In this tutorial, you will learn how to place a trade using the ascending triangle pattern . This is a breakout trading strategy with the advantage of highlighting previous breakouts. All you need to do is learn the right trading technique and you will be able to recognize in real time the anatomy of trading breakouts.

The cool thing about this chart template is that it can be used on the 5-minute chart, the 1-hour chart or any of our favorite timeframes. No matter what your trading style is, whether it’s expansion trading, day trading or swing trading . It is the theory behind the supply-demand imbalance that makes the price chart pattern work.

Let’s dive into it!

Let’s understand how it formed and how we can trade the ascending triangle formation.

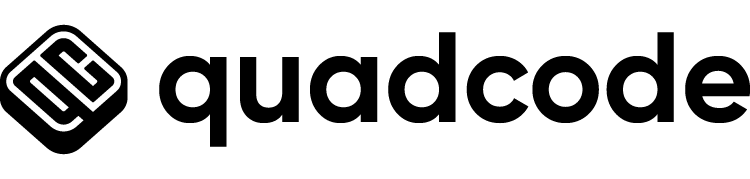

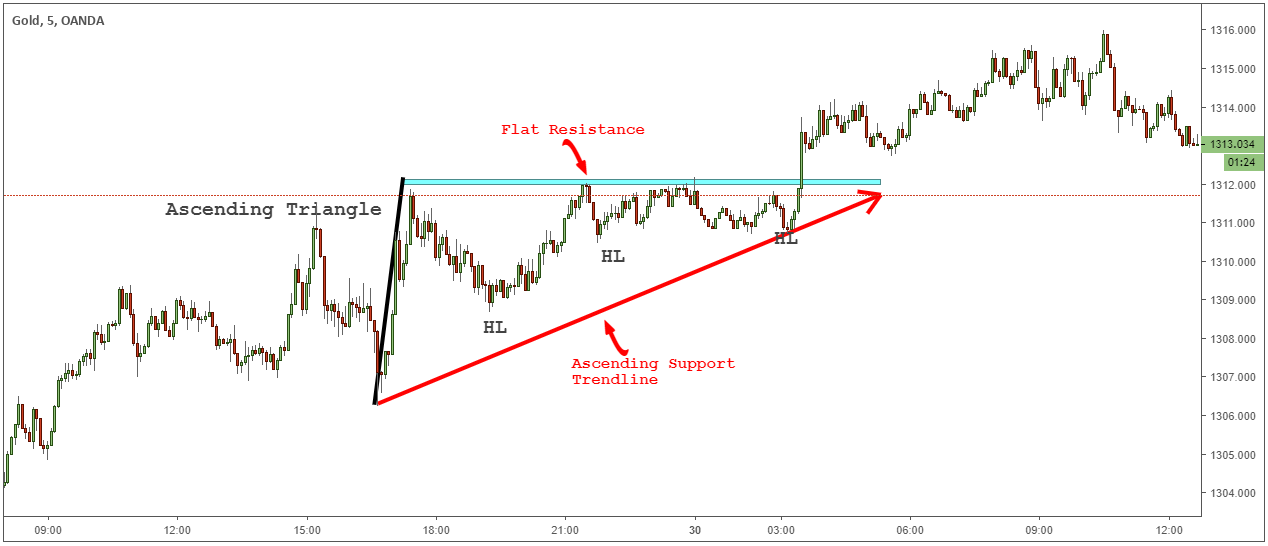

See below:

Ascending triangle pattern

The Ascending Triangle Formation is a continuation pattern and as the name suggests it has the shape of a triangle. The ascending triangle is also known as the ascending triangle because it leads to an upside breakout.

The triangle chart pattern is often considered a bullish pattern.

Note*: the reverse side of the ascending triangle is the descending triangle also known as the descending triangle.

What does the ascending triangle look like:

The first element of this price pattern is an upward slope followed by a flat top.

This shows that the market tried many times to break the resistance but failed. Therefore, we have developed a line of resistance.

The second element of the ascending triangle is a slope or trendline moving upwards. This is what makes the pattern bullish.

See chart below:

Remember that all continuation patterns such as bullish flags, rectangle patterns and many more patterns that you can find through our Trading Strategy Guide website, need to have the context of a trend. direction.

In the case of a bullish bullish triangle, we need to have a previous uptrend to support the breakout. The easiest way to remember it is:

- Ascending triangle develops in an uptrend.

- An ascending triangle develops in a downtrend.

Now that we’ve learned how an ascending formation looks like we want to share with you two things we’ve learned from trading the ascending triangle.

The first little trick we learned is that on price charts, triangles will rarely be in perfect shape.

Usually, you will see an ascending wedge that will break resistance but there is no real momentum behind the breakout. Other times, the pattern will develop spiked bars that will lead to false breakouts.

What you need to do is wait for the triangle to break out and close above our resistance line. Only then start buying on the next candle opening.

If you try to buy every swing high, you might get stuck in a whip when you trade this pattern

Next, we will move on to a simple breakout trading strategy that will teach you how to identify and trade the ascending triangle formation .

Ascending triangle chart

Now let’s go over some things that will make the triangle pattern easier to understand.

You really need to think about what’s going on behind the scenes. We don’t just want to look at prices, but also look at what market participants are doing.

When the price is moving up, it starts to develop a higher classic low. For whatever reason, buyers can become a little more aggressive with each successive new low. Or, we can say that sellers are not too aggressive when the market turns down inside an ascending triangle chart pattern.

Either side of the coin, that is what causes the triangle price formation to develop.

When we reach the highest point of the triangle where the price has nowhere to go, that’s when we should anticipate a breakout.

Once the triangle breakout occurs, we need to see an increase in volume that will lead to a nice long trade.

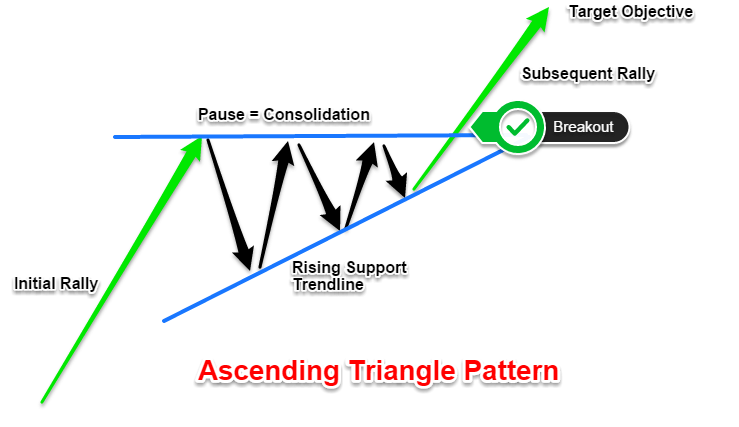

The position of the pattern is also important!

If the triangle pattern is in a large trading range, then solid resistance could be insignificant. However, if an ascending triangle price formation develops in the middle of an uptrend, that will add weight to the pattern.

When the ascending triangle develops in the direction of the trend then we will be interested in buying the breakout.

Ascending triangle trading strategy

The ascending triangle trading strategy is an easy method to capture breakouts inside a trend. To confirm the breakout, we will use the RSI tool which is a momentum-based indicator.

Since price often contracts inside an ascending triangle, at one point the bulls or bears must win. With the RSI in our trading arsenal, we can determine in advance who will win this battle.

How it works?

Let’s do it step by step:

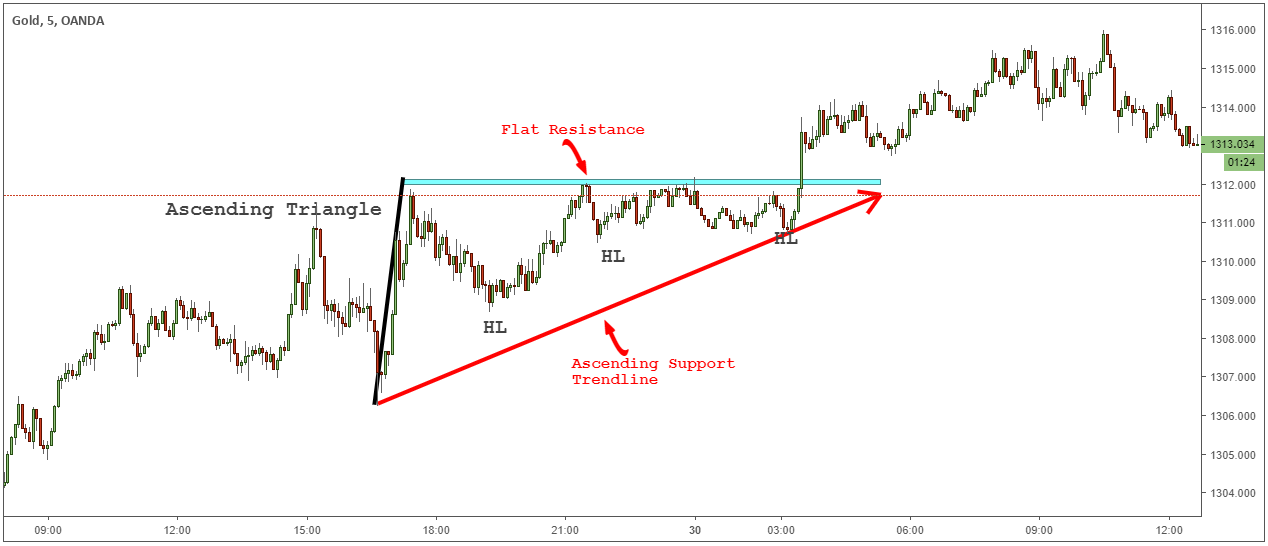

Step #1: The Ascending Triangle must have flat resistance and a rising Support Trend Line

The two elements of a good ascending triangle pattern are:

- A flat resistance that it hits many times. The more resistance lines are tested, the more likely it is that resistance will eventually fail to hold.

- The second element is an ascending support trendline that connects consecutive higher lows inside an ascending triangle formation.

See the ascending triangle chart below:

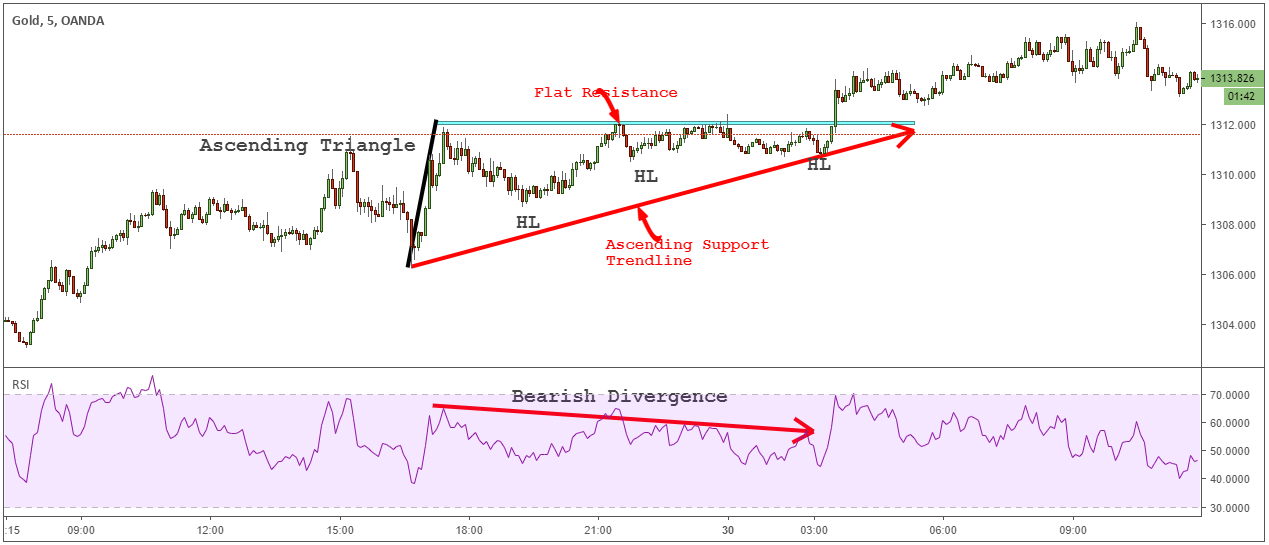

Next, we will use technical indicator RSI .

See below:

Step #2: Apply 20 period RSI on your Chart

Usually, price action consolidates inside an ascending triangle formation. This means that there is an ongoing battle between the bulls and the bears. Judging who will win this battle can be done by looking at the RSI indicators.

Before the breakout arrives, we can look at the action inside the consolidation to decide if it’s worth taking the breakout or it’s better to just wait for another trade.

What we want to see is momentum decreasing after each successive retracement of flat resistance. Basically, we would like to see a bearish divergence developing on the RSI.

See the ascending triangle chart below:

Now, before buying breakout we need to check one more thing.

See below:

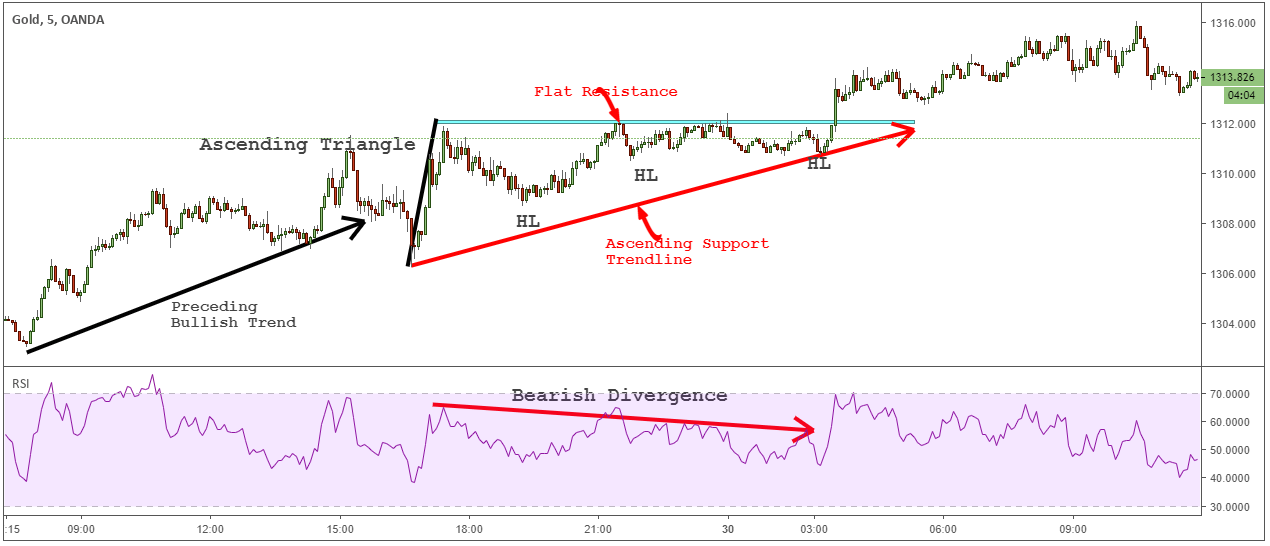

Step #3: Preview Ascending Triangle, Do We Have an Uptrend

As a continuation pattern, we naturally need a pre-trend. In the case of the ascending triangle, which is a bullish pattern, we need to have a prior uptrend.

If we have a previous uptrend, it shows that a breakout has a higher probability.

See the ascending triangle chart below:

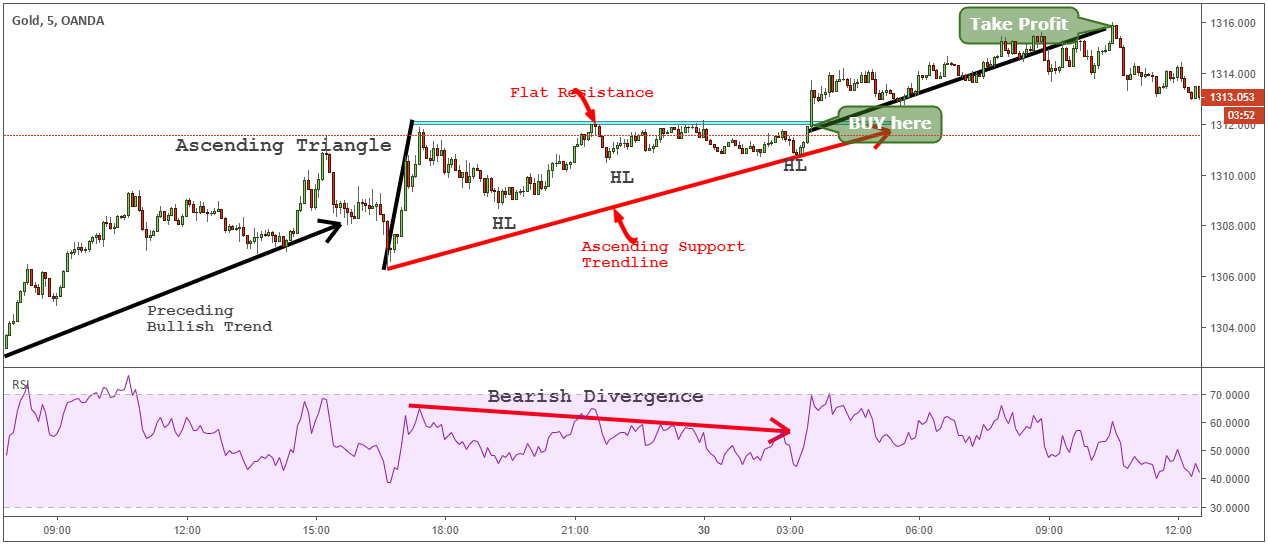

The final step is to define our entry trigger point and measure our profit targets.

See below:

Step #4: Buy as soon as we cross flat resistance

With continued patterns, best strategy is to buy immediately with breakout. If we wait too long, we will eventually leave some profit available on the table.

We already have so many confluences to confirm the breakout that we can’t wait for more confirmation. After all, we want to predict the breakout and stay ahead of the crowd.

For the take profit strategy, we will use our favorite measurement technique. This is a dynamic strategy based on actual prices rather than a random number.

To find a profit target, simply take the high and low of the ascending triangle formation and add that measurement to the breakout level. This will give you the ideal target for this continuation pattern.

Conclusion – Ascending triangle formation

The Ascending Triangle Formation is a very powerful chart pattern that exploits the imbalance of supply and demand in the market. You can time your trade with this simple template and go with the trend if you miss the start of the trend.

Many technical analysts trade breakouts without first taking the time to understand what goes on behind the scenes. With the ascending triangle, we can get off to a perfect start and see the trading opportunity before it happens. So being able to recognize an ascending triangle pattern can be a valuable tool that you can use to identify profitable trades.