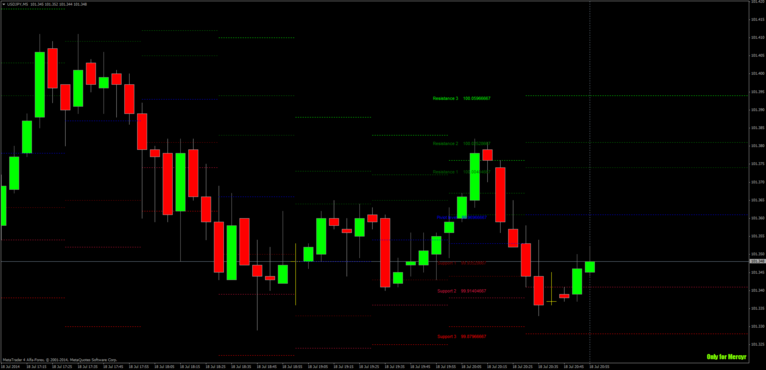

Pivot points are one of the most widely used indicators in day trading. This tool provides a specialized plot of seven support and resistance levels to look for intraday turning points in the markets. Below is an image of how they appear on the one hour chart of the AUD/JPY currency pair. All seven levels in sight.

While traders often find their own support and resistance levels by finding previous turning points in the market, pivot points are automatic on a daily basis. Since many market participants watch these levels, price tends to react to them.

Calculate Pivot Points

Pivots points can be calculated for different timeframes in some charting software programs that allow you to customize the indicator. For example, some programs may allow you to calculate pivots at weekly or monthly intervals. But the standard indicators are plotted on the daily level. The central price level – the pivot point – is calculated as a function of the market’s high, low, and close relative to the previous day (or period, more generally). These values are summed and divided by three. This is the same concept as the typical Belgian price. Pivot Point = [High (before) + Low (before) + Close (before)] / 3 Other six price levels – three support and three resistance levels – all using the value of the pivot point as part in their calculations. The three levels of support are conveniently called support 1, support 2, and support 3. The three levels of resistance are called resistance 1, resistance 2, and resistance 3. You may also see them referred to by the figures. their shorthand formulas – S1, S2, S3, and R1, R2, R3, respectively. These values are calculated as follows:

- Resistance 1 = (2 x Pivot Point) – Low (previous period)

- Support 1 = (2 x Pivot Points) – High (previous period)

- Resistance 2 = (Rotation point – Support 1) + Resistance 1

- Support 2 = Pivot Point – (Resistance 1 – Support 1)

- Resistance 3 = (Rotation point – Support 2) + Resistance 2

- Support 3 = Pivot Point – (Resistance 2 – Support 2)

Since the prices are based on the previous day’s high, low, and close, the wider the range between these values, the larger the gap between the levels on the next trading day. Likewise, the smaller the trading range, the lower the gap between levels will be the next day. It should be noted that not all levels will necessarily appear on the chart at the same time. This simply means to scale the price chart such that some levels are not included in the view window.

Uses of Pivot Points

The Pivot Point was originally used on stocks and in the futures markets, although the indicator has been widely adapted for day-to-day trading in the forex market. The Pivot Point has the advantage of being a leading indicator, which means that traders can use the indicator to gauge potential turning points in the market ahead of time. They can act as trade entry targets themselves by using them as support or resistance, or as levels for stop loss and/or take profit levels. For example, below we can see many cases where S1 plays a supporting role.

The bottom line, which is the midline and the cutoff by which everything else is calculated, is the main focus. If the price is trading above the pivot point, the market sentiment could be seen as bullish on the day (although the market could still decline during the day if this is true). If the market is flat, the price could fall and flow around the pivot point. We can observe this type of price behavior in the chart below.

While R1, R2 and R3 are so-called in the sense that they can act as resistance when the market is up, if the price breaks above them, they can also act as support if the price drops. The same is true for S1, S2, and S3, which can act as resistance to any moves as they break on support. For example, here we see a resistance level acting as support.

Using Pivot Points to Measure Probability

Pivot points are also used by some traders to estimate the probability of a price move sustaining itself. Although dependent on the market, the following probabilities are commonly reported for the likelihood that the price will close the trading day above or below the following levels:

- Closes higher than R1 40% of the time

- Closes lower than S1 40% of the time

- Closes higher than R2 15% of the time

- Closes lower than S2 15% of the time

- Closes higher than R3 5% of the time

- Close lower than S3 5% of the time

These are, of course, simply rough approximations. Simply because price is moving above or below external levels does not necessarily mean that the moves are invalid or sustainable. For example, it should never be assumed that, based on the above information, you have an 85% chance of winning a trade if you hold a long position when the price hits S2. That certainly wouldn’t be true.

Pivot Point is Stop Loss

Some traders will take a trade on one level, expecting a reversal on touch, while using the next level below it (in the case of a long trade) or higher (in the case of a short trade). ) is the stop loss. For example:

Here we see a short entry at R1 and a stop loss at R2.

Trading using Pivot Points

At this point, it seems pretty straightforward that pivot points are used as potential turning points in the market. Taking trades at these levels in the direction of the expected reversal is a very popular technical strategy. To improve the viability of this strategy, traders attach the pivot point strategy to other indicators. For instance, one can use the 50 period simple moving average to gauge the trend and one’s tendency to trade only in the direction of that trend. Alternatively, instead of making the first touch of the pivot level, one can request a secondary touch to confirm that the level is valid as a turning point. Here is an example of why Level Validation Registration is best before making a trade on a basic touch. Here is a five-minute chart of EUR/USD.

When data or news comes out, volume increases markedly and previous trading movement and intraday support and resistance levels can quickly become outdated. Above the big green bar, the price is actually holding between the two pivot levels. But if we trade every touch of the pivots, we will make both long and short trades within five minutes. After that point, the market became heavily bearish and fell steadily, showing no sensitivity to the pivot points. So you need to be careful and make sure that you are not trying to trade at a level that the market does not intend to respect when high volume is present in the market. If we write down our rules for this system: 1. a) If the 50 period simple moving average has a positive slope, take only long trades. b) If the 50 period simple moving average has a negative slope, only take short trades. 2. Executing a trade on the secondary touch on the pivot level after the first time confirms that the primary touch is a level rejection. This will be applied to the 5-minute chart, but can also be applied to higher (or lower) time compression. For day traders who use pivot points on a daily basis, using 5-minute to hourly charts makes the most sense. Swing traders can use the weekly pivot point which would be best to apply the strategy on the four hour chart on a daily basis. The position trader may be best suited to use a monthly pivot point on a daily or weekly chart. But this is a pretty simple system that can work.

Example

Here we have a 5 minute chart of the EUR/USD currency pair.

Price is in an intraday downtrend, price bounces off the S2 level (which acts as resistance) once on a retracement, resulting in a short trade on the secondary touch of S2.

This trade worked well, after resuming the downtrend shortly after.

Now, of course, the question is, how do you determine where to exit? Before placing a trade, you must have an exit plan. This can take many forms. Some options are shown in the diagram below.

A level of resistance formed shortly after the trade started moving in our direction. Naturally, it might be reasonable to expect resistance to form there again in the future. Furthermore, if price starts to consolidate and any momentum in the trend – or volume in the market in general – has faded, then we simply choose to exit the trade afterwards. Or we can take a touch of the moving average. Some traders use some of the more popular moving averages – 50-, 100- and/or 200 – as support and resistance levels, or look at a change in trend if price breaks out. moving average is being tracked. A natural return in a revolving point system, of course, on the next level in the hierarchy. In this case, if we make a short trade at S2, our profit could be S3. But as noted above, reaching the outermost level, like S3 and R3, is generally rare. It is completely defensible for day traders to take trades off the table at the end of the trading day when volume is markedly reduced.

A word across time zones

It’s also important to note that pivot points are very time zone sensitive. Most pivot points are viewed based on closing prices in New York or London. As a result, someone using charting software that uses closed time in San Francisco or Tokyo or some other time zone may have different pivot points plotted on their chart that may not be tracked on any other time zone. any major international scale. This could potentially render them muted or null. Accordingly, we recommend setting your chart time to either New York time or London time. How these relate to GMT or UTC specifically depends on where each location is in the calendar, as both cities use daylight saving time. Whichever time zone you choose, know that pivot points can be double-checked by looking through previous price data. It is important to make sure that the price is sensitive to these levels in the market you are trading.

Conclusion

Pivot points provide a glimpse of potential future support and resistance levels in the market. They can be especially useful for traders as a leading indicator for where price could turn or consolidate. They can also be used as stop loss or take profit levels. While daily pivot points are the most common and best suited for day traders, some charting platforms will allow you to chart for other timeframes (e.g. weekly, month). As with all indicators, they should not be used as the only thing on which you base your trades. They should be used in conjunction with other forms of analysis and/or other technical indicators.