Knowing which indicators to use and the best combination of technical indicators can greatly improve your chart reading skills. If you use the wrong technical indicators, this can lead to incorrect price interpretation and subsequently to bad trading decisions.

Our team at Trading Strategy Guide has meticulously curated each technical indicator to give us the best performance for each individual trading strategy we have created. Also, read our Best ADX Strategy .

However, if you are the type of price action trader who only uses bare charts, you can safely check out our final chart pattern step-by-step guide .

Technical indicators make it easy to identify current price trends and predict future price moves. By developing effective technical analysis strategies, you can increase the amount of money you make per trading day.

However, while all technical indicators are useful, they all have their own weaknesses. If you only use a single indicator to monitor the market, there may be certain price trends (or dangers) that you don’t notice.

By combining multiple technical indicators into a single trading strategy, you can limit your risk while still earning high returns. Below, we will explain how to create a multi-index strategy.

Multi-Indices Strategy should avoid redundancy and make use of the best combination of trading indicators in a meaningful way. We are also trained in the Average True Range Index.

The multi-indicator strategy runs the risk of becoming redundant because many times traders using indicators show the same kind of information. To avoid getting stuck by this trading mistake, you need to understand that technical indicators can be classified into three groups, as follows:

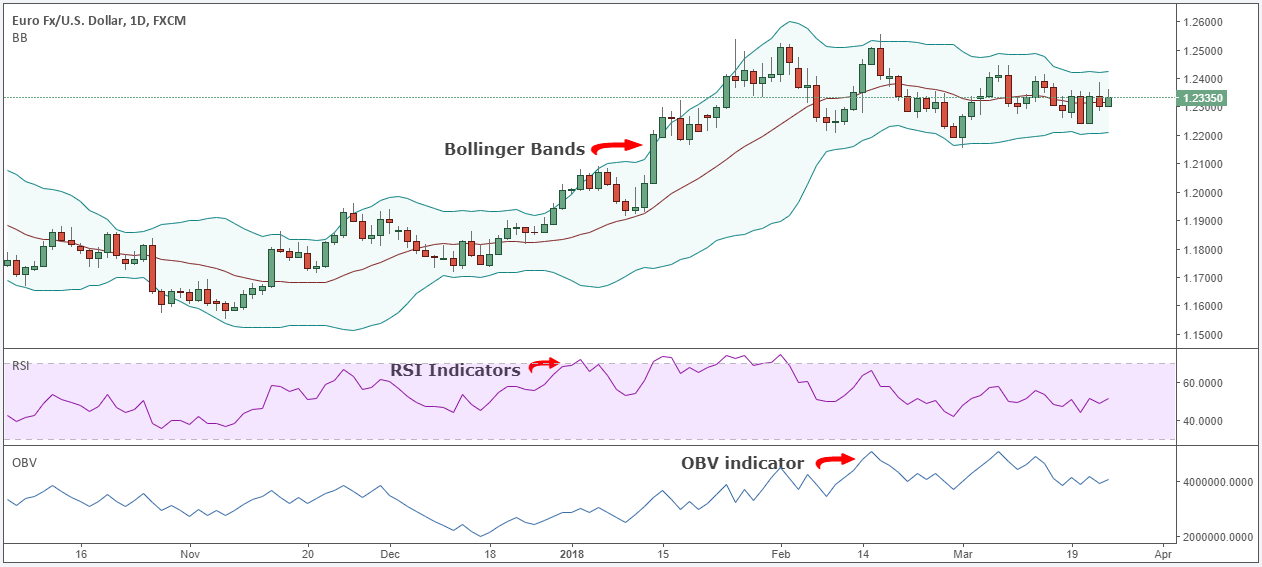

- Trend tracking indicators allow you to determine if an asset is currently overbought or oversold. Many trends follow indicators, such as Bollinger Bands, trying to create a clear channel. A clear channel will tell you whether the price is close to breaking or returning to normal.

- Momentum indicators , such as the Relative Strength Index (RSI), allow you to determine the direction and strength of the current price trend. Once an asset begins to build momentum, opening a new position becomes less risky. Looking at the Moving Average indicators also helps you gauge momentum.

- Volume indicators help traders identify a (strong) relationship between price and volume. Increasing trading volume almost always leads to an increase in price. However, these events do not always occur at the same time, which is why volume indicators are good for advanced forecasting. On-balance volume (OBV) and cash flow are two of the most useful volume indicators.

As you can see, while these types of indicators are trying to determine the same thing as to whether the price will rise, fall or remain stable from the angle that each of their offers is unique. Looking at the market from different angles can help you develop a more accurate, realistic and actionable perspective.

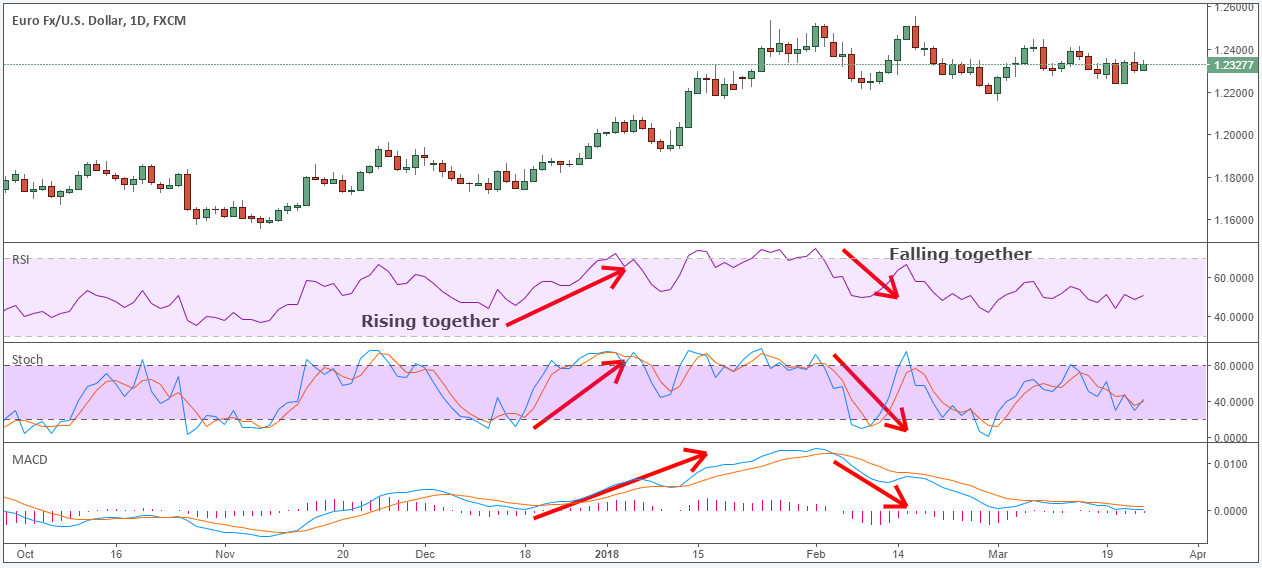

Basically, if you trade with a multi-indicator strategy that uses the RSI, the MACD and the stochastic indicator, you are essentially using 3 types of technical indicators of the same type.

These are all momentum indicators that will show you the same kind of information in one way or another. In the image above you can notice how all the indicators track simultaneously.

This is not good!

The problem with using technical indicators inappropriately is that you can actually think of stronger trade signals if all the indicators are in the same direction.

It is quite simple to overcome information that is too concentrated from using indicators belonging to the same group. Avoid using technical indicators that show the same type of information. The most strategic indicators combine indicators that show a different kind of information.

Best Strategy Multiple Indicators

Now comes the interesting part.

Moving forward, we will highlight which indicators to use for the best multi-index strategy.

We will use a momentum indicator, a trend indicator and a volume indicator that support and complement each other.

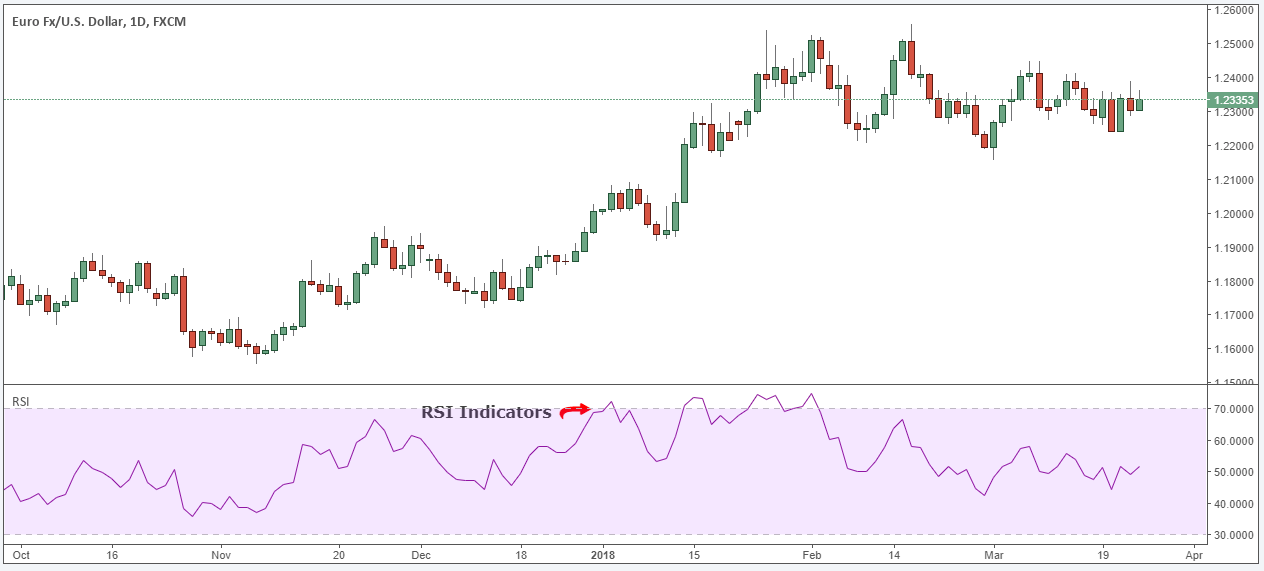

RSI momentum indicator

We won’t take the time to explain how RSI plots because we live in the computer age and they automatically do the work for us.

The Relative Strength Index is a momentum indicator and a leading indicator at the same time. A lot of traders like the RSI indicator because it is easy to use.

We use the RSI to identify possible overbought and oversold conditions in the market.

Next, we will cover our second indicator.

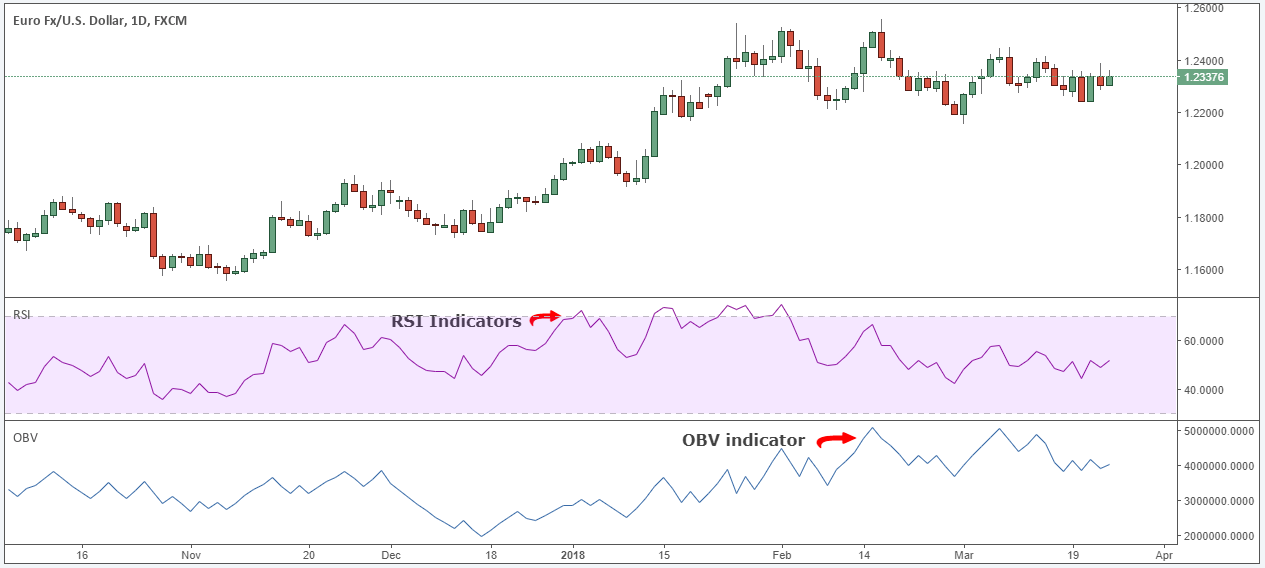

OBV – Volume Indicator

The second indicator used for our strategy is the OBV indicator.

The OBV indicator is based on the idea that both volume and price activity are equally important. In this regard, OBV combines both price and volume to show you the total amount of money entering and leaving the market.

The screenshot above shows how your chart setup will look if you follow the instructions above.

The main idea behind the Balanced Volume indicator is that the market price will follow where the mass flow is happening.

Now, all we have to do is name our final technical indicator which will complete the multi-indicator strategy .

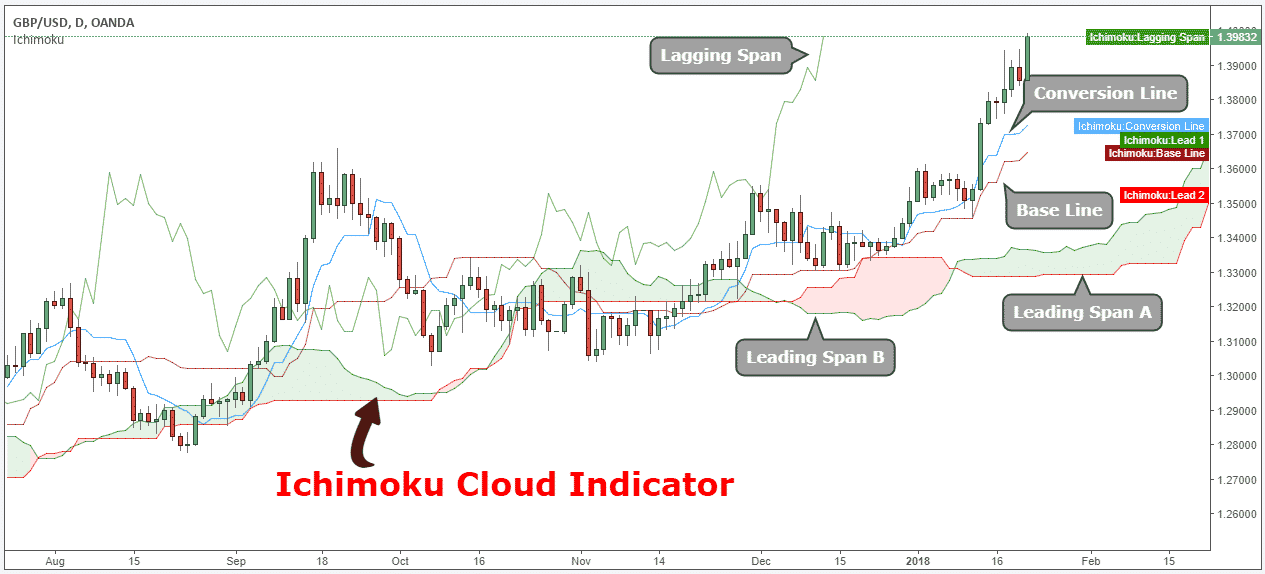

Ichimoku Kinko Hyo (Ichimoku Cloud)

The Ichimoku Cloud is another popular trend indicator . Ichimoku Kinko Hyo will draw several different lines on the chart to easily identify future cases of strong support or resistance.

On the chart of the indicator, there will be a blue line (Kijun Sen), a red line (Tenkan Sen), a green line (Chikou Span) and a red/green band (Senou Span) ). To get an accurate motion reading, each of these lines will need to be taken into account.

The blue line (baseline) will plot the average of the highest high and low low over the past 26 trading periods. Similarly, the red line (turning back line) will chart the average of the highest high and the lowest low over the last nine trading periods .

The lagged blue line will plot the closing price 26 periods in the past. This will help give you a better perspective on surveillance trends.

The first band will be calculated by averaging the blue and red lines together.

The second band will be calculated by averaging the highest high and lowest low over the past 52 trading periods.

The last step is to take the trendline and move 26 periods ago. Once all these lines are drawn together, you will have a broad view of the market. From here you will be able to decide if there is a strong enough trend to justify opening a new position.

Bollinger Bands – Trend Following Indicator

Bollinger Bands is the best trend-following indicator that measures the volatility of any market. It is also the third of many of our best strategic indicators.

Buying and selling based on bollinger bands can be a very effective trading strategy, especially if used in conjunction with other technical indicators.

In the end, your chart setup should look something like the one above.

Without further ado, let’s see how you can trade effectively using a variety of technical indicators and how to make the right profits the smart way.

Multi-criteria strategy

For our strategy you will need to use three to four technical indicators for successful trading. These indicators include the Relative Strength Index, the Ichimoku Cloud, Bollinger Bands, and Balanced Volume. Collectively, these indicators account for the proportions of trend, momentum and volume that all traders should pay attention to.

Now, before we go any further, we always recommend that you get a piece of paper and pen and write down the rules of the trading strategy. For this article, we will be looking at the buy side.

Note * This strategy can be used on any timeframe so go ahead and apply it to your preferred timeframe.

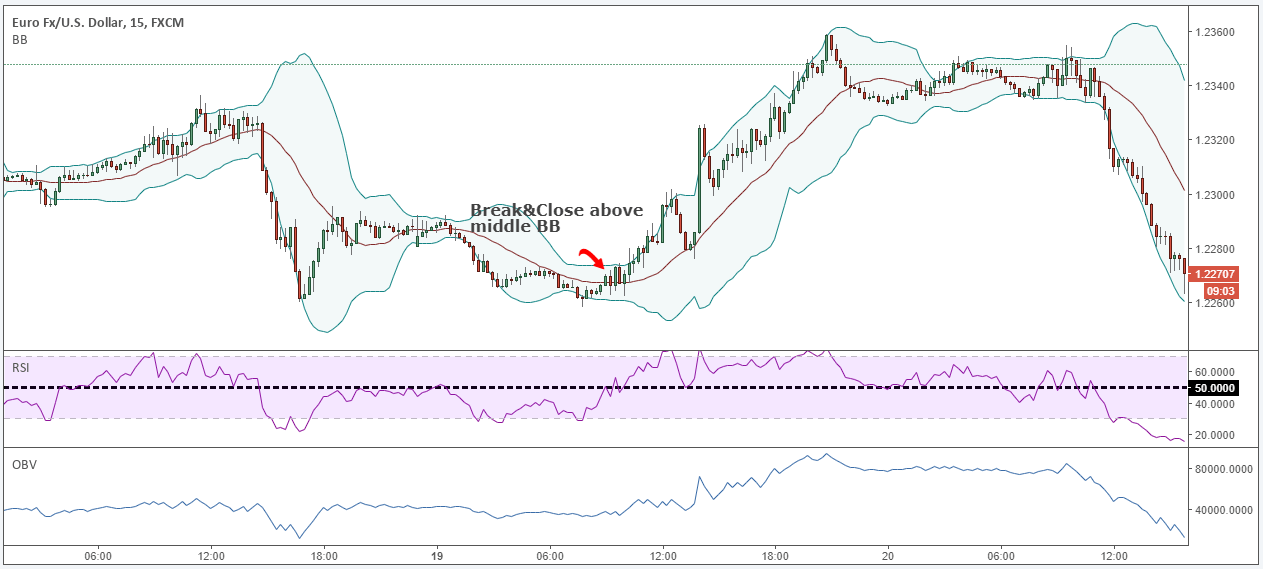

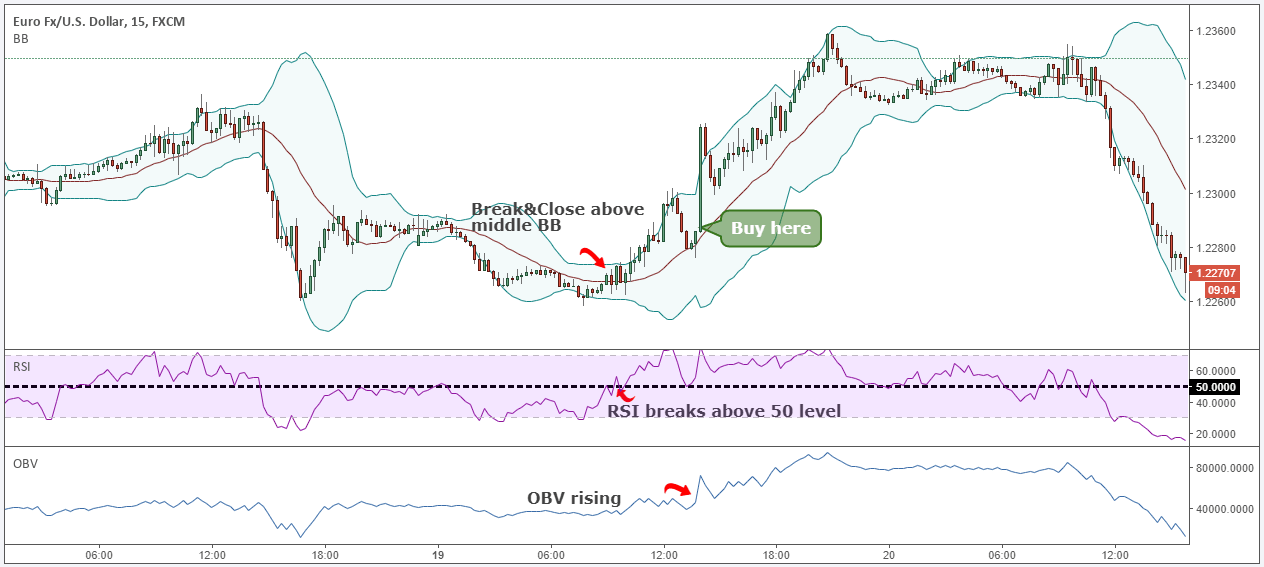

Step #1: Price needs to break and close above middle bollinger band

The first step is pretty easy!

In fact, the whole strategy is very easy to understand so you will be able to trade in no time.

So, the first confirmation we need is for the price to break and close above the middle Bollinger band. Once this trading condition is verified, we can check other indicators to add confluence to our trading signals.

Now, let’s see what the RSI has to say about the price action.

See below …

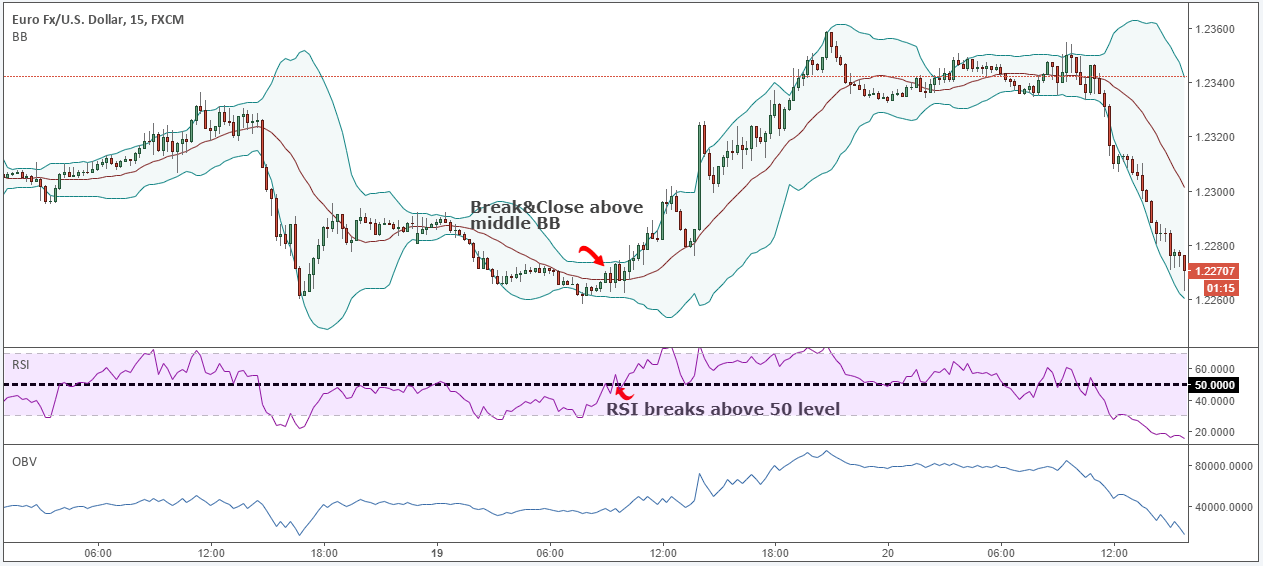

Step #2: Wait for the RSI to trade above the 50 level if it is not there yet

Everything we do at Trading Strategy Guide makes sense! We always try to make sense of the correct interpretation of the action of any technical indicator.

In this step, we try to find an agreement between what Bollinger Bends is saying and the RSI’s own price reading. So the breakout could be confirmed if momentum is behind the move.

Normally, an RSI reading above 50 is considered positive momentum while an RSI reading below 50 is considered negative momentum.

Note * You will not always see the RSI breaking above the 50 level at the same time as the price breaking above the middle BB. Sometimes, we need to wait a little longer for the upside momentum to appear.

Step #3: Wait for the OBV indicator to rise. Buy at the market when you see volume confirming the price.

The last trading condition before pulling the trigger is again easy to understand. We want to trade on one side with smart money. In this regard, we look for evidence that the trade we want to receive is the real buying power behind it.

We can notice that the real mass appears only later. It is important to have patience and wait for the correct trading conditions to be satisfied before entering into a long trade.

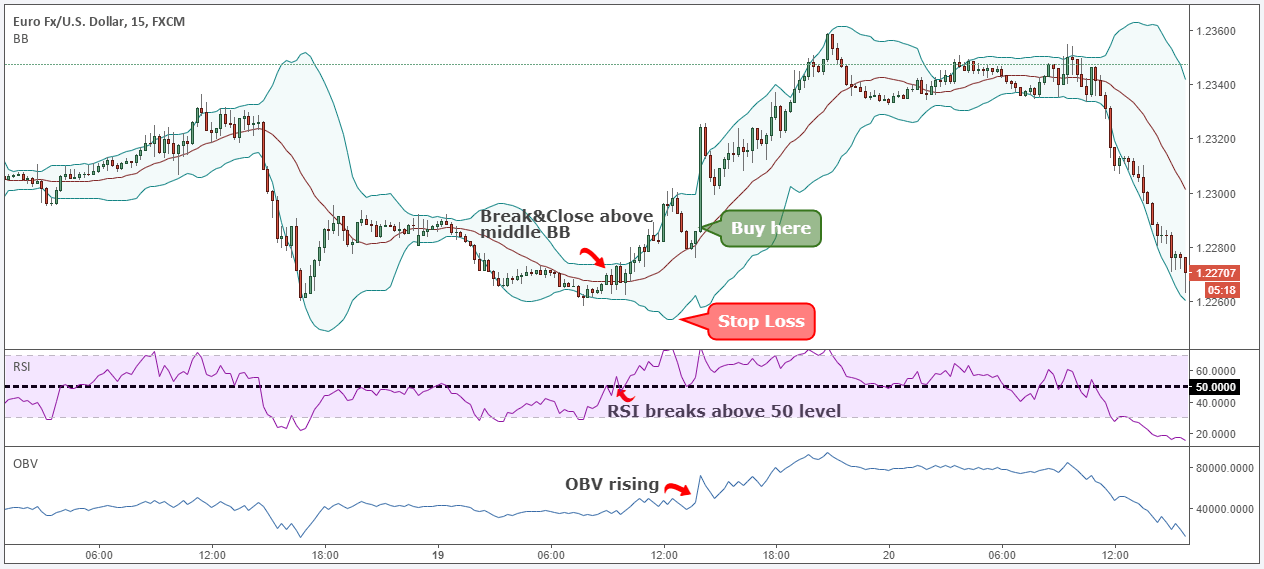

The next important thing we need to set up for our scalping strategy is where to place our protective stop loss.

See below …

Step #4: Hide your protective stop loss below the lower Bollinger Bands

Knowing where to place your protective stop loss is just as important as knowing when to enter the market.

The logical place to hide your protective stop loss is below the lower Bollinger band. A break below the lower BB will invalidate our trade idea and we want to minimize our losses.

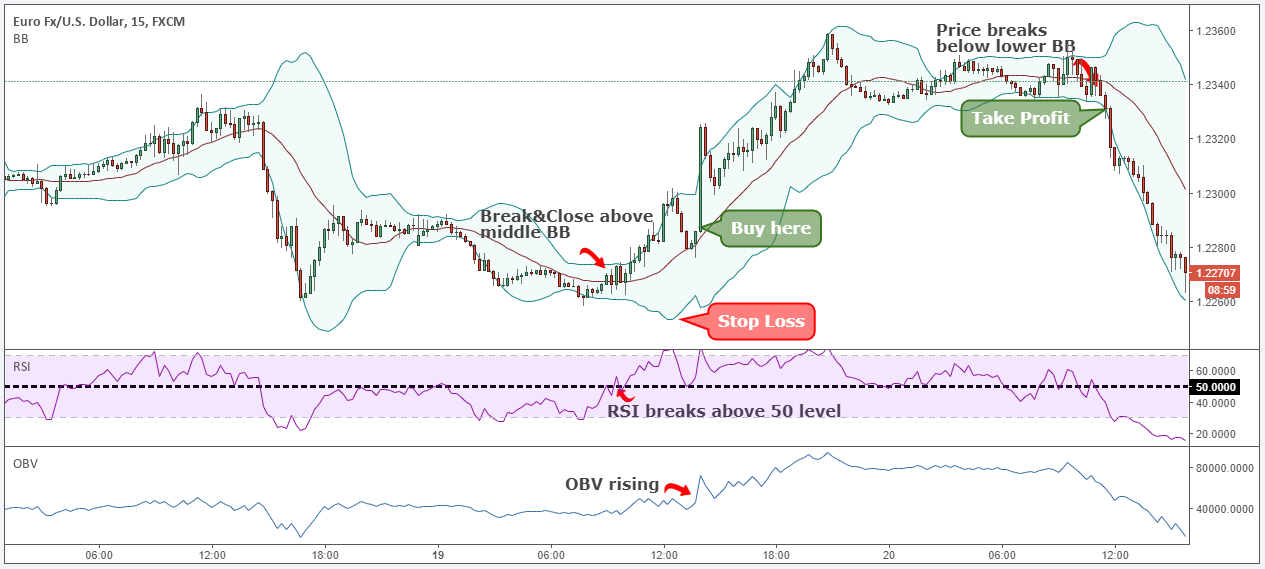

Last but not least, we also need to determine the take profit level for the multi-index strategy which brings us to the last step.

See below …

Step #5: Take profit when price breaks below lower BB

Our take profit strategy only looks at one indicator to signal us a possible exit area. If we wait for confirmation from multiple indicators then we may also return some of our profits.

In this regard, the best way to take profits is when we see a price reversal. A break below the lower Bollinger Bands is a good signal for a possible reversal, so we want to withdraw our profits.

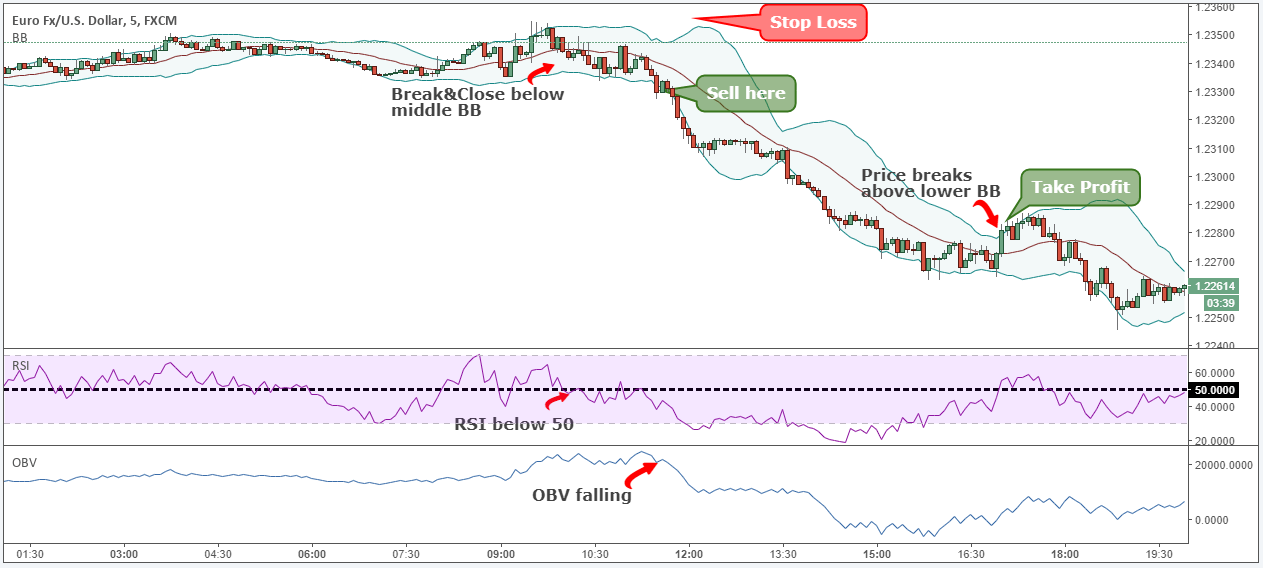

Note ** above is an example of a BUY trade using multiple technical indicators. Use the same rules for SELL trades – but in reverse. In the image below you can see an example of an actual SALE transaction.

Conclusion

You have to take the necessary time and learn what each technical indicator means. No stat gives you a 100% win rate, so don’t be a fairy chaser. In the $6 trillion Forex market, no one can predict the market with exact certainty. Here’s how to apply technical analysis step by step.

However, if you follow our best combination of technical indicatorsyou can improve your chances of winning more often than losing trades in the market. You must remember that all indicators are based on past prices so only one multi-indicator strategy can help you predict the future.