Forex trading is a huge market. Billions are traded in forex daily. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a very profitable forex trading strategy or system complicated. So learn the fundamentals before choosing the best path for you .

With this introduction, you will learn general forex trading tips and strategies that apply to online currency and forex trading. It will also highlight potential pitfalls and useful metrics to make sure you know the truth. Finally, use the trusted brokers list to compare the best forex platforms for day trading in Vietnam 2024.

Read on to discover AZ on forex, how to start trading, and how to evaluate the best platforms

Why Trade Forex?

The forex currency market offers day traders the ability to speculate on movements in the forex market and specific economies or regions. Furthermore, with no central market, forex offers trading opportunities around the clock.

- Liquidity – In the forex market there is an average volume of more than $3.2 trillion traded every day. So there are a lot of trades and moves you can make.

- Diversity – First, you have pairs that come from eight major global currencies. On top of that, many regional currency pairs are also available for trading. More options, more opportunities to make a profit.

- Accessibility – The forex market is easily accessible, open twenty-four hours a day, five days a week. As a result, you decide when to trade and how to trade.

- Leverage – A significant number of forex pairs are traded on margin. This is because leverage can be used to help you buy and sell large amounts of currencies. The larger the number, the greater the potential profit – or loss.

- Low Commissions – Forex offers relatively low costs and fees compared to other markets. In fact, some companies don’t charge any commission at all, you just pay the bid/ask spread. True ECN companies can also offer 0 spreads!

Currencies traded in Forex

Main

In the world of international day forex trading, the vast majority of people focus on the seven most liquid currency pairs on earth, first of all the four ‘specialties’:

- EUR / USD (euro / dollar)

- USD / JPY (dollar / Japanese Yen)

- GBP / USD (British Pound / Dollar)

- USD / CHF (dollar / Swiss franc)

In addition, there are three emerging pairs:

- AUD / USD (Australian dollar / dollar)

- USD / CAD (Canadian Dollar / Dollar)

- New Zealand / USD (New Zealand Dollar / Dollar)

These currency pairs, in addition to a host of other combinations, account for more than 95% of all speculative trading in the forex market, as well as retail forex.

However, you will likely notice the US dollar prevailing in major currency pairs. This is because it is the world’s leading reserve currency, playing a part in about 88% of currency transactions.

Supporting actor

If a currency pair does not include the US dollar, it is called a ‘minor currency pair’ or ‘cross currency pair’. As a result, the most commonly traded minor currency pairs include the British Pound, Euro or Japanese Yen, such as:

- EUR / GBP (euro / British pound)

- EUR / AUD (euro / Australian dollar)

- GBP / JPY (British Pound / Japanese Yen)

- CHF / JPY (Swiss franc / Japanese Yen)

You can also dive into trading exotic currencies like Thai Baht and Norwegian or Swedish krone. However, these exotic extras carry a greater degree of risk and volatility.

Finding the Best Forex Broker

The best forex brokers out there are often a matter of personal preference. It can come down to the pairs you need to trade, the platform, trade using the spot or per-point market, or require simple ease of use.

Below is a list of comparison factors, some of which will be more important to you than others but all worth considering when trading online. Details of all these factors for each brand can be found in the individual reviews.

Lowest transaction costs

Margins, commissions, swaps – everything that reduces your profit on a single trade needs to be considered. High frequency trading means these costs can add up quickly, so comparing fees should be a huge part of your choice of broker. Inactivity or withdrawal fees are also noticeable as they can be another drain on your balance.

Exchanges

The trading platform needs to be right for you. Whether you want a simple cut-down interface, or lots of built-in features, widgets and tools – your best options may not be the same as others. Learn more about forex trading platforms online here .

Demo accounts are a great way to try out multiple platforms and see which works best for you. Also, keep in mind that multiple platforms are configurable, so you’re not stuck with the default view.

Mobile trading

Forex trading on the go will be important for some people, less so for others. Most brands offer a mobile app, usually compatible on iOS, Android, and Windows.

If this is the key for you, then check out the app is the full version of the website and don’t miss any important features. Downloading these apps is usually quick and easy – brokers want you to trade. Read more about forex trading apps here .

Customer service

Is customer service available in your preferred language? Is there live chat, email and phone support? When are they available? How high this priority is, only you can tell, but it’s worth checking.

Property List

Does the broker offer the market or currency pairs you want to trade? A pretty basic check, this one. If you are trading major pairs, then all the brokers will cater for you. If you want to trade Thai Bahts or Swedish Krone, you will need to double-check the list of assets and tradable currencies.

Regulations

Do you want a broker regulated by a specific authority – FCA, SEC or ASIC perhaps? Keep in mind European regulation may affect some of your leverage options, so this may affect your peace of mind more. We include more detailed regulations below.

Margin or commission

Part of that is covered in transaction costs, but spreads are often a factor of comparison on their own.

This is because you are not tied to a broker. If you trade 3 or 4 different currency pairs and no broker has the highest spreads for all of them, then shop around. There is nothing wrong with having multiple accounts to take advantage of the best spreads on each trade. Beware of more widespread ‘hidden’ slippage too often.

Payment methods

Deposit method options at a certain forex broker may interest you. Do you want to use Paypal, Skrill or Neteller? Would you be satisfied using a credit or debit card knowing this is where withdrawals will also be paid?

Some forex brokers now accept deposits in Bitcoin or a range of other cryptocurrencies.

Protect

Most brands will follow regulatory requirements to separate customer and company funds and provide certain levels of user data security.

Some brands can give you more confidence than others, and this is often linked to the governing body or where the brand is licensed. Forex trading can attract unregulated operators. Security is a worthy consideration.

Demo account

Try before you buy. Most reliable brokers are willing to show you their platform risk free. Trading on a demo account or a simulator is a great way to test a strategy, backtest or learn the nuances of the platform. Try as many as you want before making a choice – and remember having multiple accounts is good (even recommended).

Types of Accounts

From cash, margin or PAMM accounts, to Bronze, Silver, Gold and VIP levels, account types can vary. The difference can be reflected in different costs, spread reduction, Tier II data access, payouts or leverage. Micro accounts may offer lower transaction size limits, for example.

For example, forex and professional accounts will be treated very differently by both brokers and regulators. The ECN account will give you direct access to the forex contract market. So research what you need, and what you’re getting.

Use

For European forex traders, this can have a big impact. Forex leverage is capped at 1:30 by the majority of regulated brokers in Europe. Assets like Gold, Oil or stocks are capped separately.

However, in Australia traders can use 1:500 leverage. That makes a huge difference to deposit and margin requirements. Australian brands are open to traders from around the world, so some users will have the choice between regulatory protection or more freedom to trade at will.

Just be aware that higher leverage increases potential loss, just like potential profit.

Tool or feature

From charts to futures prices or bespoke trading robots, brokers offer a wide range of tools to enhance the trading experience. Again, the availability of these as a deciding factor in account opening will be up to the individual. Tier 2 data is one such tool, where preference can be given to a brand that offers it.

Education

Forex trading beginners in particular, may be interested in tutorials offered by a brand. These can be in the form of eBooks, pdf documents, webinars, expert advisor(e), courses or full academy programs – regardless of the source, it’s worth assessing the quality before open an account. Remember that forex companies want you to trade, so it is advisable to trade regularly.

MetaTrader 4 or 5

Integration with popular software packages like Metatrader 4 or 5 (MT4 or MT5) can be very important for some traders. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to be sure.

Give ice cream

From cashback, to no deposit bonuses, free trades or deposit matches, brokers are used to offering a multitude of promotions. Regulatory pressure has changed all that. Bonuses now are few and far between. Our directory will list them where they are offered, but they should rarely be the deciding factor in your choice of forex trading. Also, always check the terms and conditions and make sure they won’t cause you to over-trade.

Execution speed

Desktop platforms will often provide excellent execution speeds for transactions. But the mobile app may not. While this won’t always be the fault of the broker or the app, it’s worth experimenting with.

Cheat

Our reviews have filtered out scams, but if you’re considering another brand, avoid getting caught with these checks;

- Are you ‘cold called’? Reputable companies won’t call you out of the blue (This includes email, or facebook or Instagram channels)

- Are they offering unrealistic returns? Just stop and consider for a minute – if they can get the money they’re asking for, why are they cold calling or advertising on social media?

- Do they offer to trade on your behalf or use their own automated or managed trades? Don’t let anyone else control your money.

If you have any doubts, just move. There are many legitimate, legit brokers out there.

With all the comparison factors mentioned in our reviews, you can now list your top forex brokers, try the demo account one by one and choose one. best account for you. We’ve rated the brokers based on our own opinions and given a rating in our tables, but only you can award ‘5 stars’ to your favorites!

Read who won DayTrading.com ‘Best Forex Broker 2024’ on the Awards page.

Forex Regulations

Regulation should be considered important. Whether the regulator is inside or outside, Europe will have serious consequences for your trading. The ESMA (European Securities and Markets Authority) has imposed strict rules on regulated forex companies in Europe. This includes the following regulators:

- CySec (Cyprus Securities and Exchange Commission)

- FCA (Financial Conduct Authority)

- BaFin – (Bundesanstalt für Finanzdienstleistungsaufsicht)

- Swiss Financial Market Supervisory Authority (Switzerland)

ESMA has jurisdiction over all regulatory bodies in the EEA

The rules include limits or limits on leverage and changes to financial products. Forex leverage is limited to 1:30 (Or x30). Outside of Europe, leverage can reach 1:500 (x500).

Traders in Europe can apply for professional status. This removes their regulatory protection and allows brokers to offer higher leverage (among other things).

Outside of Europe, the largest regulatory bodies are:

- SEC – United States Securities and Exchange Commission (US)

- CFTC – Commodity Futures Trading Commission (USA)

- CSA – Canadian Securities Administration

- ASIC – Australian Securities and Investments Commission

These include the majority of countries outside of Europe. Forex brokers that cater to India, Hong Kong, Qatar, etc. may be regulated in one of the above, instead of every country they support. Some brands are regulated globally (one is even regulated in 5 continents). Some licensing bodies, and others have registrations of legal firms.

So, to reiterate, an ASIC forex broker can offer higher leverage to a trader in Europe.

What currencies should you trade?

Investors should stick to the major and minor pairs from the very beginning. This is because it will be easier to find trades, and the spreads are lower, making scalability possible.

Exotic pairs, however, have more liquidity and higher spreads. In fact, since they are riskier, you can make serious money with exotic pairs, just be prepared to lose big in a single session.

See live forex rates here .

How is Forex traded?

The logistics of forex trading are almost identical to every other market. However, there is an important difference worth highlighting. When you trade forex on a daily basis, you are buying one currency and selling another at the same time. Hence, that is why currencies are marketed in pairs. So the exchange rate you see from your forex trading account represents the purchase price between the two currencies.

For example, the rate you find for GBP/USD represents the number of US dollars that one British pound would buy you. So if you have reason to believe that the British pound will increase in value against the US dollar, you will look to buy the pound in US dollars. However, if the exchange rate rises, you will sell your money back and make a profit. Same goes for Euros, Yen, etc.

Contract

There are several types of forex contracts:

- Spot forex contract

Conventional contract. Delivery and settlement are instant. - Forex futures contract

Delivery and settlement take place at a future date. Prices are negotiated directly, but the actual exchange is in the future. - Currency Swap

Where two parties can ‘exchange’ currencies, usually in the form of a loan or loan payment in different currencies. - Forex Contract Options

An option gives a trader the option (but not the obligation) to exchange currency at a certain price at a future date.

Forex Orders

There is a wide range of forex orders. Some popular, others less so. Using the correct one can be very important.

The two main types of forex orders are:

1. Instant order or market order

2. Orders are pending

Instant Orders / Market Orders

They are executed immediately at market prices.

A Buy is an indication to ‘go long’ or profit from a bull market. A Sell means opening a short position with an expectation of falling values.

Issuance of orders

A Stop loss is a preset level where the trader wants the trade to close (stop out) if the price moves against them. It is an important risk management tool. It instructs the broker to close the trade at that level. A guaranteed stop means the company guarantees to close the trade at the requested price.

An unwarranted stop loss can ‘slip’ in volatile market conditions and the trade closes, near, but not at the stop. The shock of the Swiss Franc (CHF) as “uncropped” is one such event.

A Trailing Stop requires the broker to move the stop loss along with the actual price – but only in one direction. So, a long position will move the stop in a rising market, but it will stay in place if the price falls. It allows traders to reduce potential losses in good times and ‘lock in profits’, while keeping the net safe.

A take profit or Limit order is the point at which the trader wants the trade to close, profit. It is a good tool for discipline (closed trades according to plan) and is key to certain strategies. It is also very useful for traders who cannot track and monitor trades all the time.

Another cancellation

Another Cancellation Order (OCO) is a combination of a Stop and Limit order, but if one is triggered, the other will be deleted or cancelled. This is an important strategic trade type.

Electronic money

Top cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP) are often traded as a currency pair against the US dollar. They can be traded just like other FX pairs. Their exchange value relative to each other is also sometimes offered, for example BTC/ETH or ETH/LTC etc.

Chart

Charts will play an essential role in your technical analysis. So you will need to find a timeframe that allows you to easily identify opportunities. In fact, the chart on the right will paint a picture of where the price could head. For example, intraday forex trading with intraday candlestick patterns is particularly popular.

See our chart page for more instructions.

Strategy

Any effective forex strategy needs to focus on two key factors, liquidity and volatility. These are two of the best indicators for any forex trader, but the short-term trader is especially dependent on them.

Forex day trading is very specific. While your average long-term futures trader can afford to hedging 12 pips (the smallest price movement is usually 1%) here and cutting 12 there, a Translation is simply not possible. This is because those 12 pips could be the full expected profit on the trade.

Accuracy in forex comes from traders, but liquidity is also important. Liquidity will mean that the order will not close at the ideal price, no matter how good a trader you are. As a result, this limits day traders to specific instruments and trading times.

Volatility is the size of market movements. So, solid volatility for a trader will reduce the selection of instruments for currency pairs, depending on the sessions. Since volatility is session dependent, it also brings us to an important component outlined below – when to trade.

When trading

While it is possible to trade 24 hours a day, 5 days a week, you should not (forex trading is not quite 24.7). You should only trade a forex pair when it works and when you have enough volume. Forex trading on weekends will see small volume. Taking GBP/USD as an example, there are specific hours when you have enough volatility to make a profit potentially negating the bid spread and commission costs.

The forex market exists 24 hours a day because there is always a global market open somewhere, due to different time zones. Not all markets actively trade all currencies, though. Therefore, different forex pairs are actively traded at different times of the day.

For example, when the UK and Europe are open, pairs including the euro and the pound sterling are good for trading. However, when New York (USA and Canada) is at the desk, pairs involving the US dollar and the Canadian dollar are actively traded.

So if you trade EUR/USD pairs, you will find the most trading activity when New York and London are open, or Tokyo for JPY and Sydney for AUD.

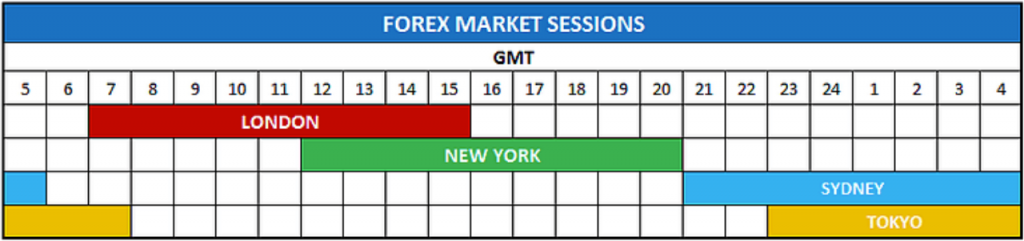

Use the daily forex chart to see key market hours in your own time zone. The image below highlights the market opening hours (and closing session times) for London, New York, Sydney and Tokyo. Crosses represent sessions with most activity, volume, and price action.

Forex trading session

Each session has a unique ‘feel’:

- Asian Session: Made up of Asian markets, opening in New Zealand and Australia and moving west. This session produces lower volume and smaller range. JPY, NZD and AUD are popular markets and news events can move prices significantly.

- The London (European Session): Really begins in Frankfurt and London an hour later. The UK opening sees more volume in the Forex market, plus volatility will peak this session. European institutions, banks and account managers will be active and macroeconomic data will be released.

- Session in New York (USA): This program opens at 9:30 a.m. New York time, but basic US data may be released at 8:30 a.m. This could build up the volume early before the ‘official’ 9:30 opening.

The “crossover” of London and New York shows the highest volatility and liquidity. Key underlying data is published, financial institutions enable forex contracts and related ‘smart money’.

Trading Alerts or Signals

The message or signal Forex is sent in a different way. User generated notifications can be made to ‘pop up’ through simple broker trading platform tools or more sophisticated 3rd party signal providers can send notifications to traders via SMS, email or direct message. Whatever the mechanism, the goal is the same, to trigger a transaction as soon as certain criteria are met.

These criteria are usually based on chart patterns and/or candlesticks. Our charts and samples pages cover these topics in more detail and are a great starting point. Paying for signal services, without understanding the technical analysis that drives them, is risky.

It is impossible to rate a service, if you do not understand it.

Traders who understand indicators like the Bollinger Bands or MACD will be more likely to set their own alerts.

But for times of poverty, a paid service can work out. Of course, you will need enough time to actually place the deals, and you need to be confident in the provider.

It is unlikely that someone with a profitable signal strategy is willing to share it cheaply (or at all). Beware of any promises that seem too good to be true. You can read more about automatic forex trading here .

50 Pips a day

If you download the pdf with forex trading strategies, this will probably be one of the first you see. Beginners can also benefit from this simple yet powerful technique as it is not an advanced trading strategy. Before venturing into any exotic pairs, however, it’s worth putting it through its paces with major pairs.

So, when the 07:00 (GMT) candle closes, you need to place two contrast pending orders. First, place a buy stop order 2 pips above the high. Then place a sell stop order 2 pips below the low of the candle. As soon as the price activates one of the orders, cancel the unactivated order.

Also, make sure you place your stop loss anywhere between 5-10 pips above the 07:00 high/low. This will help you control your trading risk. Now set your profit target at 50 pips. At this point, you can go back and relax while the market works.

If the trade hits or exceeds the profit target at the end of the day then all is planned and you can repeat the next day. However, if a losing trade is floating, wait until the end of the day before exiting the trade.

But for a more detailed example, see our strategy page on day trading techniques.

Forex trading software

There is a large selection of software for forex traders. Cost and benefits will be the main considerations, and we review a few software platforms in detail on this site:

MetaTrader 4

AlgoTrader

Transaction

NinjaTrader

These platforms cater to Mac or Windows users and even have Linux-specific apps.

Social trading platforms (or ‘Copy trading’) are another type of software related to forex trading. The leading pioneers of that kind of service are:

eToro

ZuluTrade

We expand the options for our site trading platform software and on our Software page.

Education

If you want to increase that forex trading salary, you will also need to use a range of educational resources:

- Books – You can get profitable strategy books, books on scalping, regulation, price action, technical indicators, etc. In addition, there are many niche books. So you can find the best books on strategies for beginners or two-step trend analysis for example.

- Chat Rooms & Forums – Forumslive forex day trading is a great way to learn from experienced traders. Some will even share their best free trading system. Just be careful with the quality of the advice.

- Blog – If you want to hear success stories from forex millionaires, then day trading forex blog might be the place to go. Again, tread carefully with any advice provided.

- Forex Sites – There are several specific forex websites. Some offer free, technical signals to spot trend lines and establish your foundation.

- PDF – Online you will find several forex trading system PDF files. Unlike live chat rooms, charts will often be provided to support written evidence.

Advice

Money management

The most profitable forex strategy will require an effective money management system. One technique that many people recommend is to never trade more than 1-2% of your account on a single trade. So if you have $10,000 in your account, you wouldn’t risk more than $100 to $200 on an individual trade. Therefore, a temporary string of bad results will not be able to blow all your capital.

Then, once you have developed a consistent strategy, you can increase your risk parameters. The Kelly Criterion is a specific bet scheme worth researching.

Automation

Automated Forex trading can enhance your profits if you have developed a consistently effective strategy. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once predefined criteria have been met. Also, there is usually no minimum account balance required to set up an automated system.

However, those who are looking to start trading from home should probably wait until they have completed an effective strategy first.

For further instructions, see our auto trading page .

Tax

When you read a blog about forex traders such as “a day in the life”, they often overlook the impact of taxes. In fact, it is important that you check the rules and regulations where you are trading. Failure to do so may lead to legal problems.

See our tax page for details.

Webinars & Training Videos

They are the perfect place to ask for help from experienced traders. This is because forex webinars can walk you through setups, price action analysis, plus the best signals and charts for your strategy. In fact, in many ways, webinars are the best place to find live instruction on the basics of currency trading.

3 mistakes to avoid

1. Average down

While you may not initially intend to do so, many traders end up falling into this trap. The biggest problem is that you are holding a losing position, sacrificing both money and time. While it may turn off a few times, it will eventually lead to a margin call, as a trend can sustain itself longer than you can stay liquid.

This is especially a problem for day traders as the limited time frame means you have to take advantage of opportunities as they come in and get out of bad trades quickly.

2. Trading too soon after the news

Big news comes and then the market starts to skyrocket or plummet. At this point it can be tempting to jump on board the easy money train, however, doing so without a disciplined trading plan behind you can be as harmful as gambling before the news comes out. This is because illiquidity and strong price volatility mean that a trade can quickly turn into significant losses when a big swing takes place or the ‘whip’.

Solution – wait for the volatility to subside and you can verify the trend.

3. Date of interest

It’s great to have an effective once-a-day trading strategy and system. However, even a consistent strategy can go wrong in the face of unusual volume and volatility seen on specific days. For example, holidays like Christmas and New Year, or days with breaking news events, can open you up to unpredictable price movements.

Nation

The country or region in which you trade forex can present certain problems. For example, forex traders in the United States and Canada will need to read the rules of sample trading (Canada traders have it a bit easier).

Trading in South Africa is probably safest with an FSA-regulated (or registered) trademark. Regions classified as ‘unregulated’ by European brokers will see less ‘default’ protection. So a local regulator can provide extra confidence. This is similar in Singapore, Philippines or Hong Kong. Therefore, the choice of ‘best forex broker’ will vary from region to region.

Forex trading in less regulated countries, such as Nigeria and Pakistan, means leaning more towards regulated brands than in Europe or Australia.

Forex trading; Is there a profit?

Many people question what is the salary of a trader. However, the truth is that it is very different. The majority of people will struggle to make a profit and eventually give up. On the other hand, a small minority not only proves that it can be profitable, but you can also make huge profits. So it is possible to make money trading forex, but there are no guarantees. 75-80% of retail traders lose money.

Bottom line

Currency is a larger and more liquid market than the US stock and bond markets combined. In fact, the abundance of opportunities and financial leverage make it attractive to anyone looking to make day trading forex.

Unfortunately, there is no single best strategy for forex trading. However, trade at the right time and keep volatility and liquidity at the forefront of your decision making. Follow these general rules for FX day trading and you’ll be on the right track.