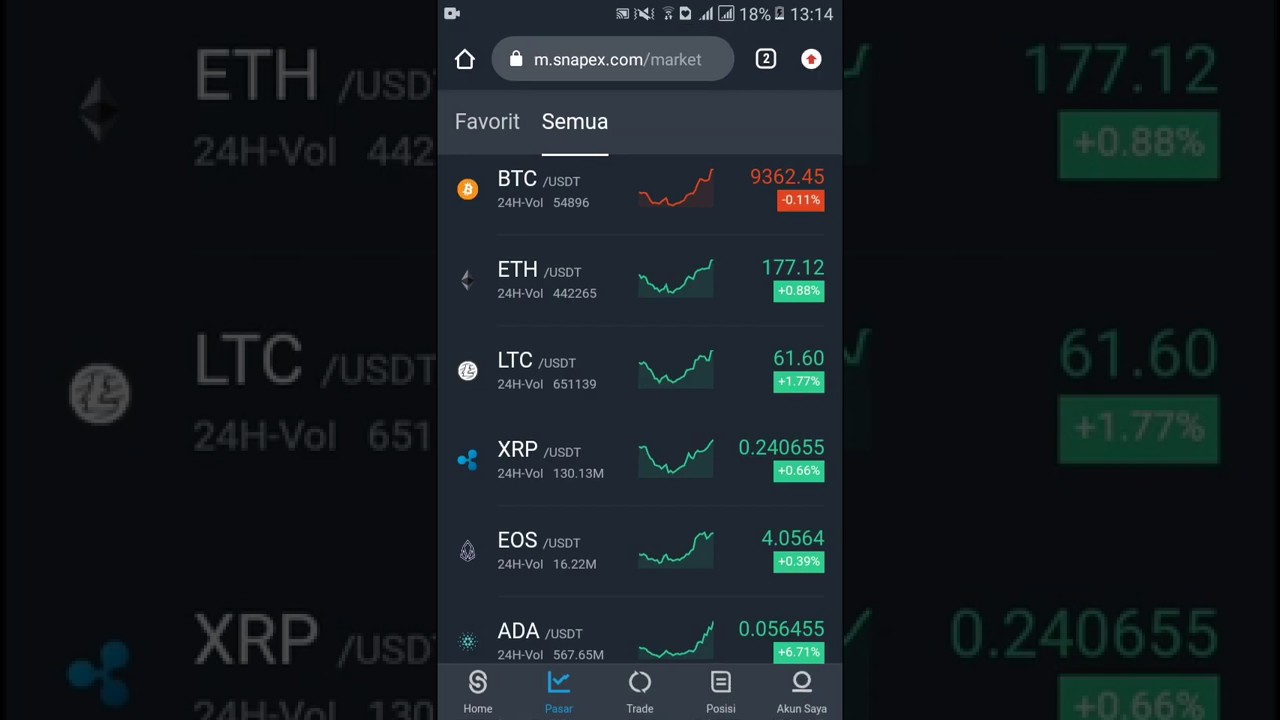

Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in 2013 when they launched their brokerage firm. Their simple approach to trading the markets resulted in them $3 million in pre-launch investment. Since then, Robinhood has gone global and grossed an impressive $176 million. The company has registered office in Palo Alto, California. The broker has traditionally been known for its clean and easy to use mobile app. However, as the number of users and revenue increased, the exchange decided to launch a web-based platform in 2018. February 2018 also saw Robinhood introduce cryptocurrency trading in:

- Bitcoin (BTC)

- Ethereum (ETH)

On top of that, they will provide support for real-time market data for the following digital currencies:

- Ethereum Classic (ETC)

- Bitcoin Cash (BCH)

- Bitcoin Gold (BTG)

- Dogecoin (DOGE)

- OmiseGO (OMG)

- Monero (XMR)

- Litecoin (LTC)

- Qtum (QTUM)

- Dash (DASH)

- Ripple (XRP)

- Star (XLM)

- Zcash (ZEC)

- NEO (NEO)

- Lisk (LSK)

For starters, Robinhood targets only US customers. However, as a result of growing popularity funds were soon raised to expand into Australia. There have also been discussions about expanding to Europe and the UK. According to user reviews, the broker is also starting to explore the addition of options trading to the repertoire.

Minimum initial deposit

There is no initial minimum deposit for Robinhood’s standard account. However, if you have a Gold margin account, you will need $2000, as the regulatory minimum. Of course, you will also need enough capital to buy a share of Nasdaq or an ETF, for example. Such a low minimum deposit requirement is a real bonus for this broker, as many competitors ask for up to $1,000 to open an account.

Spreads, commissions and leverage

Not only are there no commissions for in-app transactions, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. While many exchanges charge confusing annual interest rates, Robinhood uses a monthly fee based on the amount of equity you borrow. For example, with an account balance of $5,000 plus a deposit of $2,000, your monthly fee would be $10. As a result of this price bracket, Robinhood is one of the cheapest online brokers around.

Other transaction fees

User reviews happily indicate that there are no hidden fees. No inactivity, ACH or withdrawal fees. Having said that, there is a $75 ACAT outgoing transfer fee. There are also participating rewards and special promotions to follow. For example, sometimes Robinhood offers a referral deal where you can get free stock when you bring a friend online. Visit the official website to see what specials are running.

Robinhood Exchange

Since the web platform’s release date was announced for 2018, an impressive 640,000 customers have quickly signed up to the waitlist. Once you log in, the online platform is more powerful than the mobile app, but still lacking when compared to competitors. From the menu, the user will be able to access:

- Market commentary and analysis ratings from Morningstar

- Current stock price and price data of a certain security, such as Japanese stocks, for example

The Ticker Profile will provide a list of recently purchased stocks and index funds, which can help users identify potentially profitable assets.

However, while viewing stock prices and accessing features from the menu can be straightforward, the charting package is limited. Furthermore, the online platform will not have sophisticated testing facilities or analytical tools. Having said that, Robinhood was quick to announce that they would be providing instructions on how to use the new web-based platform. This means that all desktop clients can quickly log in with their web login details and start speculating on popular financial markets.

Mobile application

Reviews of the trading platform are divided when it comes to Robinhood’s mobile app offering, which until 2018 was the only way users could place trades. Firstly, it’s worth noting that they offer apps for both iPhone and Android users that can be downloaded from their respective app stores in just a few minutes. Software review is quick to highlight the platform is clearly geared towards new traders. The result is a simple yet effective user interface. You won’t get refinements, backtesting tools, or advanced features. Also, not everything is in one place. So you will need to go elsewhere to do your technical research and then return to the app to execute a trade. Having said that, it’s not too sparse. For example, you can still:

- Conduct transaction

- Check the watchlist

- Keep up with the news

- Pull stock price

- Deposit or withdraw

- Change your privacy settings

- View charts with basic metrics

- Conduct basic market research

On top of that, information pops up to help you get the most out of the app. Customer support is just a click away, and after the update, details of new features are quickly revealed.

How to use the Robinhood app

Reviewing the Robinhood app makes bookings super easy. You can access the transaction screen from a ticker profile. Also, if you swipe left on the ticker while in the watchlist, a ‘Buy’ button will appear. You can also delete a bookmark by swiping left. The iOS and iPhone app review notes that there are some things you can’t do. For example, you have no option columns in your watchlist other than the final price. Also, when you pull up a stock quote, you cannot modify the chart, except for the six default data ranges. Furthermore, you cannot conduct technical analysis. Finally, there is no landscape mode for landscape viewing.

Application judgment

Amazingly Robinhood offers free stock trading for Android and iOS users. The built-in consumer protections are also great for new traders as they limit high-risk investments. However, stockbroker reviews will point to more competitors offering more comprehensive mobile apps for those comfortable with the risks associated with highly volatile instruments.

Payment methods

Once you sign up for a Robinhood account, you will need to make a deposit before you can start trading. Luckily, you can link your bank account directly to Robinhood to make both deposits and withdrawals. Plus, verifying your bank account is quick and hassle-free. Note Robinhood recommends linking a Checking account instead of a Savings account. This can prevent potential transfer reversals. According to customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets.

Robinhood account

Robinhood offers three different account types:

- Standard Account – When you sign up, you are automatically given this account. It grants you access to instant deposits. Best of all, you won’t have to wait for your money to process when trading stocks and depositing up to $1,000.

- This upgraded Gold – Account gives you extra buying power, larger instant deposits, plus extended trading hours. As a margin account, you will need to keep a minimum balance of $2,000. Gold reviews are positive, with clients enjoying the benefits that come with margin accounts and more trading hours. Gold account prices will vary depending on the tier you choose. You will pay a fixed monthly fee based on the deposit. It is worth noting that trading on margin can be risky. In fact, you may lose more than your initial investment.

- Cash Account – Account cash allows you to place commission-free trades in stocks, no deposit required and instant payout. Note, you can also downgrade to a cash account from the standard Robinhood and Gold accounts.

As review brokers stand out, customers appreciate the selection of account types, allowing them to find the right fit for their trading needs. Account verification is also quick, so traders can fund their accounts and receive market speculation in a timely manner.

Demo account

Whether you are trading forex, S&P 500 stocks or penny stocks, practicing on a demo account first can help you create effective strategies before you risk real capital. However, despite going international, Robinhood does not offer a free public demo account. While you could argue there is less of a need since you have access to a free trading app anyway, virtual trading with simulated money is still a great way to test your trading software. translate and familiarize yourself with the market. Until a practice account is introduced, reviews will continue to highlight this as a significant downside to the Robinhood system.

Extra Features

Robinhood’s investment review is quick to highlight the lack of research resources and tools. Instead, the network is built more for those who implement simple strategies. Since the exchange only offers stocks, ETFs, and cryptocurrency trading, users do not receive information about alternative securities, such as options and futures. Although there are plans to facilitate other types of transactions in the future. Having said that, you’ll find fundamentals, pricing statistics, and news feeds within the app. Though for comprehensive coverage, you might be better off switching to Yahoo Finance. Plus, while the site offers articles and support tips, there’s a lack of training videos and user guides to help customers get the most out of the platform. Limited resources are a real downside to a broker’s service. For example, as cryptocurrency trading in the UK and elsewhere skyrockets, the company can really support users by providing information on blockchain technology and digital currency tokens.

Regulations & Licenses

Recent years have seen a proliferation of hacks and promises of wealth from unscrupulous brokers. As a result, it is easy for traders to find trustworthy and legit exchanges. Fortunately, when it comes to outstanding account reviews, Robinhood is a member of both FINRA and SIPC. Furthermore, SIPC promises coverage of up to $500,000 per customer, with a sub-limit of $250,000 on cash claims. On top of that, additional coverage is guaranteed through Lloyds and several other London Underwriters. This ensures customers have excess coverage so the SIPC standard limit is not enough.

Benefits

There are some very good reasons to choose Robinhood, including:

- Costs – The exchange does not charge transaction fees when buying or selling stocks and ETFs. This commission free structure is perfect for low capital traders. It’s not until you use Robinhood vs Coinbase, Vanguard, Fidelity and others that you realize how low Robinhood’s trading fees are.

- No minimum account – Trading blogs and forums are often rife with complaints about high barriers to entry because of the substantial initial deposit requirements. However, opening a Robinhood account is free and the cash account has no account minimum.

- Easy to use – Their simple app is clean, fast and easy to pick up. This is perfect for beginners who don’t want to be inundated with complicated features and options.

- Free Bank Transfers – Transfers ACH is always free. Again this will appeal to new traders who have limited start-up capital.

- Mobile users – Robinhood offers a good mobile trading app for both iOS and Android users. Users can conduct market research, trade and manage their accounts easily from within the app.

Limit

Despite the positive numbers, there are certain limitations to Robinhood’s service as well, including:

- Limited Research & Education – Investment reviews quickly point out that Robinhood lacks in-depth research and analysis tools. This can deter new traders looking for additional resources that will help them grow as traders.

- Limited Products – Although the brokerage has made strides in offering cryptocurrency trading, user reviews indicate that there are alternatives that offer a wide range of tradable instruments. broader translation.

- Basic Charts – Charts and patterns form an essential part of your market analysis. Unfortunately, take Robinhood vs Etoro, Etrade and TD Ameritrade and it quickly becomes clear the former offers an extremely basic charting package. In fact, users only get ticker information and historical price data, with no customization capabilities.

- Real-time data concerns – Although the actual application displays citation data in real-time, the terms and conditions dictate that data can be delayed up to 20 minutes.

- Basic Order Types – Robinhood does not support advanced order types or options trading, while limit orders are collected up to 5%.

- Accessibility – Since the Robinhood broker is still in its early stages, for EU and UK trading and investing, Robinhood is not an option. Fortunately, as their net worth continues to grow, the company looks set to welcome merchants from new countries.

- Negative Purchasing Power – Robinhood Gold users risk having a negative balance. While this may not result in a margin call, you will need to deposit additional funds. This will remind users that it is all too easy to lose more than your initial capital.

Trading hours

Robinhood trading hours will depend on the asset you are trading as they generally follow the market. Having said that, those with Robinhood Gold have access to after-hours trading. As a result, users can trade an additional 30 minutes before the market opens, as well as two hours after it closes. This is because a lot of companies release earnings reports after the market closes. But the downside of buying and selling in after-hours sessions is reduced liquidity, which can lead to higher bid/ask spreads.

Contact Customer Support

Financial firm Robinhood offers many ways to get in touch, including:

- Phone

- Google+

However, as user reviews are quick to point out, these resources are not available 24/7. Therefore, any issues you experience outside of market hours will have to wait until the next business day. While the options are limited, customer reviews show that the support staff are relatively knowledgeable and can assist you if your platform is down or the website is down. They can also help with a variety of account queries. Robinhood also tries to push users towards their online help center and FAQ page, where most of the user questions and concerns have been answered in detail. Please note that the customer service assistant cannot provide tax advice. Instead, go to their official website and select Tax Center for more information.

Safety & Security

In addition to insurance, Robinhood has multiple layers of security to keep data and personal information safe, including TPS encryption. Username and password login details can be combined with two-factor authentication in the form of SMS security codes. Alternatively, if you have a Fingerprint ID for an iOS or Android device, you can sign in with Touch ID. This makes getting in and out of your investment app quick and easy.

Robinhood’s Judgment

If low costs are your priority then you can’t beat Robinhood’s free trading service. But while the broker offers just enough for users to trade comfortably, it is probably best suited for beginners looking for a simple, user-friendly design. As product and platform reviews stand out, experienced traders may want to look for sophisticated tools and additional resources.

Accepted countries

Robinhood only accepts traders from the United States.