These spread strategy options will help you to overcome your risk limit and overcome your fear of losing. This practical guide will share a powerful Box spread options strategy example . We cover the basics of the bull call spread options strategy to help you hedge your risk and improve your profit margin.

If this is your first time on our site, our team at Trading Strategy Guide welcomes you. Make sure you hit the subscribe button so you get Free Trading Strategies every week straight to your email.

With spread trading options, it is important to understand the math behind it. The biggest AHA! The point in your options trading career will be when you understand how spread options work. The option spread of trading strategies presents a great opportunity to improve your profits. Start by reading our options spread strategies PDF.

Unlock options trading on the Robinhood App and start buying cheaper, free spread options: The Robinhood App Trading Guide (Everything You Need to Know) . This is one of the easiest places to start trading free options.

We will break down the introduction to options arbitrage and will describe how to become a successful options trader.

Table of contents

1 What is the spread option? How do spread options work?

1.1 What is a call spread option strategy?

2 Optional spread type:

2.1 1. Vertical Option Strategy

2.2 2. Spread Option Strategy

2.3 3. Cross spread option strategy

Spread Option Strategy 3 CallsBull Call

3.1 Profit of Bull call spread option = Strike price – Maximum risk

Example of a spread option strategy 4 box (Long Box)

4.1 Example of box spread

5 When to use the butterfly spread option strategy?

5.1 Last word – Spread strategy option

What is an option spread? How do spread options work?

Spread options trading is the act of simultaneously buying and selling the same option. There are two types of options: Call Options and Set Options . The call option gives you the right to buy in the future. Placing an option gives you the right to sell in the future. For example, if you buy a call option on Amazon stock and simultaneously sell another call option on Amazon stock, you have opened a spread trading position.

Usually, spreads include at least a two-legged order or a multi-leg option order like the butterfly spread option strategy.

Spread options can be confusing, but they are easy to understand if you have a complete options trading guide, which can be found here: Call vs Put Options – Introduction to rights trading select .

The difference in the expiration date or strike price between the two options is called the spread.

Keys to bring when building a spread:

- Combinations of options based on the same underlying asset. For example, if you buy calls for Apple stock, you also sell calls for the same Apple stock.

- You must buy and sell the same type of option. For example, if you buy a Call option, you sell another Call option

- You can use multiple combinations of expiration dates and/or strike prices.

Now let’s see what are the simplest combinations of options to create a spread:

What is a call spread option strategy?

A call spread is an options strategy used when you believe the underlying asset’s price will rise. A call spread strategy involves buying a call option with money and selling an out of pocket call option (higher strike price). Both options have the same expiration date.

Call spread is also known as bull call spread strategy. Enter this strategy when the market looks to be bullish.

The spread options will make you profitable in any kind of market conditions. You can deal with uptrends and downtrends.

For the bearish trend, we use the bear call spread trading strategy. Use this strategy when it appears the price is likely to go down. Bear call spread is an options strategy that involves buying call options with money and selling an out of money call option (lower strike price). Both options have the same expiration date.

Bear call spread trading strategy is also known as short call spread.

But what about when we get stuck in a range-bound market?

Spread options are the most versatile financial instruments. With the properoptions trading strategy , your investment portfolio can become significantly more diversified and dynamic. You have endless strike prices and expiration dates available so you can build a complex calendar spread options strategy. Therefore, the options spread can be adjusted based on current market conditions, including sideways trading.

The spread option is a double-edged sword. On the one hand, you limit the risk, but on the other hand, the potential profit is also limited. Spread options will always create a limited price range for profit.

More information on the types of spreads is presented below:

Optional spreads:

In this segment, we’ll outline how many option types span and help you better understand these concepts. Spread options can be classified into three main categories:

- Vertical spread options trading strategy.

- Horizontal options strategy.

- Cross spread options strategy.

1. Vertical Option Strategy

Vertical Vertical is built using simple spread options. A vertical spread is an options strategy that requires the following:

- Buy and sell options of the same type (Calls or Puts).

- Same expiration date.

- Same underlying property.

- But, strike prices vary.

On the option chain, these locations appear stacked vertically, hence the vertical name.

We can distinguish four types of vertical options strategies:

- Bull call spread option strategy

- Bear Call Spread Options Strategy

- Bull Put’s Spread Option Strategy

- Put . Bear Selection Strategy

We will discuss bull call propagation since all others are based on the same technique and functionality. We can also go a step further and classify the spread on the capital basis (debt spread or credit spread) involved:

- The debit spread option strategy occurs when you incur an upfront cost from purchasing the option.

- The credit spread options trading strategy occurs when you get prepaid credit from buying options.

2. Horizontal spread selection strategy

A horizontal spread is an options strategy that requires the following:

- Buy and sell options of the same type (Calls or Puts).

- Similar strike prices.

- Same underlying property.

- But, the expiration date is different.

Horizontal spreads are also commonly referred to as calendar spreads or time spreads because we have different expiry dates.

3. Cross spread option strategy

A diagonal line is an options strategy that requires the following:

- Buy and sell options of the same type (Calls or Puts).

- Same underlying property.

- But, the expiration date is different.

- And different strike prices.

Horizontal spread and cross spread are both examples of calendar spreads. The calendar option arbitrage is an advanced strategy that benefits from both the decay of the option price and the difference between the months in the contract and the downward movement of the underlying stock. As stocks change in price over time, you will have many opportunities to make a profit.

Check out our spread options trading strategy example HERE .

The bottom line is that you need to be familiar with all kinds of spread options. This will increase your success rate.

Bull call spread option strategy

What is a bull call spread?

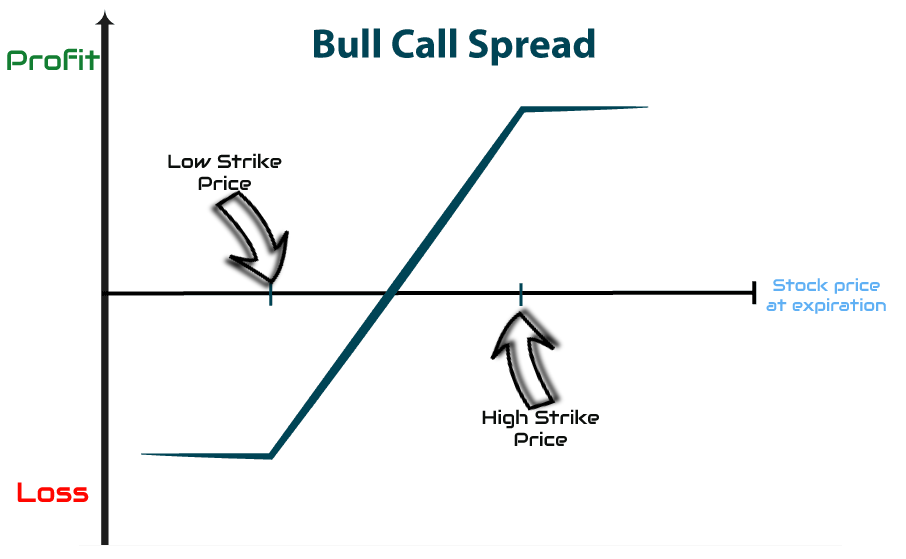

A bullish call entails simultaneously buying out-of-the-money calls and then selling out-of-money calls with the same expiration date. The reason why we sell OTM calls (out of money) is to help fund ATM calls (for money). We know that ATM calls can be quite expensive, so this is a great method to reduce those costs aka optional premium pricing.

In options trading, the premium is the upfront fee you pay when buying a call option. When you sell a call option, the investor receives the premium. So by selling the second OTM call option you are essentially offsetting some of the price you paid for the first ATM call option.

The premium can be very expensive if the strike price is close to the current stock price.

How to profit from bullish trading?

As the name suggests (BULL call), you profit from a bullish call if the underlying asset will increase in value. Market sentiment needs to move higher.

Bull + Call = Bull represents a market going higher + Call represents an option that you buy if you think the market will go higher.

The key element of a bullish call spread is the assumption that the market price will rise.

What is the maximum risk associated with bull arbitrage?

The maximum loss you can incur on a bullish call is the high price you pay for the option plus the fees. Potential loss will always be known before you enter a trade.

Now, what is the maximum profit you can make from the arbitrage options trading strategy?

Profit can be calculated by taking the difference of strike price (ATM call and OTM call) minus the maximum risk, which we calculated earlier.

Bull Call Spread Option Profit = Strike Price – Maximum Risk

Let’s go through a quick example, so we can apply options trading theory.

In this example, we’ll go with the Apple stock option price.

At the time of writing this option spread PDF strategies, Apple stock price is trading around $223 per share.

The first step to building your bull call spread is to buy ATM calls for $223. Second, because we think APP stock price will go higher, we sell OTM calls. for $250. Our profit will be capped at $250.

For the sake of simplicity, let’s say you pay $2 for ATM calls and receive $1 for selling OTM calls. The cost associated with this trade will be only $1 (2$ long call premium – $1 short call profit = $1 x 100 contract size = $100).

The final cost is $1 less than going out and buying ATM calls, hence why we have the “limited risk” expression.

The right way to buy cheap options is to use bull call spread options strategy. However, this options trading strategy is more suitable when you think that the underlying asset will only increase moderately.

In the next section, we take the spread-box options strategy and build a real-life example that leads to a risk-free arbitrage opportunity.

Example of a spread box option strategy (Long Box)

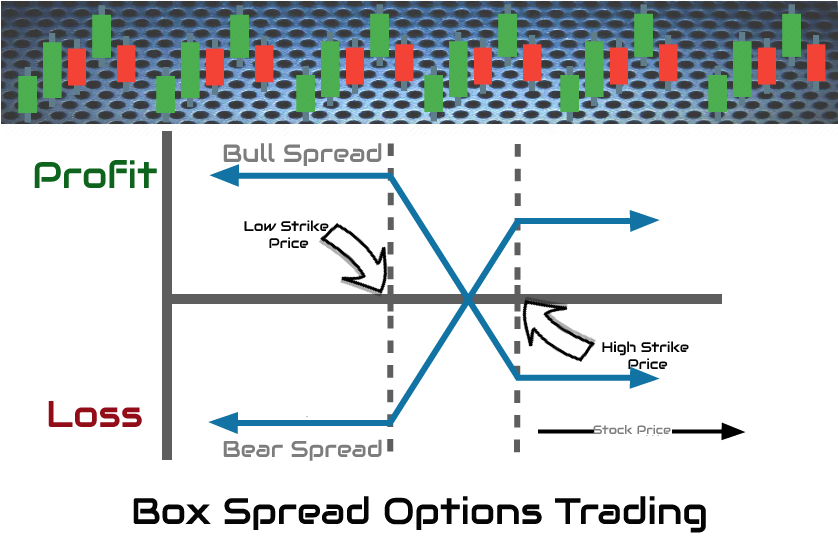

The box spread is a complex arbitrage strategy that takes advantage of price inefficiencies in option pricing. When option spreads are undervalued relative to their expiration value, a risk-free arbitrage opportunity is created.

The spread box option strategy is also known as the long box strategy.

Building a box spread option involves building a four-legged options trading strategy or a combination of two vertical spreads as follows:

- Buy bull call spread option (1 ITM call and 1 OTM call).

- Buy a bear spread option (1 place ITM and 1 place OTM).

The short box option strategy is the opposite of the long box strategy.

The way you profit from box spread options and create a risk-free position is by using the same expiration date and strike price for vertical spread. Although we eliminate the risk, the box spread also has the disadvantage of generating only a small profit.

Example of box spread

Let’s take a simple example of Alibaba’s BABA stock symbol trading at $180. Higher pricing options are available:

- October 175 Call – $5

- October 185 Call – $1

- October 175 booking – $50

- October 185 booking – $5

To do a box spread, an investor needs to buy both vertical spreads:

- Buy Bull Call Spread = Buy Oct 175 call + Sell Oct 185 call = ($5 x 100 contract size) – ($1 x $100 contract size) = $400.

- Buy Bear Put Spread = Buy 175 put October + Sell 185 October put = (contract size $1.5 x 100) – ($5 x $100 contract size) = $350.

Excluding commission, total unboxing cost is $400 + $350 = $750.

The expiration value of the strike spread is: $185 – $175 = $10 x $100 shares = $1,000.

The total profit without option fees is calculated as follows: $1,000 – $750 = $250.

If you use the wrong Options trading broker, the potential profit generated from the box spreads can be offset by large commissions. Make sure you invest in options using Robinhood’s commission-free options trading platform.

When to use the butterfly spread option strategy?

The butterfly spread is a neutral trading strategy that can be used when you expect low trading volatility in the underlying asset. The butterfly spread uses a combination of a bull and a bear spread, but has only three legs. If you are trying to go long, a three legged options strategy can be formulated as follows:

- Buy with money

- Sell two calls for money

- Buy a money call

Long call butterfly risk is limited to the premium you pay for opening three-legged positions. The butterfly can also be built by combining and selling a belt and buying a sling.

Learn the art of trading the spread options strategy to capture the next big move: Straddle Options Strategy – Profit from Big Moves.

The short butterfly strategy is the opposite of the long butterfly strategy.

Final Words – Option Spread Strategy

While stock traders need to be 100% right to make a profit, option spread strategies can make you money even if you are only partially right about your trades. Options spreads can help you develop non-directional trading strategies like the spread options strategy example outlined in this options spread course.

Many options traders start their career by simply buying put or buy call. But, at some point along with the growth of an options trader, they quickly switched to options trading. For example, implementing a bullish call option spread strategy will give you better risk control.

For more options, trading tips and strategies follow: Top 10 Options Blogs and Websites to Follow in 2019.

Don’t forget spread options trading comes with a lot of alternatives on how to manage risk. Nowadays, most options trading platforms make it quite easy to place complex options strategies at the same time. Give them a demo options platform before you risk your own hard earned money.